The number of technology startups in India surged from around 2,000 in 2014 to approximately 31,000 in 2023, with roughly 1,000 tech startups incepted last year alone, shows the Economy Survey 2024.

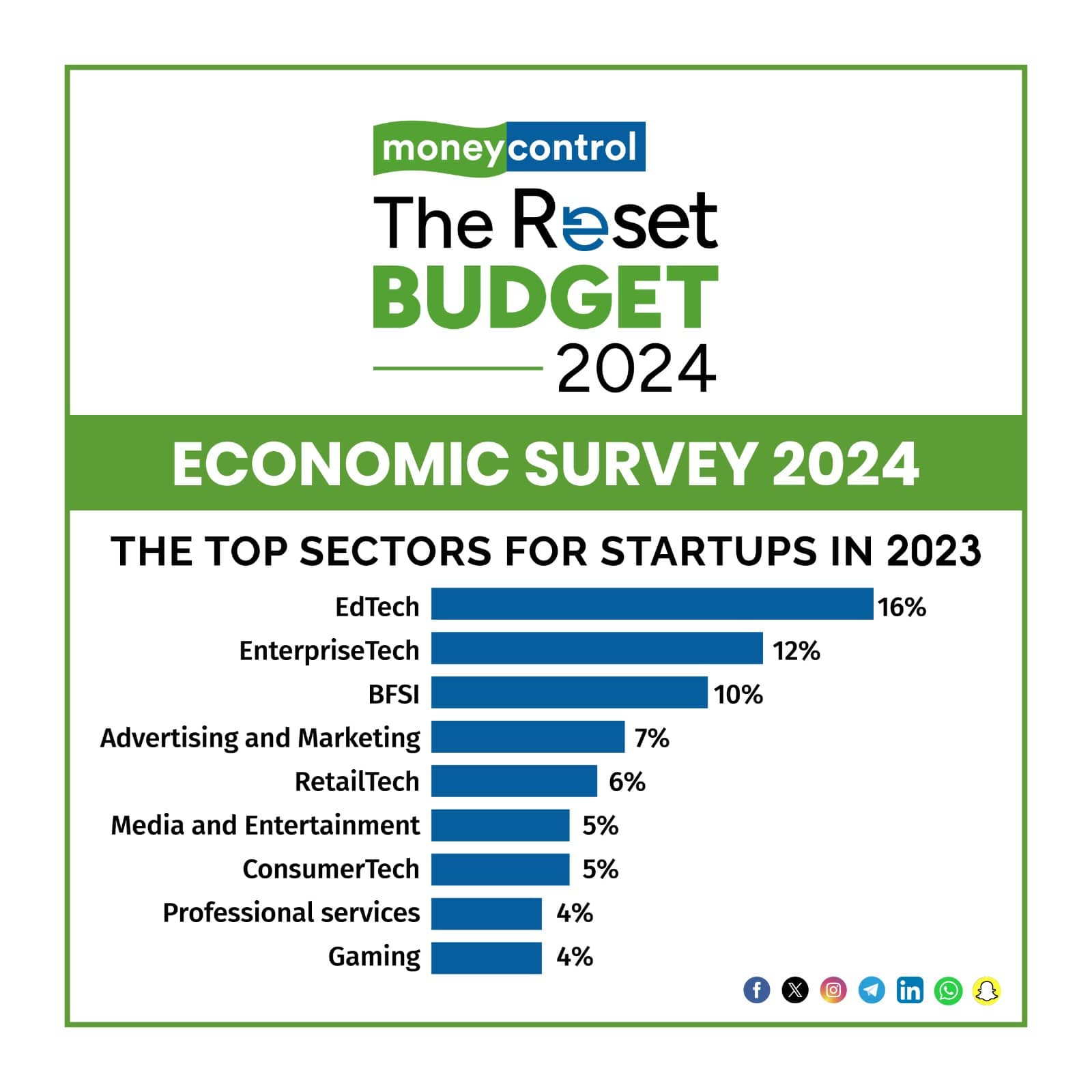

Edtech remained among the top sectors for startups in 2023 with 16 percent growth in number, followed by enterprise tech (12 percent), BFSI (10 percent), advertising and marketing (7 percent), retail tech (6 percent), media and entertainment (5 percent), consumer tech (5 percent), professional services (4 percent) and gaming (4 percent).

The Survey notes that several factors have contributed to the rise of startups across these sectors.

For instance, change in consumption patterns and increased internet penetration aided the growth among retail startups, while introduction of UPI was key to the success of BFSI or fintech firms since 2016.

“The demand for scalable and efficient cloud solutions led to the growth of Software as a Service (SaaS) start-ups, resulting in 21 unicorns since 2014. The Covid-19 pandemic accelerated growth in sectors like HealthTech and EdTech, spurred by the increased need for tele-consulting and remote learning solutions,” the Survey notes.

12,000 patent applications in 8 yearsStartups in India filed more than 12,000 patent applications from 2016 to March 2024, it showed.

From around 300 startups in 2016, the number of DPIIT-recognised startups increased to more than 1.25 lakh by end-March 2024, with over 47 percent of them having at least one woman director.

Interestingly, more than 45 percent of these ventures emerged out of Tier 2 and 3 cities.

“Under Fund of Funds for Startups, more than Rs 10,500 crore has been committed to more than 135 Alternative Investment Funds, which invested more than Rs 18,000 crore in startups by the end of FY24, according to the Survey.

The Fund of Funds for Startups (FFS) was launched by the government under the Startup India initiative to provide financial assistance to startups for proof of concept, prototype development, product trials, market entry and commercialisation.

Under FFS, the scheme does not directly invest in startups, instead provides capital to Sebi-registered AIFs, known as daughter funds that in turn invest the money in growing Indian startups through equity and equity-linked instruments.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.