BUSINESS

Jain Resource Recycling: Will the IPO funds accelerate exports?

The company’s global recognition, forward integration, and conservative financial management lend credence to its growth story

BUSINESS

Solarworld IPO: Can this light up you portfolio?

Robust order book, strong customer relationship to support growth

BUSINESS

Atlanta Electricals: Should investors plug into this IPO?

The company is riding on capacity expansion and strategic acquisitions

BUSINESS

GK Energy IPO: Solid fundamentals or just another hot public issue?

Strong growth, but execution and visibility remain key risks

BUSINESS

Does the blueprint to modernise defence make it a long-term bet?

The government unveils 15-year roadmap that opens up multi-decade opportunities to integrate production, supply chains, and advanced technology platforms

BUSINESS

Defence GST cuts: Boost for OEMs, system makers and exports

The move will ease procurement costs for both manufacturers and integrators

BUSINESS

Vikran Engineering IPO: Can it deliver sustainable growth?

Equity infusion and prudent leverage to give VEL financial flexibility to capture opportunities in emerging areas

BUSINESS

INOX India: Strong order book, tech edge offset tariff, execution risks

The Industrial Gas segment, the largest revenue contributor, declined 9.5% due to US tariffs. However, the company says there are very few suppliers in the US and tariffs apply mainly to steel components.

BUSINESS

Mangal Electricals IPO: Will it offer electrifying returns to investors?

The company is ramping up capacity & diversifying portfolio, though the valuation captures much of the optimism

BUSINESS

Va Tech Wabag: Can this water stock create waves on bourses?

Healthy financial position, a diversified order book, and favourable sector tailwinds to drive growth

BUSINESS

Hindalco Industries – Execution, strategic expansion key growth levers

Resilient Q1 with strong India operations and record downstream performance

BUSINESS

Tata Power: Betting on renewables, execution strength

The company has multiple levers to power growth

BUSINESS

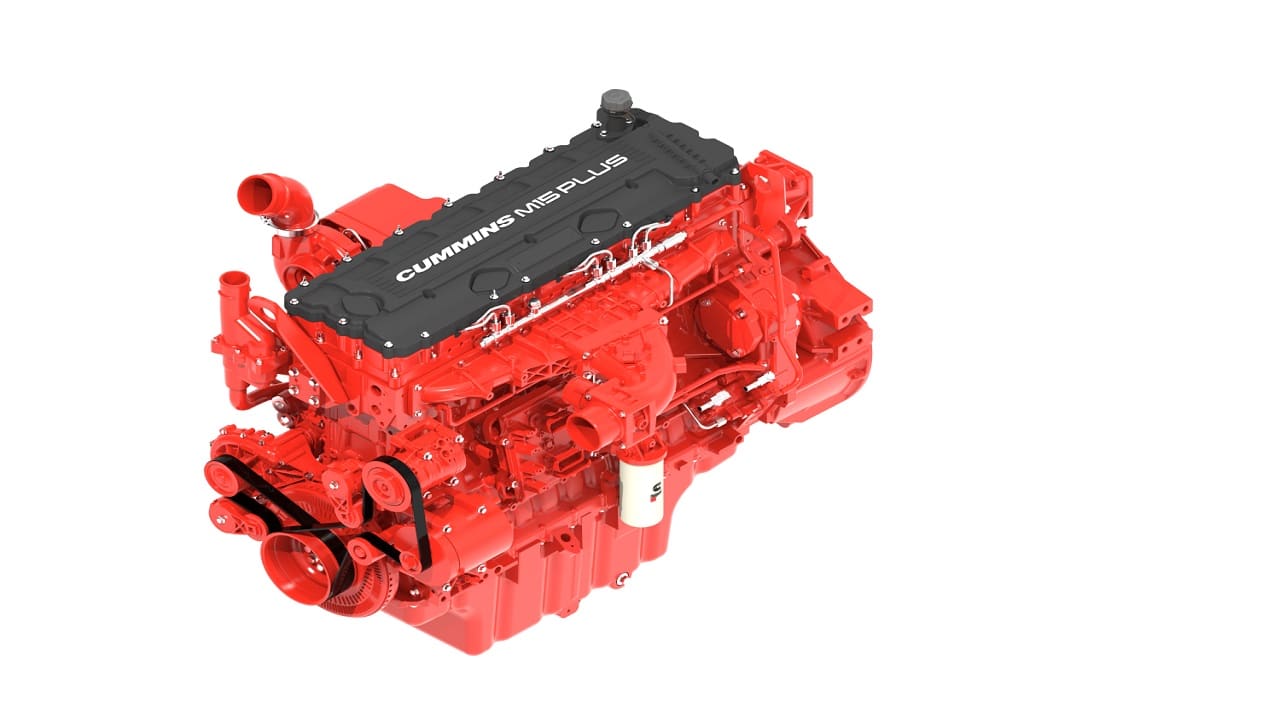

Cummins India: Execution, diversification, innovation drive earnings resilience

Investments in capacity, digitisation, and new product development—particularly in clean and hybrid energy systems—suggest that growth momentum will continue

BUSINESS

Thermax: Execution to rebound, green bets to drive future earnings

While Q1FY26 saw some execution slippages, the company is hopeful that the next few quarters could bring better growth and margins

BUSINESS

Tata Steel turns to cost savings for profit stability amid volume pressure

While the near-term business performance may appear subdued, the company’s structural initiatives, such as capacity expansion and operational efficiency, are good for the long term

BUSINESS

KEC's T&D business powers earnings momentum

The company’s healthy order book, strong project pipeline, improving margins and capacity expansion initiatives provide a solid visibility for future growth.

BUSINESS

Sri Lotus Developers: Will the IPO give investors a luxurious experience?

Ultra-luxury focus, capital-light model, and strong project pipeline underpin value creation

BUSINESS

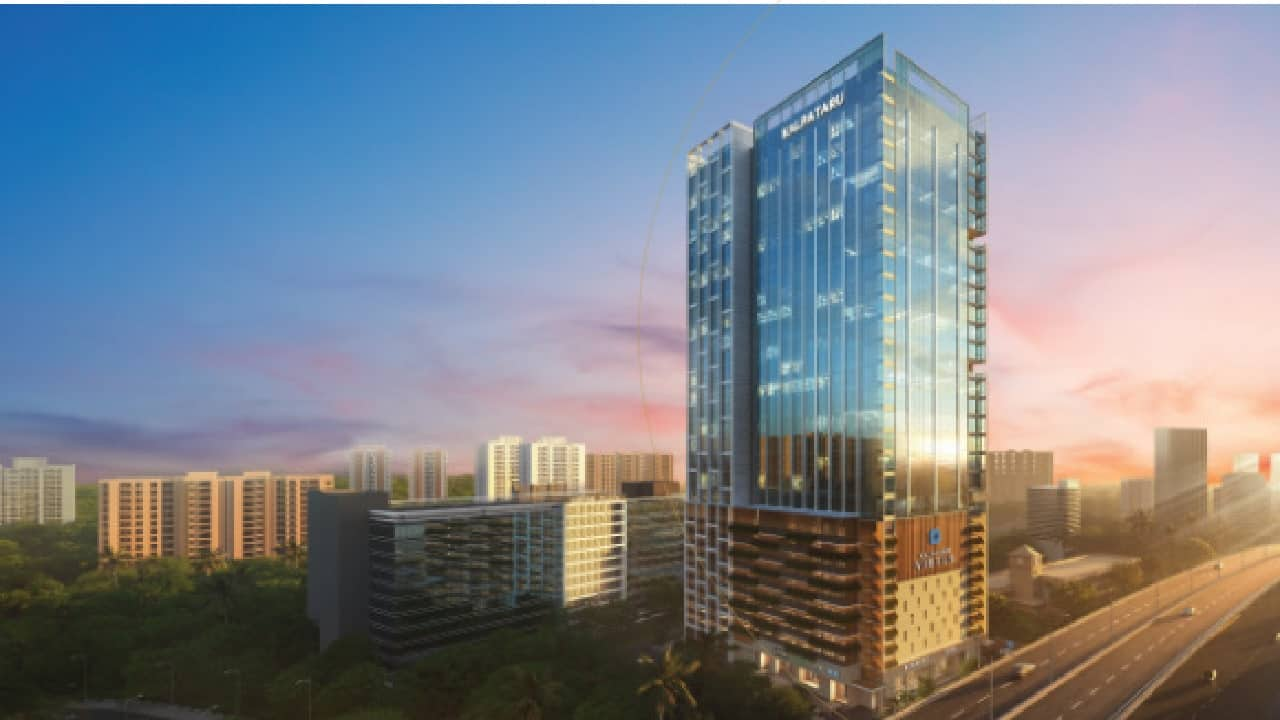

Indiqube IPO: Is it worth a look at the offer price?

A prominent player in flex space with operations in 15 cities

BUSINESS

JSW Steel eyes rebound in Q2 after margin-led Q1 profit surge

Optimistic outlook on the back of expansion, import curbs, and domestic demand strength

BUSINESS

Why this power T&D player could be a re-rating candidate

Robust order book and better visibility across core and non-core verticals

BUSINESS

Smartworks Coworking Spaces IPO: Should investors book this space?

A leading player in the managed campus market with a promising growth trajectory

BUSINESS

Inox India: Will the stock take note of strong levers for earnings growth?

The company now has a better cost structure and improved business visibility

BUSINESS

Ellenbarrie Industrial Gases IPO: Can it pump up gains for investors?

The flotation comes at a time when the company is ramping up capacity and aiming for national expansion

BUSINESS

Oswal Pumps taps solar opportunity with IPO-backed expansion

Through its Rs 890 crore issue, OPL will deploy Rs 360 crore to scale up its solar pump production from 2 lakh to 5 lakh units annually