Nazara Technologies on May 24 reported a net profit of Rs 0.18 crore, registering a significant drop from Rs 9.4 crore in the year-ago quarter.

This was mainly due to a Rs 16.87 crore loss from discontinued operations during the quarter, as a result of write-offs in many of the company's legacy businesses including its real-money gaming business Halaplay.

As part of the restructuring, Nazara said it is either merging or closing entities that are not aligned with its future vision, including Nazara Bangladesh, and NZ Mobile Nigeria.

The firm said it is in the process of divesting subsidiaries Nazara Kenya, Nazara Pro, digital entertainment firm Crimzon, and Sports Unity (maker of quiz app Qunami), while also evaluating options for Nazara Singapore and Mauritius entities.

As a result, most of the cash generated by its telco business will now directly benefit the parent company, it said.

The diversified gaming and sports media firm said the net profit from its continued operations was at Rs 17.1 crore for the quarter, up 43.6 percent from Rs 11.9 crore profit in Q4-FY23.

Revenue from operations was at Rs 266.2 crore for the quarter, down 8 percent year-on-year (YoY) from Rs 289.3 crore in the corresponding quarter last year.

For the full year FY24, Nazara posted a net profit of Rs 74.75 crore, up 21.8 percent from Rs 61.4 crore in FY23. The profit from its continuing operations increased 41.2 percent to Rs 89.5 crore in FY24, as against Rs 63.4 crore in FY23. The operating cash flow (pre-taxes) at Rs 131.4 crore in FY24.

Revenue grew 4.3 percent to Rs 1,138.3 crore in FY24 as against Rs 1,091 crore in FY23.

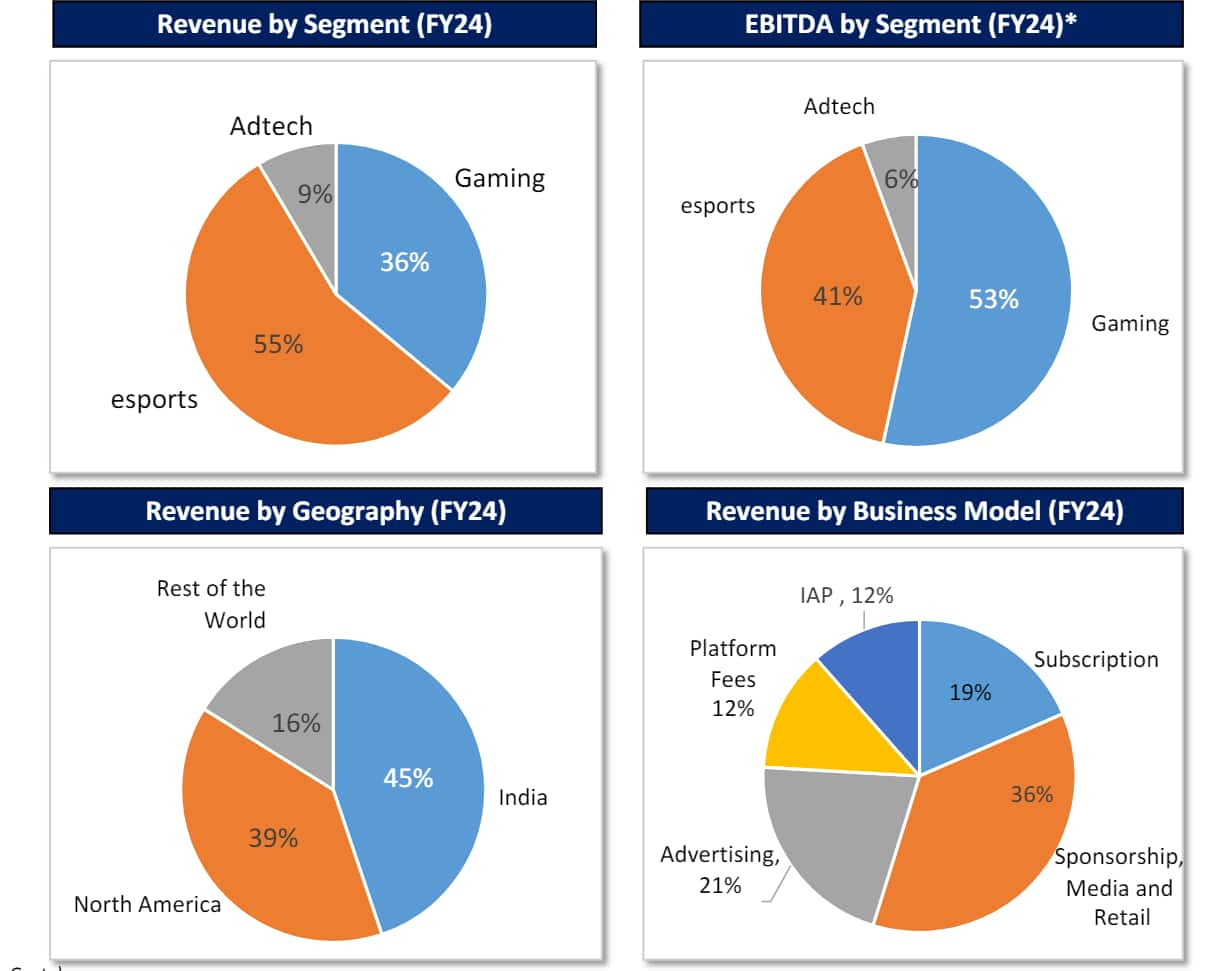

Nazara Technologies currently operates in three key sectors - gaming (World Cricket Championship, Kiddopia, Animal Jam, Classic Rummy etc), esports (Nodwin Gaming, Sportskeeda) and advertising (Datawrkz).

A look at the revenue split of Nazara Technologies in FY24

A look at the revenue split of Nazara Technologies in FY24

New operating model

Nazara said it also implemented a new operating model earlier this year to enable more revenue and free cash flows to accrue directly to the parent company by merging gaming IPs. This includes increasing its stake in mobile gaming subsidiary Nextwave Multimedia to 100 percent.

Nextwave Multimedia is the developer of the World Cricket Championship (WCC) franchise, which claims to be the largest mobile-based cricket simulation game.

Nazara Technologies first acquired a majority stake in Nextwave Multimedia in 2018 and increased its stake to 71.88 percent in May 2023. The firm is now buying the remaining 28.12 percent stake for Rs 21.63 crore from founder shareholders P.R Rajendran, R Kalpana and P.R Jayashree in two tranches.

The first tranche will include buying 1,000 shares, representing a 3 percent stake of Nextwave, for Rs 2.3 crore in cash. The second tranche will include buying 8,375 shares, representing a 25.12 percent stake of Nextwave, for Rs 19.33 crore either by cash or stock issuance of Nazara Technologies within six months of the closure of the first tranche.

Read: Nazara subsidiary Nextwave Multimedia to buy IP assets of Games24x7's Ultimate Teen Patti

Nazara said it would consider deploying a similar playbook for other existing games as well as new acquisitions, whereby those core gaming IPs would be merged into the parent-listed entity to extract synergies and capture cash flows directly at the parent level.

In March, Nazara Technologies had earmarked a $100-million war chest for mergers and acquisitions over the next 24 months.

"FY24 has been a year of building a strong foundation for rapid future scaling. We are optimistic about FY25, expecting accelerated growth in both revenue and EBITDA. With substantial cash reserves and a robust M&A pipeline, we are well positioned to seize further growth opportunities and enhance our growth trajectory through strategic M&A over the next 12 months" said founder Nitish Mittersain.

He also noted that key initiatives from FY24 are set to yield results in the coming year, including the company's new publishing unit, new game launches through existing studios, and IP partnerships.

Read: NSE should become Nasdaq in 5 years, more founders should list in India: Nazara's Nitish Mittersain

Segment-wise performance

Esports remained the biggest vertical for the company, with revenues of Rs 148.2 crore in Q4FY24, up 6 percent YoY from Rs 140.1 crore in Q4FY23. Profit jumped to Rs 8.82 crore in Q4-FY24 from Rs 4.71 crore in Q4-FY23.

Nodwin Gaming's revenues saw an 8.7 percent decline to Rs 99.1 crore for the quarter, while Sportskeeda witnessed a 67 percent jump in its revenues to Rs 49 crore.

The gaming vertical reported revenues of Rs 91.1 crore for the quarter, down 17 percent YoY from Rs 110.2 crore in Q4FY23. The vertical however reported a loss of Rs 18.45 crore for the quarter, as compared to Rs 10.3 crore profit in the same quarter last year.

The Kiddopia business saw its revenue decline by 11.8 percent to Rs 50.9 crore for the quarter. The company said that its subscriber base declined to 255,382 for the quarter, from 273,249 subscribers in Q3FY24, due to lower user acquisition spends.

Revenue from Animal Jam business grew to 24 crore in Q4-FY24, due to increased revenue from Mystical Wing Bundle and continued success and monetisation of an in-game feature Wishing Coins. The feature helps players build wishes for specific attributes for their fantasy animals, requiring more coins for more detailed wishes.

Nazara's freemium business, which includes the cricket simulation game World Cricket Championship, saw its revenue decline to Rs 3.9 crore during the quarter from Rs 5 crore in the year-ago quarter.

Nazara said that Nextwave’s ad monetization, live ops, brand sales, and user acquisition operations have been revamped, and the firm expects those to drive better retention and monetization for the franchise in FY25.

WCC had a monthly active user base of 8.1 million, of which 1.1 million are daily users.

The real-money gaming business saw its revenue fall sharply to Rs 4.8 crore for the quarter, from Rs 12.6 crore revenue in Q4-FY23, due to the impact of the government's 28 percent GST regime that became effective from October 1, 2023. The higher GST cost along with providing bonuses to players resulted in lower net revenue, the company said.

Nazara said that its Gross Gaming Revenues (GGR) have only seen a slight decline, indicating that customers are still playing almost the same amount of games on the platform, but the portion paid out as GST has increased sharply from 12 percent to 51 percent of Gross Gaming Revenue, the company said.

The segment posted a profit of Rs 1.2 crore for the quarter, as compared to Rs 2.4 crore profit in the year-ago period.

However, the company said it expects strong revenue growth from July 2024 on the back of new features and gaming formats. The firm mentioned that it is also focusing on incentivising players to play more with deposited funds, rather than withdrawing and re-depositing funds.

This is crucial to reduce the company's tax outflow since the government levies 28 percent GST on player deposits.

Explained: GST Council’s 28% tax on India’s real-money gaming sector

Nazara's adtech business saw a 29.5 percent decline in revenues to Rs 27.5 crore for the quarter, from Rs 39 crore in the same quarter last year. For the full year FY24, revenue dropped to Rs 103.8 crore from Rs 153.2 crore the year before.

The revenue drop comes as the firm shifts focus from low-margin clients to higher-margin clients and product businesses.

Nazara said the increased product development and marketing efforts, especially in the US market, throughout FY24 resulted in the EBITDA declining to Rs 8.3 crore for the year, from Rs 13.5 crore in the year before.

In terms of geographies, India accounted for 45 percent of the company's revenues for FY24, while North America contributed for 39 percent and the rest of the world contributed the remaining 16 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.