Anubhav SahuMoneycontrol Research

Food and beverages colour industry, a niche segment of dyes and pigment industry, not only benefits from secular growth from the end market but also possess significant barriers to entry due to regulatory needs. As a result, industry has an oligopolistic structure wherein a few companies are in the lead with technical knowhow and quality control which help in offering a palette of colour solutions vetted by necessary regulatory requirements in different geographies and client approvals.

In this secular demand driven industry, there are two listed players in India which are witnessing earnings traction – Vidhi Specialty Food Ingredients and Dynemic Products. While Vidhi Speciality is pricing in an earnings visibility from capacity expansion plan, Dynemic Products looks interesting on valuations, given similar scale of operations.

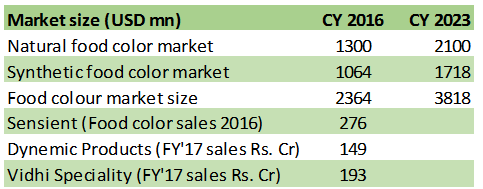

Global food colour industry/ major players

Global food and beverages colour market size is estimated to be about USD 2.4 billion, with about 55 percent share constituted by natural food colours and rest synthetic. It’s a small segment compared to global dyes and pigment market of about USD 35-40 billion, yet underpinned by secular growth trends. Market researchers forecast about 7-8 percent CAGR growth in the next seven years driven by regulatory requirements, urbanization and structural demand scenario for the food and beverage industry.

Source: researchnester.com, marketsandmarkets.com, Moneycontrol research

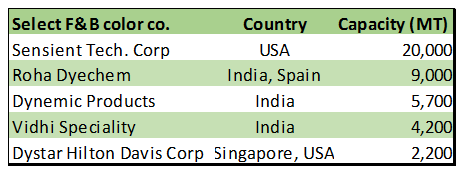

Key global manufacturers of food colors are Sensient Technologies Corporation, CHR Hansen, GNT, Roha Dyechem and DyStar Hilton Davis Corp. The largest manufacturer from India is an unlisted player – Roha Dyechem, having operations at India and Spain. Interestingly, another global player – DyStar Hilton Davis Corp -- is a part of DyStar group, in which Indian dyes and pigment major Kiri Industries has a stake of ~38 percent.

Vidhi Speciality (market cap: Rs 471 crore) and Dynemic Products (Rs 218 crore) are the key pure listed players in this segment in India. Other unlisted companies in India having FDA approval and exposure to food colors are Neelikon Food Dyes (plant at Dhatav).

Table: Select manufacturers production capacity

Source: Moneycontrol Research, Valuepickr.com, annual reports

Food colour usage

Food colour usage is for categories like confectionary, bakery products, desserts, dairy products, seasonings, beverages, pet foods. Purpose varies from enhancing naturally occurring color, masking natural variation in colours, and to protect flavours and vitamins from environmental damage.

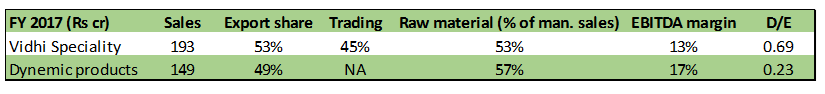

Listed Indian companies and capacity

Both Vidhi Specialty (incorporated in 1994) and Dynemic Products (established in 1990) are leading manufacturers of synthetic and natural food grade colors. While Vidhi Specialty’s also has a trading business of food colors (45 percent of FY17 sales), Dynemic Products is mainly into manufacturing and sales of synthetic food colors (74 percent of sales).

As per the annual report of Dynemic Products, it is in the process of setting up of its third plant in Dahej, for which it is awaiting environmental clearance. It’s currently having a capacity of about 5700 MT (24,000 sq feet facility) in Gujarat. Vidhi Specialty is aiming to double its capacity to 8,400 MT by 2020 and thus intending to capture market share of about 20 percent among the major players. Its current manufacturing facilities are at Dhatav, Raigad.

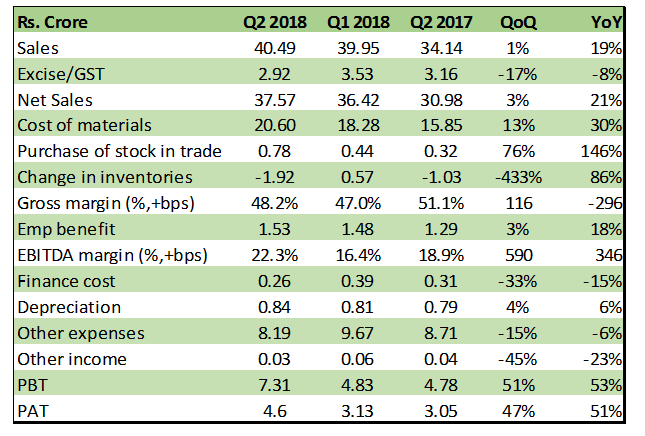

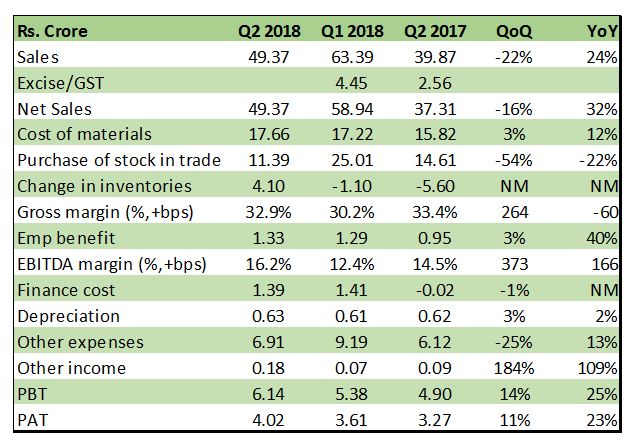

Stellar quarterly result

Dynemic Products witnessed improved topline growth of 19 percent YoY basis. Net profit margin rallied 51 percent benefitting from higher operating performance and lower other expenses. Vidhi Speciality posted double-digit growth in both topline and bottomline. Comparable margins for Vidhi Specialty was lower due to higher contribution of lower margin trading volumes.

Industry leader, USA based Sensient Technology Corp also reported a good set of numbers with improved pricing and volume growth in recent quarters.

Table: Dynemic Products

Table: Vidhi Speciality

Technology and broad product portfolio – barriers to entry

Usage of colors in food is closely regulated and varies from region to region. It is reported that about 14 colors are permitted for use in food in Europe, 6 in USA and 8 in India. Roha Dyechem mentions that there are some colors permitted in Europe, USA but not allowed in India (like Allura). So continuously maintaining various approvals (BIS, FDA, EU & WHO), certifications (Kosher & Halal) backed by an appropriate lab with testing facilities is an ongoing requirement.

Secondly, availability of broad product portfolio is helpful for tapping all needs to major end-client customers. Here, product offerings and capabilities for natural colors gets crucial as demand is picking up this segment.

Key risk - raw material and currency fluctuations

As a majority of products in this segment are exported currency fluctuation along with volatility in raw material cost (~50 percent of sales) are key risks. However, there is some natural hedge as a good part of raw material is imported (64 percent in case of Vidhi Specialty in FY17). With respect to raw materials, availability and price of dye intermediates from China is a key concern. Further, a long gestation period in the product approval by customer and success rate are the additional risks.

Promoters' creeping higher share in Dynemic Products

The promoter stake in the Dynemic Products is about 39.8 percent as per September quarter records. Promoters have been engaged in incrementally increasing their holding in the current quarter as well. In case of Vidhi Speciality, promoter stake is already high at 64.3 percent currently.

Competitive sector – scale and investment matters

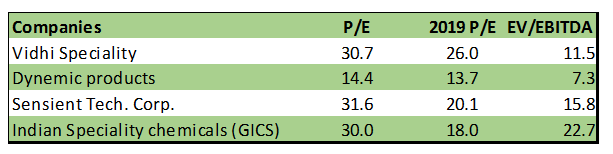

Source: Thomson Reuters

This niche segment of dyes and pigment benefits from the promising trends for the end market. Trading multiples for Vidhi Specialty is in line with the global leader while the latter has a better margin profile (EBITDA 18 percent vs. 13 percent for Vidhi Specialty) and a broader range of product portfolio (including natural colors).

However, expanding capacity for the Indian players makes them ready for the growth in terms of market share gains. In this regard, progress status of capacity expansion would be a near-term trigger for the companies. Both the companies have witnessed improved margin and return ratios over the last three years. The balance sheet has also strengthened and both the companies have reduced their net borrowings recently. Dynemic products appear relatively better placed with a similar earnings trajectory, capacity but better multiples, in our view.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!