Sachin Pal

Moneycontrol Research

Cera Sanitaryware reported a decent Q2 FY19 in a challenging business environment. The company reported healthy double-digit topline growth. Operational performance, however, remained flat on account of a slight change in product mix and increased cost pressures. Cera’s business continues to witness robust performance in a subdued market. Despite a muted performance in H1 FY19, the management remains optimistic on demand revival in coming months and expects the company to post double-digit topline for the full year.

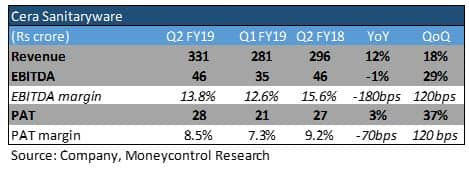

Decent topline growth, but higher costs drag margins

Revenue increased 12 percent year-on-year to Rs 281 crore. Demand was impacted by transporters strike in July and Kerala floods in August and September. Earnings before interest, tax, depreciation and amortisation (EBITDA) came in flat as margin contracted 180 bps YoY (100 bps = 1 percentage point) on the back of increased cost pressures. Bottomline also moved in line with operational performance and profit after tax was marginally higher compared to last year.

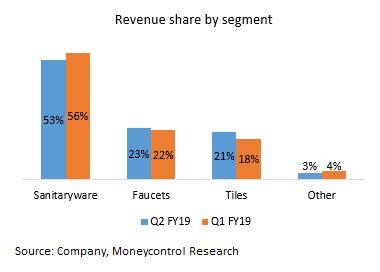

Tiles leading growth among segments

On a segmental basis, the Q2 revenue mix was largely in line with the previous quarter. Tiles has a smaller revenue base and continued to grow at a faster rate (19 percent) compared to other business segments. Its contribution to revenue increased to 21 percent compared to 18 percent in Q1 FY19. Faucets grew at 16 percent and sanitaryware clocked a topline growth of around 7 percent YoY. Blended margin came in lower on account of increase share of the tiles business.

Cera’s sanitaryware plant is operating at near full capacity utilisation. In contrast, faucets and tiles are operating at slightly lower plant utilisation levels. Utilisation of these plants lie in the range of 75-80 percent.

Successive price hikes to ease off margin pressures

Rising raw materials prices and input costs are impacting margins across the building materials industry. Natural gas is a major constituent of the tile manufacturing process. However, it forms a very small constituent in sanitaryware manufacturing. Overall, gas-related expenses increased to around 1.9 percent of revenue in the quarter gone by. The same stood around 1.5 percent in the previous quarter.

The company had previously taken a selective price hike of 2-5 percent in May-June to mitigate cost pressures. Margin improved sequentially as these price hikes supported operational performance. In line with the industry players, the management increased product prices in October to alleviate margin pressures.

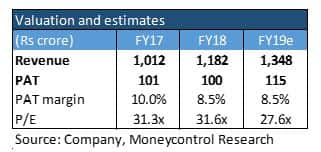

Cera expects to achieve mid-teen revenue growth in FY19, led by double-digit growth in faucets and tile segments. These successive price revision should alleviate the margin pressure being faced by the company in recent months.

Outlook and recommendationOverall demand for building material products continues to be muted as real estate activity is facing a subdued market environment. Q2 FY19 turned out to be another challenging quarter for Cera Sanitaryware as demand was impacted by a number of adverse factors. However, double-digit topline growth in a muted demand environment reinforces our faith in the management’s execution.

From an operational standpoint, the company has an established distribution network and has been able to develop a strong brand recall among customers. The company has superior operational execution among its peers, which gets reflected through its margins, high return ratios and strong balance sheet. The stock has seen a gradual correction and is now trading at a FY19 price-to-earnings multiple of 28 times which appears reasonable for accumulation from a long term view.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.