Hindalco Industries ( CMP: Rs 694, Market capitalization: Rs 1,55,463 Crore, Stock Rating: equalweight) began FY26 with a steady operational performance, record downstream aluminium earnings, and disciplined cost control in its upstream business, despite a mixed global demand environment and tariff headwinds at Novelis. Strong execution in domestic operations and timely progress on strategic expansions should continue to support its business.

During Q1FY26, consolidated EBITDA grew by 5.4 percent YoY, while consolidated PAT rose 30 percent YoY to Rs 4,004 crore, reflecting a stronger India contribution. India EBITDA grew 13 percent YoY to Rs 4,982 crore, with PAT up 45 percent to Rs 2,846 crore.

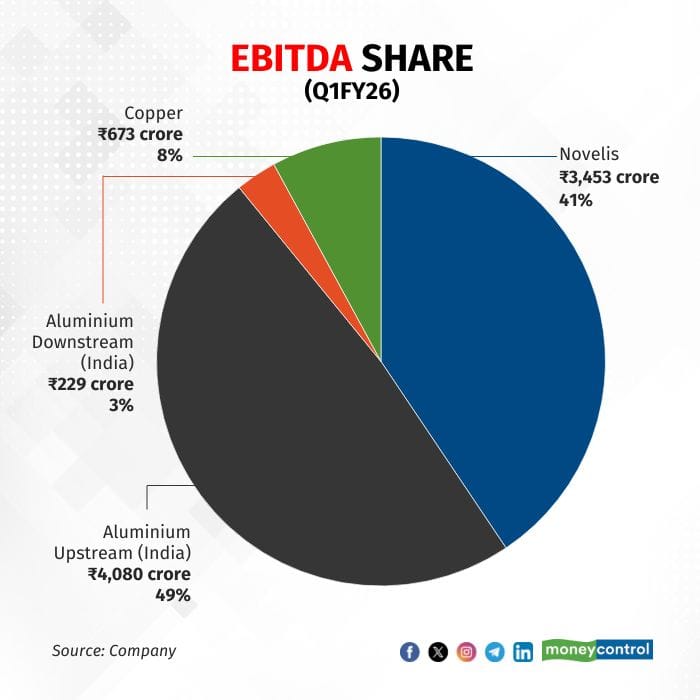

Upstream Aluminium (India): Shipments remained stable at 325 KT, but revenue rose 6 percent YoY to Rs 9,331 crore and EBITDA grew 17 percent YoY to Rs 4,080 crore. The EBITDA/tonne was $1,467 (up 15 percent YoY), aided by the lowest production cost in 15 quarters from higher linkage coal availability. This also supported overall margins.

In the downstream aluminium (India), which is 5 percent of total revenue, shipments reached a record 119 KT (up 6 percent YoY), with an all-time high EBITDA of Rs 229 crore (up 108 percent YoY). The EBITDA/tonne rose 92 percent YoY to $264, driven by high-value products like EV battery enclosures.

In the copper business, shipments rose 4 percent YoY to 124 KT, but the EBITDA fell 16 percent YoY to Rs 673 crore, impacted by sharply lower TC/RCs, partly offset by higher by-product realisations and operational efficiencies. On the flipside, domestic copper demand surged 19 percent YoY to 423 KT.

Its 100 percent international subsidiary, Novelis, which accounts for 59 percent of its consolidated revenue, saw 1 percent YoY growth in shipments to 963 KT, led by beverage packaging demand (over 8 percent YoY). However, adjusted EBITDA fell 17 percent YoY to $416 million, with EBITDA/tonne down to $432 due to elevated scrap costs and tariff impacts.

Hindalco’s earnings trajectory in the near-to-medium term will be supported by upstream cost leadership, downstream value addition, and global capacity expansion. In aluminium, India demand is projected to grow at 10 percent YoY in FY26, supported by strong momentum in the electrical, renewable energy, construction, and packaging sectors. FRP (flat rolled products) demand is expected to expand by 6-7 percent, with premium products such as automotive body sheets, beverage can stock, and EV battery enclosures gaining greater share.

In the upstream business, margins are likely to remain strong, the company indicated, although Q2 could see a modest rise in costs (around 3 percent) due to monsoon-linked coal logistics and higher calcined petroleum coke prices. Beyond Q2, linkage coal availability and cost rationalisation should restore cost advantages. The commissioning of the Chakla and Meenakshi coal mines will provide long-term raw material security.

Downstream growth will be reinforced by the ramp-up of the Aditya FRP facility and the expansions at Silvassa. As these capacities mature, Hindalco’s ability to capture higher realisations from value-added products should improve EBITDA stability and reduce exposure to LME price volatility. In copper, new smelter capacity and continued demand growth in renewable energy, electric vehicles, and power infrastructure will sustain volume growth, even if global TC/RC benchmarks remain subdued.

Novelis’ recovery in H2 FY26 remains critical. Cost optimization initiatives, an improved product mix, and incremental demand from beverage packaging in North America and Asia are expected to gradually offset tariff-related headwinds. The Bay Minette plant in the US will be a game-changer, adding recycling and rolling capacity. The management expects Q2 performance similar to Q1, with gradual recovery in H2 aided by cost savings exceeding $100 million in FY26 (up from $75 million) under a $300-million structural cost-reduction programme.

At Rs 666, the stock trades at 5.6x FY27 estimated EV/EBITDA (10-year average: 5.5x). Valuations appear reasonable given strong visibility from capacity-led growth, structural demand drivers in aluminum and copper, and a healthy balance sheet supported by strong liquidity.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.