BUSINESS

Stellar Q1 show to hasten re-rating of ICICI Bank stock

The Q1 FY22 earnings reaffirm that ICICI Bank has transitioned well from a stressed bank to a growing lender

BUSINESS

CSB Bank: Rise in NPAs in gold loans takes the shine off Q1 earnings

While GNPA of CSB Bank has risen, ultimate credit cost – a more appropriate indicator of asset quality for gold loans – is expected to remain low

BUSINESS

Bajaj Finance Q1 hits a rough patch, asset quality loses balance

The stock upside hinges on progress of digital plans

BUSINESS

HDFC AMC Q1 – Rich valuation and falling market share to limit stock upside

Despite a pick-up in AUM and higher equity contribution, yields remained under pressure during the quarter

BUSINESS

HDFC Bank’s earnings growth moderates in Q1 — Is the golden era over?

A marginal blip, but bank well poised to leap forward

BUSINESS

How should investors look at Zomato’s valuation?

While its market share has grown in recent years and popularity has increased manifold after the outbreak of the pandemic, Zomato’s IPO pricing has raised many eyebrows

BUSINESS

Equity inflows moderate in June, but rising SIP folios and assets a bright spot

Regular investing in MF schemes reached a new milestone, with SIP accounts crossing 4 crore and SIP AUM reaching an all-time high of Rs 483,964 crore

BUSINESS

Market cap is soaring and so are fortunes of these financial stocks

These are proxies for capital market growth and have seen a stellar run from the bottom of the crash last year

BUSINESS

Where do HDFC Bank, CSB Bank stand? Pre-earnings business updates reveal a lot

For the quarter ended June, both HDFC Bank and CSB posted strong growth in advances

BUSINESS

Two big positives in Repco Home Finance’s earnings

Earnings of Repco Home Finance are set to improve in FY22 with business returning to normalcy and leveraging getting better

BUSINESS

The government’s support to the microfinance sector won’t change its fortunes

The ease of credit will certainty help but for sustained improvement, the supply side measures need to be accompanied by demand revival

BUSINESS

Reliance’s foray into green energy will boost India’s renewable energy ambitions and geopolitical standing

RIL AGM 2021: India’s energy sector is on the cusp of a solar powered revolution and Reliance is set to play a leading role in it

BUSINESS

Will Assam MFI package help Bandhan Bank’s stock?

As per the proposed package, the Assam government will take on the liability of up to Rs 8,500 crore for certain categories of MFI borrowers in the state

BUSINESS

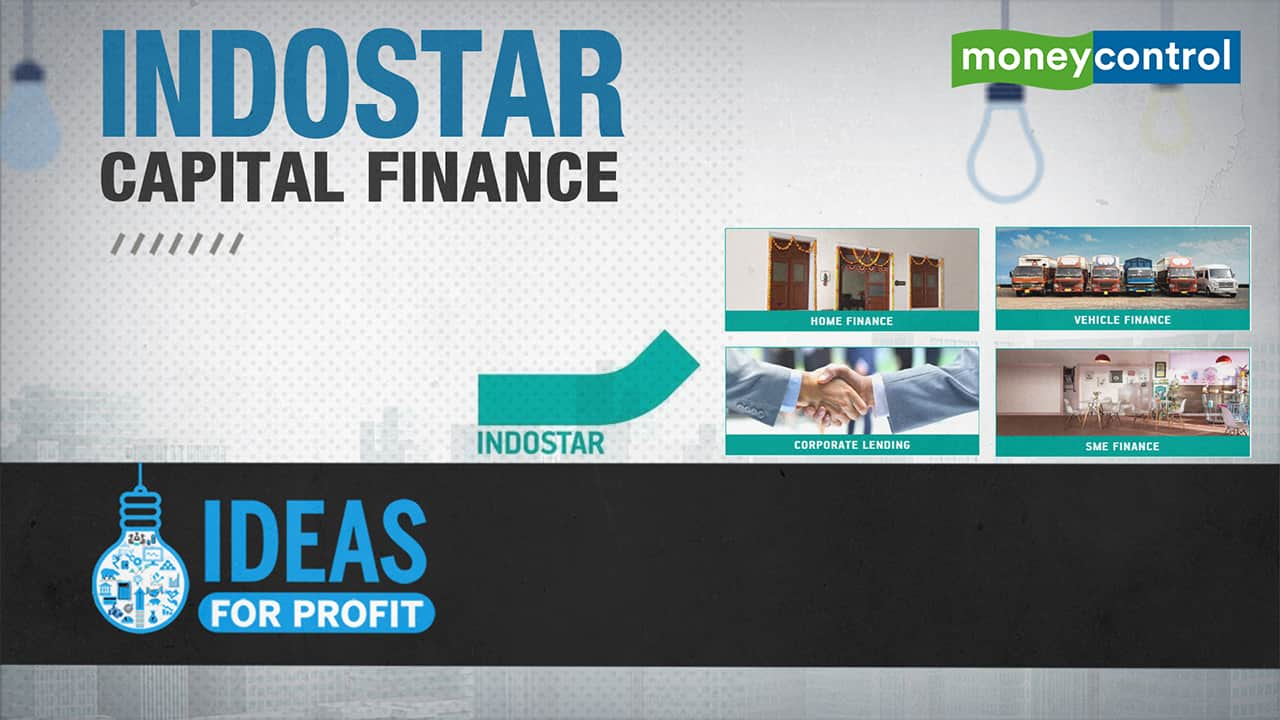

Indostar Capital Finance – Past imperfect, present tense but future promising

The equity capital infusion by Brookfield has strengthened Indostar’s ability to grow the book both organically as well as inorganically

BUSINESS

Three factors that add value to LIC Housing Finance

Despite the pressure on asset quality, there were some positive readings from the earnings

BUSINESS

How much value will the potential buyer assign to IDBI Bank?

While the current valuation of IDBI Bank is pricing in the improvements in operating metrics and profitability, there can be further upside, driven by the potential sale of bank

BUSINESS

With large inflows in May, equity mutual funds are back in favour

The peaking of second wave seems to have boosted investor enthusiasm about equities and has drawn them back to mutual funds

BUSINESS

PNB Housing stock showed the way. Will other HFCs follow suit?

We see PNB Housing’s rally as a key trigger for re-rating of the sector

BUSINESS

Why should investors consider City Union bank despite sharp fall in asset quality in FY21?

City Union Bank's management had cautioned about the asset quality stress much in advance

BUSINESS

CAMS is priced at premium to mutual fund stocks. Why should investors consider it?

Given the robust return ratios and CAMS’ vantage positioning, the premium valuation will sustain

BUSINESS

How much more can SBI stock rally on the back of stellar asset quality in FY21?

SBI’s asset quality has not only improved significantly but it also trended better than that of private peers in FY21

BUSINESS

SBI Cards – A quintessential consumption play that stands to gain from peaking of second wave

With around half of its revenue derived from consumer spending (fee income) and other half from credit business (interest income), SBI Cards is a consumption company in the financial services space

BUSINESS

Home First Finance — A worthy long-term bet available at reasonable valuation

Home First, being an affordable housing player, is well poised to benefit from structural growth in the segment

BUSINESS

Reason to cheer despite sharp fall in April inflows into equity mutual funds

With positive flows in equity schemes in the past couple of months, mutual funds have turned saviour for equity markets as they are seen absorbing the selling by FPIs