BUSINESS

How increasing your home loan EMI by Rs 5,000 can save over Rs 26 lakh in interest

You will also be able to pay off your Rs 50 lakh loan 7.5 years ahead of schedule.

BUSINESS

New India Co-op Bank crisis: Customers should change bank mandates for EMIs, redirect MF SIPs

Cancel ECS debit instructions issued to New India Co-op Bank for loan EMIs and pick another bank account to honour your repayment commitments. Change the bank mandates to ensure that your mutual fund redemption proceeds are credited to an alternative, functional account.

BUSINESS

New Income Tax Bill: Section 80C tax-saving deductions now under clause 123

The new Income Tax Bill, tabled today in the Lok Sabha, retains all the deductions and exemptions but under new section numbers

BUSINESS

New Income Tax Bill: Expect simplified rules, digital focus, and reduced litigation

The proposed I-T Bill would introduce the concept of ‘tax year’ to replace the financial year and is likely to be 622 pages long with 536 sections. However, it is unlikely to introduce drastic changes, say experts.

BUSINESS

New Zealand revises 'golden visa' rules. Do wealthy Indians stand to gain?

Well-heeled Indians are increasingly seeking residency rights in developed countries by buying property or investing in financial assets or businesses. Will New Zealand's revised norms open up yet another avenue for HNIs?

BUSINESS

Will your Rs 12-lakh salary enjoy ‘nil’ tax even with additional STCG income? Here’s what experts say

Chartered accountants differ on a salaried taxpayer’s eligibility for the tax rebate if her total income—including special rate income such as short-term capital gains—is over Rs 12 lakh but the salary component itself does not exceed the threshold. The income tax department ought to explicitly clarify its position on the rule, they say.

BUSINESS

Ulips with annual premiums of over Rs 2.5 lakh to be taxed like equity MFs. Here’s what it means for policyholders

Budget 2025 has clarified that ULIPs where annual premiums exceed Rs 2.5 lakh a year or 10 percent of the sum assured will be treated as capital assets, at par with equity-oriented mutual funds.

BUSINESS

What Budget 2025 means for salaried taxpayers, senior citizens and investors

Tax measures announced in Budget 2025 will have a wide-ranging impact on individual taxpayers across income brackets, as also senior citizens, students and outbound travellers.

BUSINESS

No tax on GIFT City Ulip maturity proceeds even if premiums exceed Rs 2.5 lakh per year

Regular Ulips’ maturity proceeds attract tax if their annual premiums exceed Rs 2.5 lakh. However, Budget 2025 has granted a concession to Ulips sold by insurance companies’ GIFT city branches.

BUSINESS

Selecting the beneficial tax regime: Without HRA, old regime makes little sense; new regime scores across income slabs

The new, simplified tax regime is now a clear winner in the case of most tax slabs, show Deloitte calculations. In case of annual income of over Rs 24 lakh, the old regime will result in higher savings, only if you claim deductions worth more than Rs 8 lakh.

BUSINESS

Hike in basic exemption limit, rejig of tax slabs mean big savings for taxpayers under the new regime

Tax-payers across income brackets will benefit from the increase in basic exemption limit from Rs 3 lakh to Rs 4 lakh and wider tax slabs under the new, simplified tax regime. The enhanced tax rebate limit will benefit those with incomes of up to Rs 12 lakh.

BUSINESS

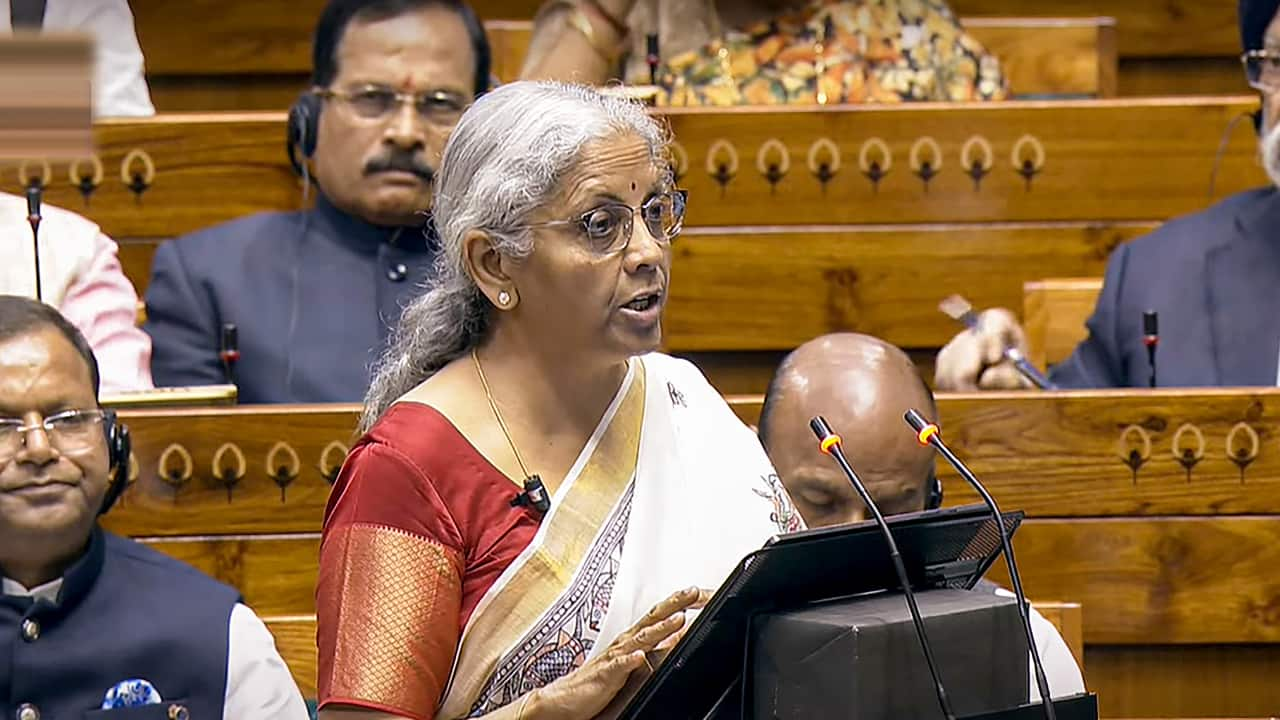

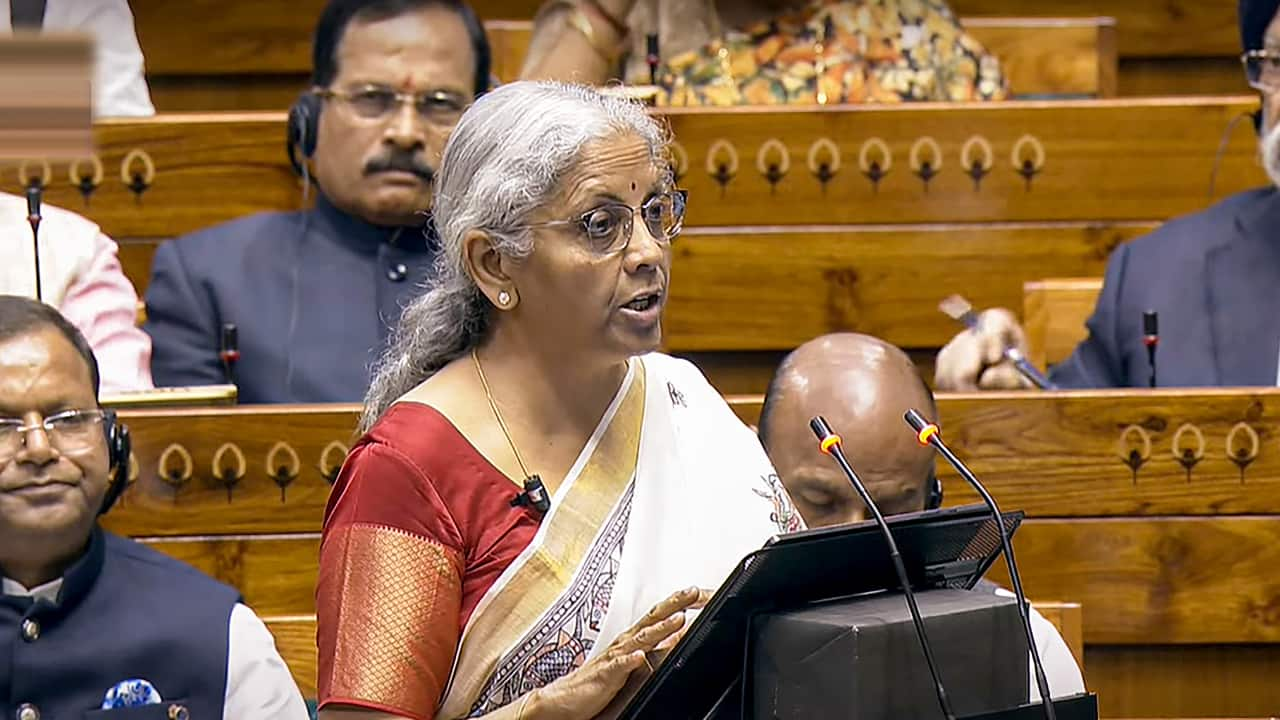

Big boost to the middle class: No tax on incomes up to Rs 12 lakh under the new regime, says FM

Budget 2025 also rejigged tax slabs and rates under the new tax regime and increased the basic exemption limit from Rs 3 lakh to Rs 4 lakh. However, as expected, old tax regime slabs and rates will remain unchanged.

BUSINESS

Income tax expectations: Will Budget 2025 raise the basic exemption limit, standard deduction under the new regime?

Finance Minister Nirmala Sitharaman may not scrap the old tax regime, but tax sops, if any, are likely to be announced only under the new tax regime.

BUSINESS

Will Budget 2025 hike the basic exemption limit to Rs 10 lakh, raise standard deduction to Rs 1 lakh?

The old tax regime might not be scrapped, but it is unlikely that any tax concessions will be announced under this structure. However, there is scope to make the new tax regime more taxpayer friendly, say tax experts.

BUSINESS

Old vs new income tax regimes: How to choose the most beneficial tax structure

Budget 2024 ushered in sweeping changes in the new tax regime, rejigging income tax slabs and hiking the standard deduction to Rs 75,000 while leaving the old tax regime untouched. While the former is clearly being favoured, some taxpayers still find the old regime more beneficial.

BUSINESS

MC-Deloitte CEO survey: Over 44% CEOs want Budget 2025 to reduce income tax slab rates in both old and new regimes

Close to 13 percent of the CEOs polled said they were expecting a stable regime, with no changes in either of the income tax regimes.

BUSINESS

Sukanya Samriddhi @10: The scheme can add value to your daughter’s education corpus, but do not ignore allocation to equities

Sukanya Samriddhi Yojana can make up the debt component in your daughter’s education portfolio. Equities, on the other hand, can generate wealth over 10-15 years by yielding inflation-beating returns.

BUSINESS

Budget 2025: Exempt NPS annuity income from tax, allow deduction for Vatsalya scheme, say experts

Compulsory annuitisation of 40 percent of the National Pension System (NPS) corpus is a roadblock to greater adoption, say industry players and independent experts. It should either be exempt from tax or investors should be offered an alternative, such as a systematic withdrawal option.

BUSINESS

Here's why you don't need term insurance beyond your working years

For those who do not have liabilities or yet-to-be-discharged responsibilities, a term insurance cover with a tenure extending late into 60s or 70s is not required, though life insurance companies do offer long-term policies

BUSINESS

Health insurance claim rejected? Approach the insurance ombudsman for complaint resolution

Over 95 percent of health insurance complaints pertained to partial or total claim rejections, according to the Insurance Ombudsman annual report for 2023-24. If you feel your health insurer has rejected your claims unfairly, you can approach the ombudsman offices for grievance redressal.

BUSINESS

Tax rebate denied in July 2024? Revise your return by Jan 15 to claim the same

Even if your return has been processed and you have received a refund or paid any additional tax that may have been demanded, you can revise your return.

BUSINESS

Investment declaration to employers: Five tax-saving hacks that can reduce your outgo in 2025

Top tax-saving tips: Tax planning must start in April, at the beginning of the financial year. Yet, many leave the job for the last minute, when they have to submit the proof of investment in January or February.

BUSINESS

Top five changes in income tax rules in 2024

Income tax rules: Here’s how a raft of Union Budget announcements in July 2024 such as revised new regime of I-T slabs, major changes in capital gains tax structure, higher standard deduction under the new tax regime and increase in tax deduction limit for employers' contribution to NPS have impacted individuals’ tax payable.

BUSINESS

Insurance in 2024: Higher life insurance surrender values, shorter moratorium period in health insurance and more

The regulatory reform from IRDAI that attracted the maximum attention was the change in computation of surrender values and charges for endowment policyholders, but the regulator modified several other rules that directly affect retail life, health and general insurance policyholders.