Anubhav SahuMoneycontrol Research

The FMCG space has been seized by turbulence due to the disruptive Patanjali entering the fray. But one can’t deny the secular growth prospects of the sector. In trying to make the most of these two conflicting realities, we came across a company that benefits from both the growth of the new challenger and the secular rise in consumption.

The relatively unheard of player is JHS Svendgaard, a contract manufacturer for oral care products catering to companies like Patanjali and Dabur that is on an expansion spree. It’s a turnaround story that grabs attention because it is a surrogate play on the disruptor’s aggression, offers an opportunity to participate in the growing oral care market, and now boasts of a clean and strong balance sheet.

Biggest oral care contract manufacturer

JHS is one of the biggest oral care contract manufacturers and currently produces oral care products like toothbrushes and tooth paste (50 percent of revenue each). The company currently caters to major FMCG manufacturers which are expected to constitute 70-75 percent of FY 2017-18 revenue. In addition, JHS is also focusing on its own brand (10-12 percent of revenue). The company’s major clients include Dabur, Patanjali, Amway, Vanessa, Marya Day, Walmart and Emami.

Oral care: Secular growth

India’s per capita toothpaste consumption of 147 g (vs China 277 g) is amongst the lowest in the world. Growing awareness about oral healthcare underlines the secular growth potential for this sector. Colgate, the dominant player in the toothpaste category has lost market share (57.4 percent to 55.1 percent) in last two years to Dabur and Patanjali, both JHS clients, suggesting a healthy orderbook growth will continue.

Source: Moneycontrol Research

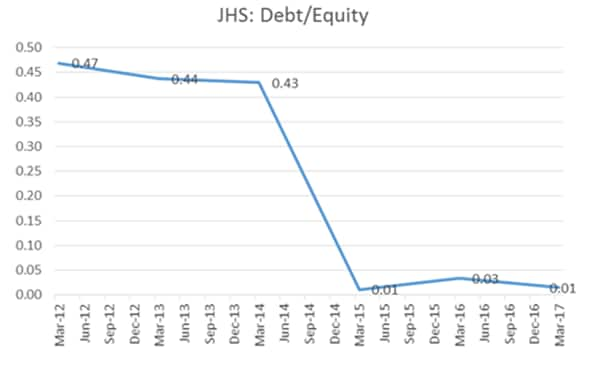

Turnaround story – zero debt company

JHS had posted a loss during 2013-2016 on account of the failed arrangement with its then key client, a major FMCG player, that led to litigation. Recently, the company reached an out-of-court settlement, helping it to clear a contingent liability of Rs 206 crore. Over the years, the company has worked on reducing debt and at present has near-zero debt on its balance sheet.

Learning its lesson from the above episode, JHS is working on the diversification of its client base and limiting exposure to any single entity. For 2020, JHS is targeting 50 percent revenue share from its own brand and limiting single client exposure to about 15 percent. However, depending on the robust contract manufacturing opportunity, the ambition to establish its own brand might undergo changes.

In the FY 2016-17, the company posted a profit of Rs 21.98 crore (vs loss of Rs 21.63 crore in FY 2015-16), partially aided by topline growth of 5.4 percent.

Earnings Snapshot (Rs crore)

Source: Moneycontrol Research

Capacity ramp-up and the client consolidation

Our conversation with the vice-president (finance) of JHS Svendgaard, Ashish Goel, gave us interesting insights into the company’s capacity expansion plans and success in client consolidation.

In the FY17, capacity utilisation improved to 80 percent from the level of 60 percent a year before. The new capacity expansion, to be commissioned in early 2017-18 at Kala Amb, Himachal Pradesh, would increase capacity by about 80 percent (100 percent in toothpaste and 70 percent in toothbrush category). The company is targeting volume growth to the tune of 45-50 percent in 2017-18 as about 50 percent of the capacity expansion is already backed up by client commitments.

Client consolidation is another area where the outlook appears to be promising. In Q4 2017, company started tooth paste manufacturing for Patanjali along with the existing tooth brush manufacturing. Thus, making Patanjali its biggest client. Dabur is the second biggest-client, for which JHS had already been manufacturing both product categories. Thus, after Colgate, the two biggest FMCG players in the oral care products, are sourcing from JHS. Interestingly, their market share is increasing in this niche segment. Thus, in a way, JHS is a proxy for the entire segment of dental care growth in India.

Reduced margins may be new normal for FMCG sector

EBITDA margins were at 11 percent for FY 2016-17 and expected to be in the range of 13-15 percent in the medium-term through improvement in product mix and scale. Given the nature of business and the current competitive pressure, we don’t expect margins to go back to 2008-10 levels when it reported 23-25 percent.

Valuation not a hindrance given earnings growth

Based on reported numbers, JHS is trading at FY 2017 P/E of 10x. However, if we take the tax benefit accrued in Q4 2017 into account, adjusted P/E multiple is about 43x vs FMCG average of ~ 52x.

We expect the margin trajectory to improve as the company ramps up production. The company is expected to report 111 percent earnings CAGR in FY17-19E. So on PEG basis, stock is trading at 0.4, which is attractive in our view.

In sum, we think that JHS Svendgaard is an indirect play on Patanjali’s volume growth in select high-growing segments and also a proxy for Indian dental care consumption growth. We advise clients to accumulate this stock for the medium term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.