The Nifty50 which started with a small gap on the higher side build the momentum to reclaim its crucial resistance level of 10,600 but last hour of sell-off pulled the index towards 10,550 making a small bullish candle on the daily candlestick charts.

A small bullish candle is formed when the index closes higher but there is plenty of movement on either side. The candle would typically have a slightly large body.

The index witnessed some selling pressure around its 50-day exponential moving average and 5-DEMA which are placed around 10,614 levels. The trend might have just tilted towards the bulls as long as it holds 10,276 levels and the next target is placed around 10,700.

Investors are advised to stay long with strict stop losses below 10,498 levels, suggest experts. Given that most of the volatility is caused by global factors, traders should use bounce back towards 10,700 to book profits or close long positions.

The Nifty50 which opened at 10,518 rose to an intraday high of 10,637. It slipped below 10,500 levels to hit an intraday low of 10,479 before closing 100 points higher at 10,576.

"Unless bulls push the indices beyond 10,736 levels on closing basis, a constructive rally may not be witnessed in the markets. As our twin momentum oscillators generated a buy signal in today’s session along with other additional technical parameters already in buy mode we expect markets to trade with a positive bias for next couple of trading sessions," Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

Technically speaking short-term traders can retain positive bias as long as Nifty50 sustains above 10,498 levels on closing basis breach of which may again drag it down towards 10,276 levels, he said.

“However, as the element of risk is high due to uncertainty in global markets traders are advised to close their long positions as we head towards 10,700 levels owing to weekend factor in next trading session,” added Mohammad.

We have collated the top fifteen data points to help you spot profitable trade:

Key Support & Resistance Level for Nifty:

The Nifty closed at 10,576.90 on Thursday. According to Pivot charts, the key support level is placed at 10,491.6, followed by 10,406.4. If the index starts to move higher, key resistance levels to watch out are 10,649.9 and 10,723.

Nifty Bank:

The Nifty Bank closed at 25,920.65, up 0.98 percent. Important Pivot level, which will act as crucial support for the index, is placed at 25,663.27, followed by 25,405.83. On the upside, key resistance levels are placed at 26,152.27, followed by 26,383.83.

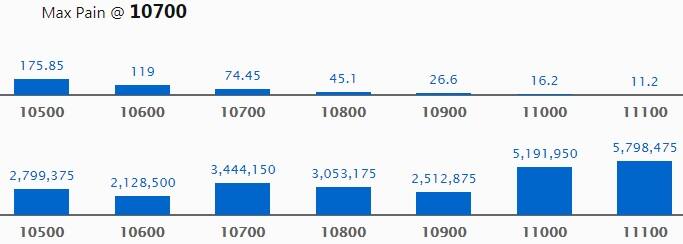

Call Options Data:

Maximum call open interest (OI) of 57.98 lakh contracts stands at strike price 11,100, which will be a resistance for the February series, followed by 11,000, which now holds 51.91 lakh contracts in open interest, and 10,700, which has accumulated 34.44 lakh contracts in OI.

Call writing was seen at the strike price of 10,900, which saw the addition of 2.58 lakh contracts along with 11,100, which added 2.37 lakh contracts.

Call unwinding was seen at the strike of 10,600, which shed 4.6 lakh shares, followed by 11,000 which shed 3.4 lakh contracts and 10.800 which shed 2.27 lakh shares.

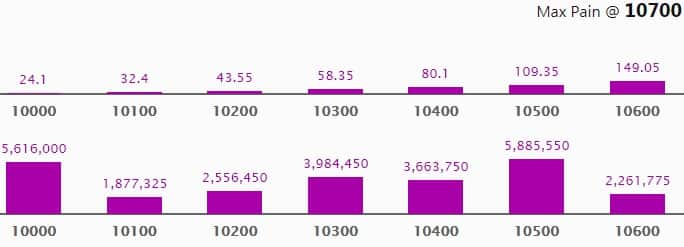

Put Options Data:

Maximum put OI of 58.85 lakh contracts was seen at strike price 10,500, which will act as a crucial base for February series, followed by 10,000, which now holds 56.16 lakh contracts and 10,300 which has now accumulated 39.84 lakh contracts in open interest.

Maximum Put writing was seen at the strike price of 10,500, which saw the addition of 9.53 lakh contracts, followed by 10,400, which added 6.21 lakh contracts and 10,300, which added 5.94 lakh contracts.

Put unwinding was seen at 11,000, which shed 0.97 lakh contracts, followed by 10,900, which shed 0.7 lakh contracts and 10,000, which shed 0.59 lakh contracts.

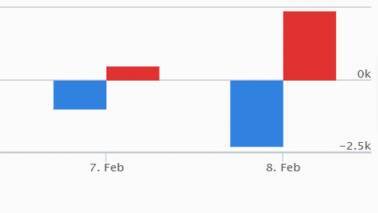

FII & DII Data:

Foreign institutional investors (FIIs) have net sold shares worth Rs 2,297.09 crore, while domestic institutional investors (DIIs) bought shares worth Rs 2,373.59 crore in the Indian equity market on Thursday, as per provisional data available on the NSE.

Fund Flow Picture:

Stocks with high delivery percentage:

High delivery percentage suggests that investors are accepting the delivery of the stock, which means that investors are bullish on the stock.

113 stocks saw long build-up:

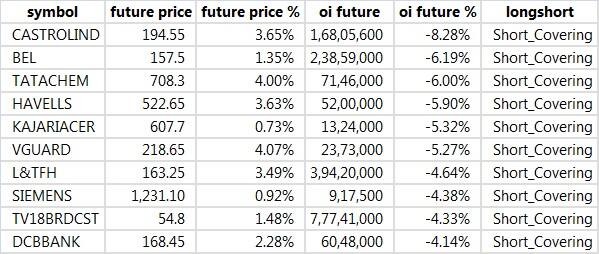

75 stocks saw short covering:

A decrease in open interest along with an increase in price mostly indicates short covering.

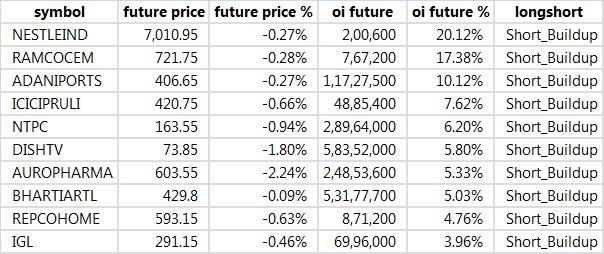

22 stocks saw short build-up:

An increase in open interest along with a decrease in price mostly indicates short positions being built up.

1 stock saw long unwinding:

Long unwinding happens when there is a decrease in OI as well as in price.

Bulk Deals:

Astron Paper & Board Mill Ltd: Niraj Laherchand Modi bought 2,50,056 shares at Rs 126.42 per share.

Omkar Speciality Chemicals: Ravi Pareek sold 3,77,892 shares at Rs 44.94 per share.

(For more bulk deals click here)

Analyst or Board Meet/Briefings:

Parag Milk Food: The Board has approved the un-audited standalone and consolidated financial results of the company for the quarter and nine months ended December 31, 2017.

Bombay Dyeing: The Board of Directors considered and approved the un-audited financial results of the company for the third quarter/nine months ended December 31, 2017.

Stocks in news:

Aurobindo Pharma: The Company has fixed February 21, 2018 as the Record Date for the purpose of payment of second interim dividend.

ACC Ltd: The Company has recommended payment of a final dividend of Rs 15 per equity share of Rs 10 each.

Trent to raise funds through issue of commercial paper upto an amount not exceeding Rs 200cr

Mr Malvinder Singh and Shivinder Singh have tendered resignation from the directorships of Fortis

Indiabulls Real Estate to meet on Feb 14 in relation to demerger of residential and commercial biz

Indian Bank change in overnight MCLR for various tenors.

Vijaya Bank issue of equity shares to govt on preferential basis for a amount upto Rs 1277cr

Canara Bank to raise upto Rs 1000cr via rights issue

4 stocks under ban period on NSE

Security in ban period for the next trade date under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

The security which are banned for trading are Fortis, GMR Infra, HDIL and Jain Irrigation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.