Krishna Karwa

Moneycontrol Research

With India’s stock indices recording new highs almost every other day in the past fortnight, there was one company which, silently and out of nowhere, declared a phenomenal set of numbers for the quarter and year ended March 2017.

Fiberweb (India) Limited (FIL), an entity with weak fundamentals in the past, declared as a sick unit by the Board of Industrial and Financial Reconstruction (BIFR), has turned around its performance remarkably. It has not only come out of the purview of the BIFR scheme, but also gained a Star Export House status and became a positive net worth entity by the end of June 2016. With procedural restructuring nitty gritties out of the picture, the path ahead seems promising for the company. So is this stock truly worth considering, especially after a huge stock rally in recent times? Let’s find out.

Company Background

Established in 1985, FIL, a 100 percent export-oriented unit, manufactures synthetic fabric (polypropylene spunbond nonwoven variant) products for a range of diverse applications such as hygiene (baby diapers, adult diapers, sanitary napkins), agriculture (crop covers and mulching fabric, wind and insect protection), and textile (protective garments in hospitals, spas and industries; components for upholstery and luggage; bed sheets, pillow covers and curtains).

Investment Rationale

1. Capacity expansion to facilitate top-line growth

Exhibit: Capex Plan Allocation

FIL’s Rs 100-crore capex plan, which primarily aims at expanding its fabric capacity, was undertaken to meet growing demand for the company’s products across geographies. Peak incremental revenues of Rs 350 crore can be achieved when the expanded capacities (40 percent of such output will pertain to value-added products by the end of FY19) are commissioned in entirety in due course of time.

The actual benefit of higher sale volume will start accruing to the company from the second half of FY18 and will gradually keep scaling upward in FY19.

2. Robust order book traction

FIL's order book, worth Rs 105.72 crore by the end of Q4FY17, grew by 29 percent quarter on quarter. Furthermore, the company has enough number of order bookings till August 2017, attributed to a healthy increase in enquiries from prospective/present global clients, especially those in the United States of America and elsewhere. In January 2017, the company set up a subsidiary in the UAE, too, so as to be better positioned to cater to its buyers’ procurements in the US and other markets, which have been growing rapidly by the day.

3. Emphasis on value-added products (VAPs)

In the past, FIL manufactured synthetic fabric and supplied the same to its buyers, who, in turn, would convert it to the product before selling it to the final consumers. However, the company, by virtue of its progress towards VAPs, has been taking active steps to handle the conversions/modifications at its own end.

An increase in the share of VAPs in total turnover from 5-8 percent in FY16 to 15-16 percent in FY17 resulted in the spike in earnings in FY17 in general and the fourth quarter in particular. VAPs also command higher realizations and margins. On an average, for every 10 percent of VAPs sold by the company, a one percent hike in the operational margins can be expected. In FY18/FY19, the share of VAPs is expected to increase to 30/40 percent, respectively.

4. Leverage unlikely to dent performance

To fund the proposed capital expenditure, the company raised Rs 32.5 crore through a preferential issue of equity shares (not forming part of FIL’s promoters’ shareholding) and is likely to borrow to the tune of Rs 67.5 crore in the near future. Albeit the dilution in per share earnings, the benefit of operating leverage should be significant. The pay-back period for the new capacity is unlikely to stretch beyond 3 to 5 years. We anticipate the interest coverage for FY18 and FY19 to be roughly around 4.7x and 3.7x, respectively.

5. Growing demand for technical textiles

Technical textile products serve a multitude of niche purposes spanning the breadth and depth of all industries in some form or the other. It continues to grow at an estimated minimum rate of 10 percent every year.

Threats

No investment decision is completely devoid of risks. For FIL, synthetic fabric exports constitute around 70-75 percent of turnover every year, with United States’ share in the overall export value being maximum. Therefore, any form of global volatility will impact performance.

Being a 100 percent Export Oriented Unit (EOU), FIL needs to mandatorily comply with specified regulations from time to time. The company is eligible to claim subsidies as well. Any major change in regulations could impact earnings.

Finally, the company is subject to volatility in polymer prices. Introduction of value-added products to the product portfolio may address the issue to some extent.

Valuation & Recommendation

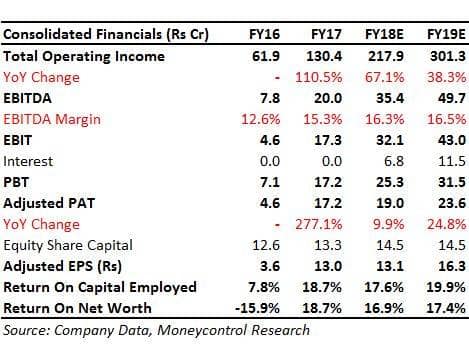

After the huge run-up in the stock, the company ought to be on the radar of investors for the earnings growth that it will offer on account of capacity expansion and a shift in product mix in favour of value-added products. However, given the current euphoria in the markets, investors may start looking at accumulating the stock gradually as the valuation (at 21x FY19 projected earnings) could soften on account of market gyrations. Buying on dips would be the strategy to go.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.