Jitendra Kumar GuptaMoneycontrol Research

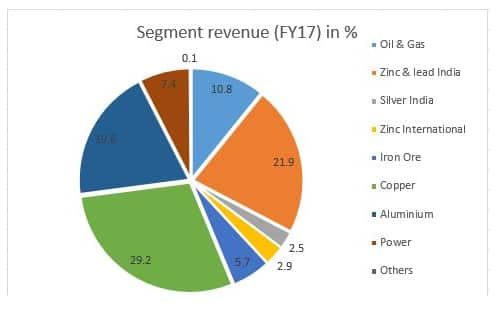

In the ongoing commodity up-cycle, companies like Vedanta, which has a diversified business portfolio comprising of copper, aluminium, zinc, oil & gas, iron ore and power, are having a dream run.

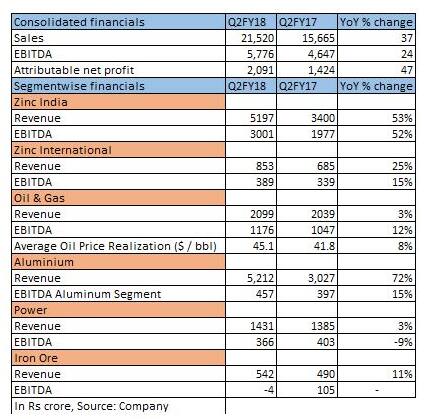

The company has smartly increased its production across the segments to capitalise on higher international commodity prices. During the recently concluded September quarter, the company reported strong 41% year on year growth in net profit on a sales turnover of Rs 21520 crore-which grew by 37%.

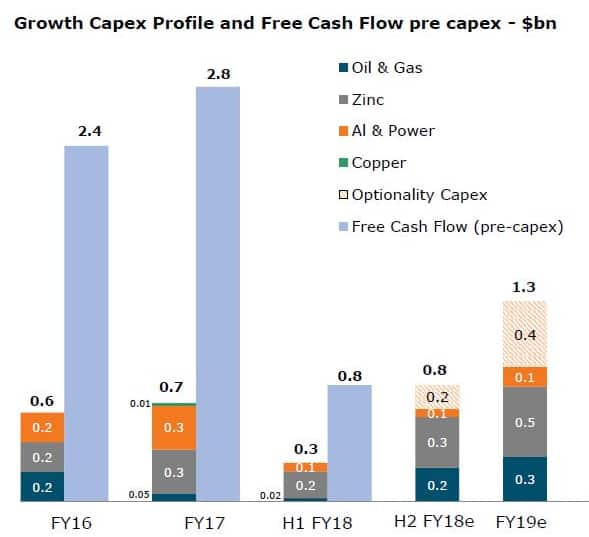

What is noteworthy is that the management believes that the best is yet to come with many of its large growth projects getting commissioned over the next 6-12 months and trending higher international commodity prices. While addressing the analyst call the company indicated that the performance could be even better second half of the current fiscal.

Post the quarterly results, street has already started to factor higher growth. The consensus estimates (does not fully reflect recent upgrades) suggest an annual earnings growth of almost 40% till FY19. However this hardly seems to be reflecting in the valuations, as the stock is currently trading at 8-9 times it’s FY19 estimated earnings which is cheap considering the growth in earnings, strengthening balance sheet, revival in commodity prices and improving cash flows.

Quarterly results: volumes and prices drive growth

The biggest contributor to its growth has been zinc business which is held under the 65% subsidiary Hindustan Zinc. Zinc lead and silver, which accounts for 27.3 of its revenues witnessed strong 28-30% growth in volumes. Along with volumes, increase in zinc and lead prices--up 31% and 25% to $2969 per tonne and $2334 per tonne respectively drove 45% increase in EBITDA of the India business and 15% growth in international zinc business.

Similarly its other large segment--copper--which accounts for 29% of its revenues reported 9% growth in volumes to 106000 tonne in Q2FY17, but the larger gains came from higher copper prices. LME copper prices traded at 33% higher at $6349 in Q2FY18 as against $4772 per tonne in Q2FY17. The other important segment, oil and gas, accounting for 11% of the consolidated sales, reported good 13% growth in EBITDA despite lower production at most of its facilities. Oil & gas benefitted because of the higher Brent crude oil prices during the quarter at $52.1 a barrel as against $46 a barrel in corresponding quarter last years.

Zinc, copper, oil & gas put together accounts for about 70% of its revenues. And because of the strong performance from these segments, the company was able to negate some of the downward impact from the aluminium, iron ore and power business.

Aluminium – impacted by cost pressure

Aluminium, which is about 20% of consolidated sales, was hit because of cost pressure. Aluminium traded at $2009 per tonne in Q2FY18 as against $1619 per tonne in Q2FY17, thereby helping in better realisation. That apart, its overall production grew by 50% to 383 kilotons (kt) leading to strong 72% growth in aluminium sales. However segment EBITDA grew merely by 15% to Rs 457 crore as a result of 20-30% increase in cost of production at Balaco and Jharsuguda plants to $1853-1865 per tonne as against 1412-1545 a tonne in the corresponding quarter last year. Higher cost was largely on account of non-availability of coal for its captive power plants as well as increase in international thermal coal prices as the company had to rely on imported coal. That apart one of its plant was shut down for a brief period impacting power cost.

In fact because of similar reasons, its independent power division made a negative contribution of Rs 44 crore in the group EBITDA. But power and aluminium is not alone, its iron ore segments, though accounts for mere 6% of revenues, too got a hit because of monsoon leading to production disruption reporting overall 14% decline in production to 1.2 million tonne leading to EBITDA loss of Rs 4 crore.

Guided to better growth

While few segments dragged profitability, over the next two quarter some of these issues are expected to ease with the company making efforts to seek linkage coal and worries over the monsoon impact subsiding in the coming quarters.

IIn copper the company is evaluating to double its capacity. In aluminium, with the full ramp up of first and third facility at Jharsuguda, the company has guided to production of about 1.5-1.6 million tonne in FY18 as against 1 million tonne in FY17. In zinc as well the company has guided to higher production at 950 kt as against 696 kt in FY17. In oil and gas as well Vedanta has plans to ramp up production with majority of its coming in first half of FY19.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.