The initial public offering of Security and Intelligence Services (India) is set to open for subscription on July 31 and will close on August 2.

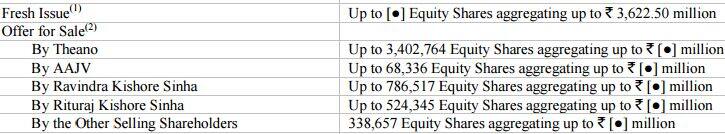

The issue comprises of fresh issue, and offer for sale by promoter group as well as investors.

Bids can be made for minimum 18 equity shares and in multiples of 18 shares, thereafter. The equity shares are proposed to be listed on BSE and National Stock Exchange.

SIS has a diverse portfolio of business support services which includes security services, cash logistics services and facility management services.

Axis Capital, ICICI Securities, IIFL Holdings, Kotak Mahindra Capital Company were global coordinators and book running lead managers, while SBI Capital Markets, IDBI Capital Markets are merchant bankers to the issue.

Here are 10 factors that you should know before subscribing the issue:-

About the Issue

Private security and facility management services provider Security and Intelligence Services has fixed a price band at Rs 805 to Rs 815 per share for the issue.

It aims to raise Rs 774.45 crore at lower end of price band and Rs 779.58 crore at higher end of price band.

The IPO comprises of fresh issue of shares worth Rs 362.25 crore and an offer for sale of upto 51,20,619 shares by existing shareholders.

Investors, who will sell shares, are Theano Private Limited and AAJV Investment Trust while promoters are Ravindra Kishore Sinha and Rituraj Kishore Sinha. There are 45 other selling shareholders who will also sell shares.

Objects of the Issue

Security and Intelligence Services (SIS) will receive fresh issue proceeds while offer for sale money will go to selling shareholders.

The funds raised through fresh issue would be used for repayment & pre-payment of a portion of certain outstanding indebtedness availed by company (about Rs 200 crore); funding working capital requirements (Rs 60 crore); and general corporate purposes.

Company Profile

SIS is the second largest security services provider in India in terms of revenue, as of March 2016. It provides a comprehensive range of security services ranging from providing trained security personnel for general guarding to specialised security roles in India and Australia.

It also provides cash logistics services (including transportation of bank notes and ATM related services), and electronic security services and home alarm monitoring and response services.

Other than security services, the company also provides facility management services including cleaning, janitorial services, electricians etc.

Its customers for private security and facility management services include private sector business entities operating in industries ranging from manufacturing and defense to mining, IT/ITeS, airports and aviation.

As of April 2017, it has branch network of 251 branches in 124 cities and towns in India. In Australia, it operates in each of the eight states and employed 5,754 personnel servicing 245 customers.

Brands - SIS offers private security and facility management services utilising the following brands and trademarks, including trademarks licensed from joint venture partners and licensors:-

Strategic Deals

In March 2008, SIS entered into an exclusive license agreement with ServiceMaster for the 'ServiceMaster Clean' brand, and associated proprietary processes, operating materials and knowhow in order to develop facility management business in India.

In August 2016, acquired 78.72 percent stake in Dusters Total Solutions Services Private Limited (one of the largest facility management services providers), with the agreement to increase its shareholding to 100 percent over the next three years.

It has entered into joint ventures with affiliates of Prosegur Compañía de Seguridad, SA (a global player in cash management and alarm monitoring); and an affiliate of Terminix International Company, LP (a multinational provider of termite and pest control services).

In Australia, it has wholly-owned subsidiary MSS Security Pty Limited that provides security services. It entered in Australia by acquiring Chubb Security's security services business in August 2008.

In June 2017, SIS through its subsidiary SIS Australia Group Pty Ltd signed definitive agreements to increase voting rights in Southern Cross Protection Pty Ltd (SXP) from 10 percent to 51 percent, with effect from July 1, 2017.

With effect from July 2017, it, through 100 percent subsidiary, SIS Australia Group, acquired an additional 41 percent of the voting rights in SXP. As a result, SXP has become one of its subsidiaries.

Effective July 2017, SIS, through its subsidiary, SIS Australia Group Pty Ltd, acquired 51 percent equity for Rs 88.36 crore in Andwills Pty, the holding company of Southern Cross Protection Pty Limited (SXP). As per share purchase agreement, the company has a right to increase its shareholding in Andwills to 100 percent after three years.

Andwills is the holder of 85 percent of the equity share capital in SX Protective.

Strategy

SIS aims to grow its businesses across customer segments; use and upgrade technology to improve productivity and customer satisfaction; leverage existing branch infrastructure to achieve operational synergies; and to explore inorganic growth through strategic acquisitions.

While it renders security and facility management services at 11,869 customer premises in India, as of April 2017, the company believes that there is significant opportunity to further increase the services offered to existing customers.

Management

Promoters, Ravindra Kishore Sinha and his son Rituraj Kishore Sinha, have over three decades and one decade of experience, respectively, in operating this business. Ravindra's wife Rita Kishore Sinha is also a director on company's board.

Ravindra Kishore Sinha has over 30 years of experience in fields which company operate. He is a Member of Parliament (Rajya Sabha) from Bihar while his son has over 14 years of experience.

Company currently has 12 Directors on its board, including six independent directors:-

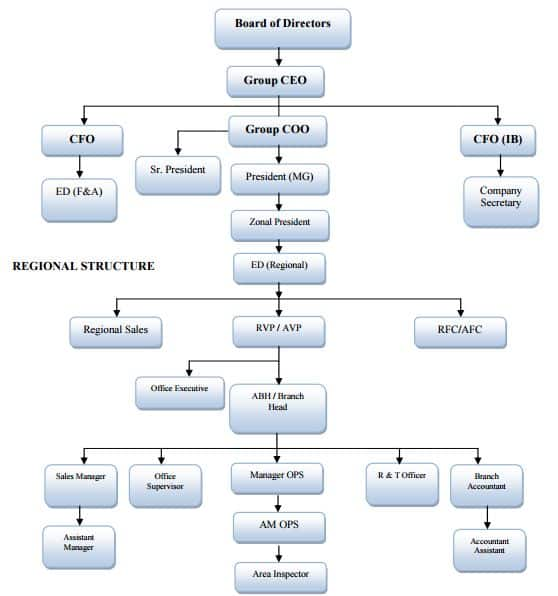

Management Organisation Structure

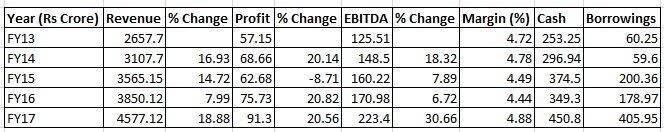

Financials

The company clocked revenues of Rs 4,600 crore in financial year 2016-17 employing 1.54 lakh people.

Total revenue grew at a CAGR of 14.56 percent to Rs 4,577.122 crore for fiscal year 2017 from Rs 2,657.7 crore for fiscal year 2013.

Revenue from operations for fiscal year 2017 from security services, cash logistics, electronic security and facility management businesses (including revenues from pest-control services) were, Rs 3,982 crore, Rs 165.13 crore, Rs 6.93 crore and Rs 394.98 crore, respectively.

EBITDA (earnings before interest, tax, depreciation and amortisation) has grown to Rs 223.38 crore for FY17 from Rs 125.51 crore for FY13.

Revenue from operations from security services business in India grew at a CAGR of 29.67 percent and revenue from operations from security services business in Australia grew at a CAGR of 7.7 percent in Australian dollar terms in FY13 and FY17.

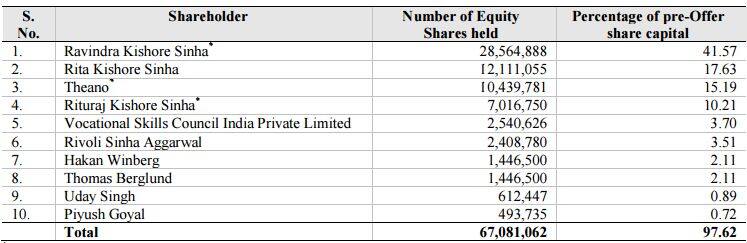

Shareholding Pattern

Shareholding Pattern

Top 10 shareholders as on the date of this Red Herring Prospectus are as follows:

* 37,10,570 equity shares (comprising of 36,37,098 equity shares by Theano and 73,472 equity shares by AAJV) are proposed to be transferred to promoters (i.e. 18,55,285 equity shares to Ravindra Kishore Sinha and 18,55,285 equity shares to Rituraj Kishore Sinha) by the investor selling shareholders pursuant to the second amendment agreement and the letter amendment, as per company's prospectus.

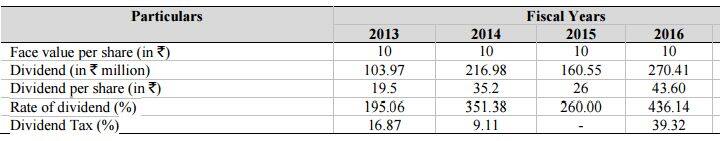

Dividend Policy

In FY17, the company has not paid any dividend. The dividends declared by company in each of the fiscal years 2013, 2014, 2015 and 2016 are given below:

Risks

Brokerage houses listed out some risks, which are:-

> Company is subject to several labour legislations and regulations governing welfare, benefits and training.

> Company recently acquired Andwills Pty Ltd and Dusters Total Solutions Services Private Limited. Failure to integrate the units remains the key risk.

> Political exposure of promoters

> Competition from the unorganised sector

> SIS is exposed to certain operational risk as it provide private security to sensitive sectors

> Less diversified business as significant portion of total revenue comes from security services

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.