Finance minister Nirmala Sitharaman on February 1 gave individual income taxpayers a reason to cheer by raising the income tax rebate limit from Rs 7 lakh to Rs 12 lakh. The move will bring down their tax payable to nil.

The rebate is available to resident Indian taxpayers. Essentially, salaried taxpayers with income of up to Rs 12.75 lakh will not have to pay any tax now, thanks to the standard deduction.

The minister also proposed to rejig slabs under the new regime, including increase in the basic exemption limit to Rs 4 lakh, in a big savings boost to the middle class. Unlike tax rebate, a hike in basic exemption limit benefits even those in the higher income brackets.

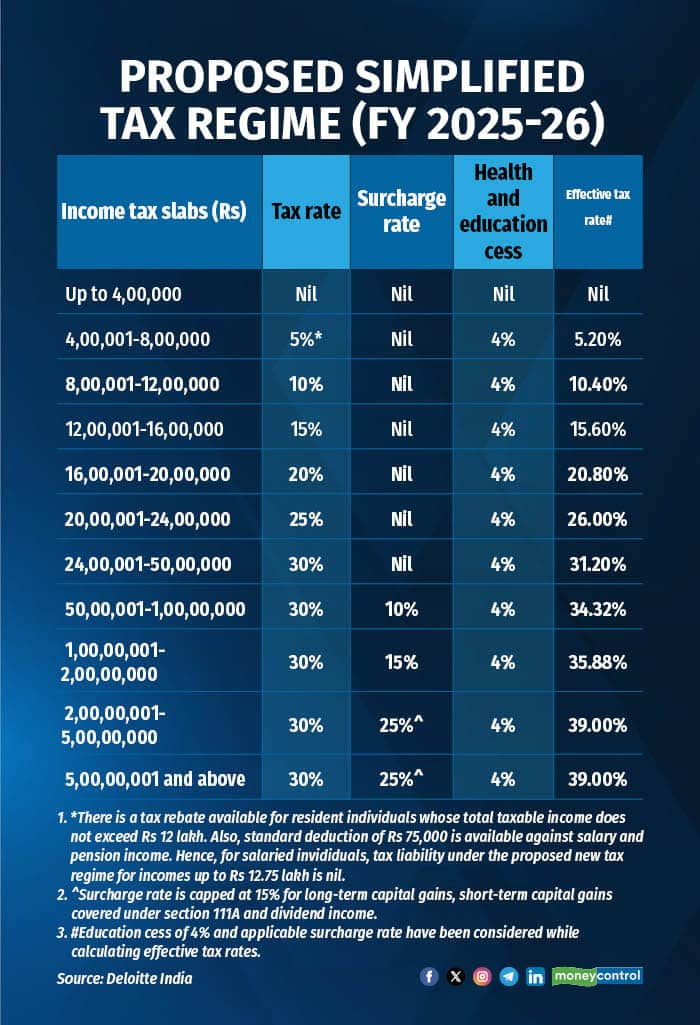

Here are the new tax slabs:

Rs 0-Rs 4,00,000 – Nil

Rs 4,00,001-8,00,000 – 5%

Rs 8,00,001-12,00,000 – 10%

Rs 12,00,001-16,00,000 – 15%

Rs 16,00,001-20,00,000 – 20%

Rs 20,00,001 to Rs 24,00,000 – 25%

More than Rs 24 lakh - 30%

"I am now happy to announce that there will be no income tax payable up to income of ` 12 lakh (i.e. average income of Rs 1 lakh per month other than special rate income such as capital gains) under the new regime. This limit will be Rs 12.75 lakh for salaried tax payers, due to standard deduction of ` 75,000," Sitharaman said in her Budget speech. Put simply, the rebate (Rs 60,000 per the February 1 proposals) will not be allowed on special rate incomes such as capital gains.

Sitharaman said that those with an income of Rs 12 lakh will now save Rs 80,000 (100 percent of tax they were paying so far), while those earning Rs 18 lakh will get a benefit of Rs 70,000 (30 percent of the tax payable as per existing rates). Those earning Rs 25 lakh will make tax-savings of Rs 1.1 lakh (25 percent of their current tax outgo).

She also announced the government's decision to table the new Income Tax bill in the parliament next week which seeks to simplify the rules and language for taxpayers and administrators, potentially reducing disputes.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.