Recent press reports suggest that Bharat Petroleum Corporation Limited (BPCL) might acquire government’s majority stake in India’s biggest gas transporter GAIL (Gas Authority of India Limited). Though the final approval is still pending, the government has asked banks to evaluate the deal structure. But is the proposed deal really synergetic for the companies or is it a desperate attempt by the government to narrow the current year’s deficit hole by pushing up the capital receipts?

The dealBPCL is looking to purchase either a part or whole of the government’s 54.88 percent stake in GAIL. The value of the entire stake (without any premium) is approximately worth Rs 37,758 crore as calculated on today’s price.

This purchase comes at a time when the government has been expressing a desire for consolidation in the oil space to create integrated oil companies which have the potential to compete with global giants. It also falls in line with governments’ targeted divestment plans for the fiscal year.

Synergies for BPCLBPCL is a state-owned oil refining and marketing company with a market capitalisation of Rs 1,07,660 crore. The company has 13 percent of India’s refining capacity and is the second largest oil marketing company in India with more than 13,500 fuel stations across the country. The company has 9 city gas distribution contracts of which 4 are in a joint venture with GAIL. It had recently announced plans to expand in the downstream gas and petrochemical segment.

The proposed deal falls in line with BPCL’s plan for expansion in the downstream gas market and would give the company access to GAIL’s huge ready-made gas distribution network in the form of over 11,000 km of gas pipelines and over 850 CNG stations across the country. This would facilitate rapid expansion for BPCL in the retail market, which is much needed given the changing oil marketing landscape in the country, increased competition with the entry of foreign players and anticipated growth in consumption of cleaner fuels in the coming years.

Impact on financialsThe purchase would mean significant addition to the finance cost for the company. Although the contours of the deal has not been finalized yet, assuming the deal is financed entirely via debt, it would escalate the finance costs by Rs 800-900 crore. This is around 8-9 percent of net FY17 earnings of the company. The additional debt would considerably increase the leveraging in the company and push up the debt equity ratio from the current 0.96 to 2.08. As far as GAIL is concerned, the deal would only mean a change in the ownership profile and we do not see much direct benefit prima facie.

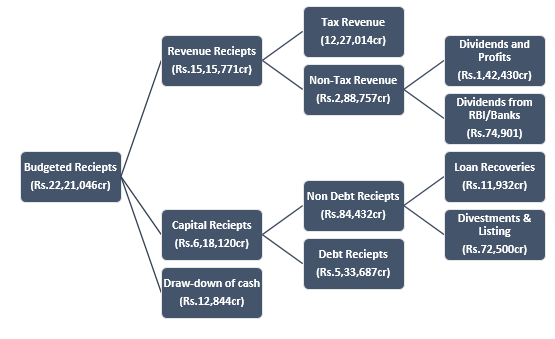

The government’s sideThe government stands to benefit the most from the deal. If we look at the broad fiscal math, the progress report so far hasn’t been too encouraging.

In the current fiscal, there has been a slowdown in the tax receipts. The July collections were around 50 percent of the monthly target owing to the implementation of GST. Although the tax receipts are expected to pick up in the latter half of the year, the rate of recovery is not certain. If the current trend prevails then there might be a hit on the annual tax revenue collections.

Moreover, the RBI had intimated the government last month about a lower dividend payout for the year, cutting it drastically from Rs 65,876 crore last year to Rs 30,659 crore this fiscal. This would reduce the non-tax revenue significantly. To add to the woes, the latest quarter’s GDP growth (April-June) was the lowest in the last three years. Hence, any reduction in infrastructure spending could negatively impact economic growth. Owing to these factors, there is increased pressure on the government to take the initiative to source more revenue from other avenues.

According to the current year’s budget estimates the government has budgeted Rs 72,500 crore divestment. Latest figures from the department of investment and public asset management show only 26 percent of the planned annual divestment (Rs 19,078 crore) has been achieved so far. Another Rs 33,300 crore is expected to flow in with the HPCL stake sale to ONGC which would take the total receipt under divestment to around Rs.52,370 crore. The GAIL divestment would not only help the government to achieve the targeted divestment, it would rather help compensate for stumpy performance in the other revenue generating areas.

Overall the deal brings about significant synergies for BPCL and would facilitate its strong and rapid expansion in the retail segment, though there would be a significant surge in debt on BPCL’s balance sheet. Further deal details are not finalised yet and feasibility of the deal would depend on the valuations. The government stands as a strong beneficiary and the deal would be a quick fix to achieving its divestment targets and reducing the year’s deficit.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.