The surprise resignation of Vishal Sikka as MD & CEO of Infosys weighed heavily on D-Street which cost its shareholders a notional loss in market capitalisation of about Rs 27,000 crore while the cumulative investment of Narayana Murthy’s family saw a decline of about Rs 1,000 crores as stocks touched multi-year low.

Infosys which started with a gap on the lower side slipped over 13 percent to touch its multi-year low of Rs884.20 in trade on Friday.

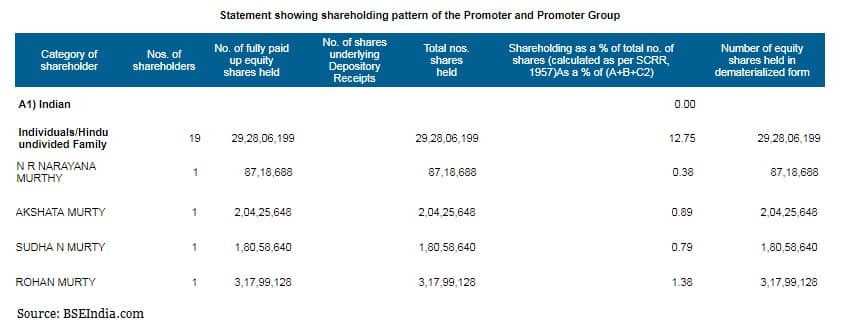

The promoter and the promoter group cumulatively holds nearly 29,28,06,199 shares in Infosys and out of that Narayana Murthy and his family holds 7,90,02,104 shares according to BSEIndia website.

N Narayana Murthy holds 87,18,688 shares while Akshata Murthy held 2,04,25,648 shares. Sudha Murthy holds 1,80,58,640 shares and Rohan Murthy held 3,17,99,128 shares as of June quarterly shareholding data.

The cumulative notional loss which Narayana Murthy suffered today is a little above Rs 100 crore while other members of the members of the family saw a national loss of little over Rs 900 crores (refer table) from Thursday’s closing price of Rs 1020.85 on the NSE.

Sikka’s exit draws a long drawn out board room battle to a close but is that over, only time will tell. One of the prime reason highlighted by the board of Infosys was a letter authored by Murthy, the Founder of Infosys which was released to various media houses attacking the integrity of the Board and Management of the Company alleging falling corporate governance standards in the Company.

Murthy's continuous assault, including this latest letter, is the primary reason that the CEO, Vishal Sikka, has resigned despite strong Board support, Infosys said in a press release.

The board further clarified that Murthy’s letter contains factual inaccuracies, already-disproved rumors, and statements extracted out of context from his conversations with Board members.

Also Read: Narayana Murthy hits back at Infosys board: Here's the complete statement

However, in a release, he said that “I am extremely anguished by the allegations, tone, and tenor of the statement. I voluntarily left the board in 2014 and I am not seeking any money, position for children or power,” said N Narayana Murthy.

“My concern primarily was the deteriorating standards of corporate governance which I have repeatedly brought to the notice of the Infosys board,” he said.

“The move is a succession plan to the company where Sikka comes on the board as vice chairman. During the past couple of month’s resignation of Dadlani who was responsible for generating business in the company came as a setback,” Mahesh Singhi, Founder & MD, Singhi Advisors told Moneycontrol.

Also Read: Vishal Sikka resigns as Infosys CEO & MD with immediate effect

“These rejig at top position was calling for post the exit. The resignation is just a succession plan for him post the company transformation since he took over,” he said.

Singhi further added that this also seems as the direct move to me at the time when the company is battling against the time to put Infosys back on the growth pedestal, as an embattled board and management face questions on poor corporate governance from some of the company’s founders, led by N.R. Narayana Murthy.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.