BUSINESS

Franklin Templeton mess: A liquidity mishap or a series of wrong, aggressive bets?

The closure of Franklin Templeton’s six funds has opened room for questions.

BUSINESS

Franklin Templeton fund closure: Will RBI step in to save MFs from likely redemption pressure?

As investors look for safer assets, bank deposits — despite the lower returns they offer — may see more preference since safety will be sought-after over returns.

BUSINESS

RBI's TLTRO 2.0 fails to get good response. What does it mean for fund-starved NBFCs?

"Limited participation by banks in the TLTRO 2.0 clearly highlights the bank's reluctance to lend to mid-size and small NBFCs and MFIs in the current situation," Brickwork Ratings said.

BUSINESS

RBI's much-hyped refinance window may fail to help small MFIs and MSMEs

"Due to the repayment clause and the minimum rating required, most MFIs are not even approaching SIDBI for refinance facility," said P Satish, Executive Director of Sadhan, an industry body.

BUSINESS

RBI says 10% cap for banks to invest TLTRO funds applies only to the fourth tranche

On 16 April, Moneycontrol had reported about the confusion in the markets on whether this rule applies to all rounds of TLTRO.

BUSINESS

ICICI Bank confirms exposure to Singapore firm Hin Leong, says taking appropriate steps

On April 20, Moneycontrol reported that ICICI Bank has an exposure of $100 million (about Rs 760 crore) to Hin Leong.

BUSINESS

RBI announces more measures to nudge banks to lend to small NBFCs. Will lenders act at least now?

Smaller NBFCs and MFIs typically do not get preference since these companies are perceived to be high-risk borrowers and normally carry lower ratings.

BUSINESS

Singapore’s Caladium ups stake in Bandhan Bank to 4.49%

Of late, sovereign funds and other overseas investors are increasingly looking at Indian companies as share prices have fallen and these entities look good to global investors from an investment perspective.

BUSINESS

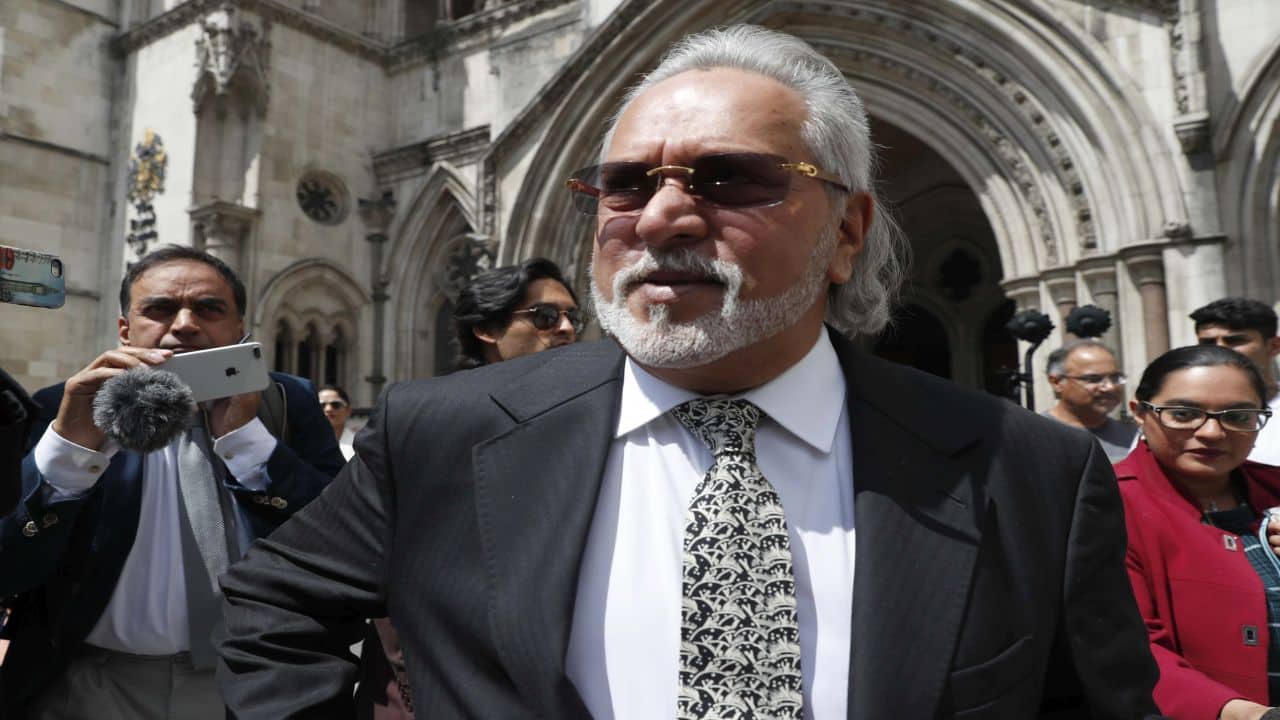

Vijay Mallya saga: Endgame for ‘the King of Good Times’ but what next for his lenders?

Mallya's holding in United Breweries is 11.04 percent which has a value Rs 2,696 crore and that of United Spirits (1.52 percent) at Rs 582 crore. In total, if banks manage to sell these share holdings on April 20, banks would get Rs 3,278 crore. But selling these shares and recovering money isn’t that easy.

BUSINESS

ICICI Bank has $100 million exposure to troubled Singapore oil trader that hid losses

Singapore-based Hin Leong Trading (HLT) is in the dock for non-disclosure of hundreds of millions of dollars in losses over several years. HLT has sought a six-month moratorium on debts of $3.85 billion to 23 banks, including ICICI Bank.

BUSINESS

RBI unhappy with banks being ‘selective’ and ‘cherry-picking’ instructions on NBFC loan moratorium issue

With no consensus in IBA meeting, the industry lobby is likely to move back to the RBI seeking clarity. But, the RBI’s view is that it never had any objection to banks giving moratorium facility to NBFCs and hence, further clarity on this issue isn’t required.

BUSINESS

How SBI and a section of banks interpreted RBI’s silence to deny moratorium for fund-starved NBFCs

In the backdrop of lack of clarity on the moratorium and banks' reluctance to invest in smaller companies, NBFCs may see their liquidity position weaken.

BUSINESS

HDFC Bank Q4: Good show, but the COVID-19 shock is likely to weigh heavily beginning June quarter

With economic activity coming to a grinding halt and cash flows of companies getting impacted, analysts expect a rise in bad loans across the sectors. This could take a toll on HDFC Bank’s earnings too in the beginning first quarter.

BUSINESS

RBI’s TLTRO 2.0 fund allocation may disappoint smaller MFIs, NBFCs yet again

The smaller MFIs and NBFCs desperately need funds since their collections have stopped. Every month during the moratorium, these companies are losing 8-10 percent of the collections. The average loan tenure of their loans is 18-24 months.

BUSINESS

Shaktikanta Das' silence on loan moratorium for NBFCs may spoil the liquidity party

Governor Das has been silent on the biggest demand from NBFCs--moratorium on the loans NBFCs borrowed from banks. This has come as a big disappointment for NBFCs.

BUSINESS

COVID-19 lockdown | NBFC-MFIs stare at liquidity shock: Will RBI step in?

The lock-down announced in late March to fight Covid-19 spread has hit the industry bad. NBFC-MFIs are also looking at the likelihood of high bad loans as lock-down could result in major income loss of small borrowers.

BUSINESS

RBI’s 10% cap for banks to invest in TLTRO funds lacks clarity

This means any particular bank will not be able to consider the same company which has already benefited from the window for further funding unless the bank borrows more to stay within the limit.

BUSINESS

Coronavirus impact | MFIs sitting on a ticking time bomb as loan defaults likely to go through the roof

NBFC-MFIs are in bigger trouble since, under RBI rules, these companies have to give moratorium to borrowers. But, at the same time, NBFCs are not eligible to get moratorium from banks. Thus, it is a double whammy for these firms.

BUSINESS

India GDP: Are private forecasters taking a shot in the dark?

There is a great deal of uncertainty at this stage on the COVID-19 economic fallout. The future course that the Indian economy will take highly depends on the fiscal response the government will adopt and the extent of the virus infections.

BUSINESS

Is RBI’s liquidity shot failing to reach small firms gasping for money?

According to primary dealers and bankers, mainly AAA rated top companies got money from banks while smaller firms have been largely left out.

BUSINESS

MPC minutes: Virus’ ‘dance of death’, uncertainty on post-COVID-19 world and a promise to fire again

In the words of Michael Patra, deputy governor of the RBI, the coronavirus’ 'danse macabre' is taking a catastrophic toll on human lives, causing economic disruptions, and “in these challenging circumstances, monetary policy has to assume an 'avant garde' role.

BUSINESS

PBOC buys 1.1% HDFC shares on behalf of Chinese sovereign wealth fund, Saudi picks 0.7% stake: Deepak Parekh

Saudi Arabian Monetary Authority (SAMA) too have picked up 0.7 percent in HDFC on behalf of Saudi sovereign wealth fund, Parekh said. SAMA’s name isn’t reflecting in the names of major shareholders since the holding is less than one percent of the company.

INDIA

Thrissur Pooram is not happening this year due to the virus. That is a big deal in Kerala

There is a deep emotional connect to Keralites to Thrissur Pooram. Every year, days before the event, people flood the cultural capital of the state (as Thrissur is known) and leave only after the spectacle is over. But this year things are different.

BUSINESS

How the Wadhawans offer a peek into the lives of powerful crony capitalists

According to the Enforcement Directorate, the Wadhawans had real estate dealings with gangster Dawood Ibrahim's aide and drug trafficker Iqbal Mirchi, whom they allegedly met in London.