Indian tech companies and start-ups are back on a talent hunt after nearly 12-18 months of freeze on hiring following mass layoffs in a difficult business environment.

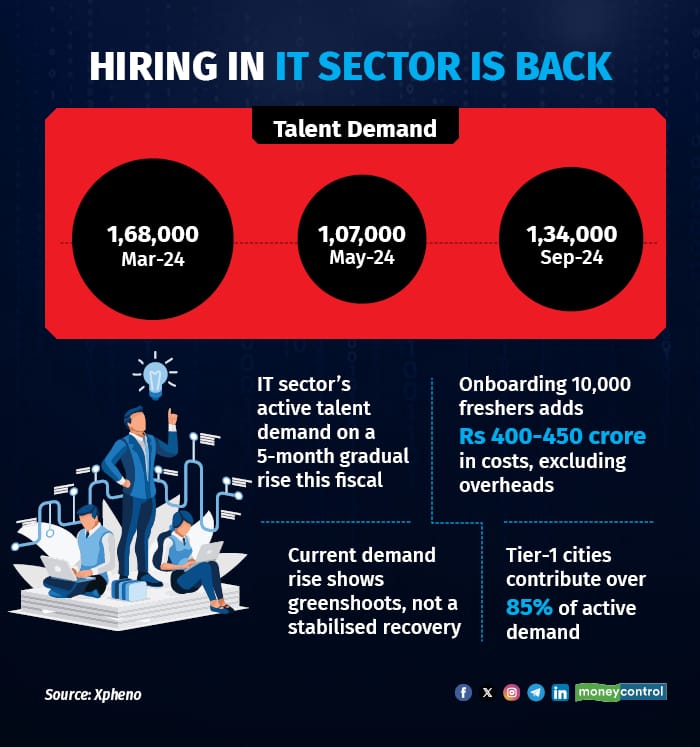

While this may only be the green-shoots as stabilised recovery is yet to be confirmed, the active demand for talent from the IT sector’s collective of services, products, and startups have been on a five-month gradual climb in the fiscal year 2025, according to data from specialist staffing firm Xpheno.

The data suggests that after closing March 2024 with a 20-month high of 168,000 active openings, demand had dropped to 156,000 and then hit a record low for the fiscal in May 2024 with 107,000 openings.

The current demand, though is only a 25 percent rise over the record low of May 2024, it's still less than 50 percent of its typical peak demand. “The sharp decline was a moderation in line with sustained global headwinds and sluggish IT expenditure with a drop in discretionary tech spends,” Anil Ethanur, co-founder of Xpheno, told Moneycontrol.

“Hiring is happening in IT companies across levels. Campus hiring will also pick up. IT companies had picked up big benches in the last few years. Now, with utilisation rates back to the pre-Covid levels, they have started hiring again. The hiring activity looks way better compared to the last two-four quarters,” Hitesh Oberoi, CEO and MD of Info Edge, which operates job search portal Naukri.com, said.

Oberoi expects attrition rates and salaries to also start climbing from here on, though it won’t be in the range of the pandemic period which he said was an aberration.

Hiring in IT sector, startups is backHiring and campus placement trends

Hiring in IT sector, startups is backHiring and campus placement trendsAfter reporting record low hiring numbers for both lateral and freshers in FY24, IT companies have begun opening up positions this fiscal and the top players have set out on their targets for hiring freshers.

Tata Consultancy Services (TCS), Infosys, HCLTech, Wipro and Tech Mahindra together plan to recruit around 81,000–88,000 freshers in FY25, following a year-long lull.

“IT hiring in India is showing resilience despite the economic slowdown in the US. Global demand for IT services remains high, and companies worldwide continue to outsource their tech needs to India due to cost advantages and the availability of skilled workforce,” Sunil C, country manager for India at Adecco, told Moneycontrol.

As salary expectations are likely to rise, retention strategies will be crucial if demand fluctuates. With hiring on the rise, attrition may also increase, leading to wage escalations.

“In India, salaries in the IT sector are projected to rise by approximately 5-7 percent on average. Salary hikes in lateral hiring have always been healthy, and in niche technologies, they are expected to be better due to increased demand for these skills,” Sunil added.

Xpheno, however, shared that the uptick in campus hiring is going to be cautious and more conservative. The degrowth in headcount for IT companies for the last two fiscals was the impact of the overall strategy to protect margins.

“Fresher hiring is not for the faint-hearted, especially in uncertain market conditions. Every 10,000 freshers onboarded translate to a Rs 400–450-crore direct compensation cost load and then the overheads get added to it. Enterprises that have degrown headcounts to optimise costs and protect margins, will go slow on such high spends, till they have visibility of revenues and margin trajectories,” Ethanur said.

He cautioned that the positive business sentiment is only early signals, and not strong enough for anyone to bet big on at this stage.

Xpheno said over 85 percent of these active demand is centred around Tier-I locations, while Tier 2 and 3 locations are not performing significantly better. But there are also openings in full-time hybrid and remote mode, which growth doubling since January 2024. This will have a spillover effect with eventual talent action in tier-2 and 3 locations.

According to technology industry body Nasscom, up to 15 percent of India’s tech talent resides in Tier 2 and 3 cities. Tier 2 and 3 cities are emerging as significant growth centers, attracting businesses and talent due to lower costs and improved infrastructure.

Startups are back in the gameStartups in India have cumulatively laid off over 30,000 people across tech and non-tech roles since the beginning of 2022. But now, industry insiders believe things have started to change a bit.

Info Edge’s Oberoi said that the layoffs were primarily happening in that period of funding winter, high burn rates and macro challenges. The startups that had to shed flab have already done that.

“Now those startups have got their act together, enough startups have started to break even. The startups which had to lay off, they did. They are now gearing up for growth, and for that they will need people. Startups want to grow at 40-50 percent annually, that will not happen without increasing the headcount,” Oberoi told Moneycontrol.

Sunil and Ethanur added that this hiring trend may not be the same across demographics, and some sectors and regions are likely to benefit more.

“This resurgence is particularly strong in tech hubs like Bengaluru and Pune, with a 37 percent increase in new startups leading to a 14 percent rise in job opportunities. Startups in the AI/ML and high-end product spaces have significantly increased their hiring spends, while others remain cautious,” Sunil said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.