Saudi Arabia’s sovereign wealth fund raised $5.5 billion from a three-part green bond sale, the second debt offering by the Public Investment Fund within four months.

The PIF secured more than $32 billion of orders for the bonds that have maturities of 7, 12 and 30 years, according to people familiar with the matter, who asked not to be identified. The deal priced with the notes to yield 115, 145 and 185 basis points over US Treasuries.

The wealth fund in October raised $3 billion with its debut dollar bond sale that also marked its first foray into ethical finance. Saudi Arabia’s government, which controls the PIF, tapped the debt market in January, raising $10 billion through its first Eurobond sale of 2023.

The PIF plans to use the proceeds for general corporate purposes and to finance, refinance and invest in green projects.

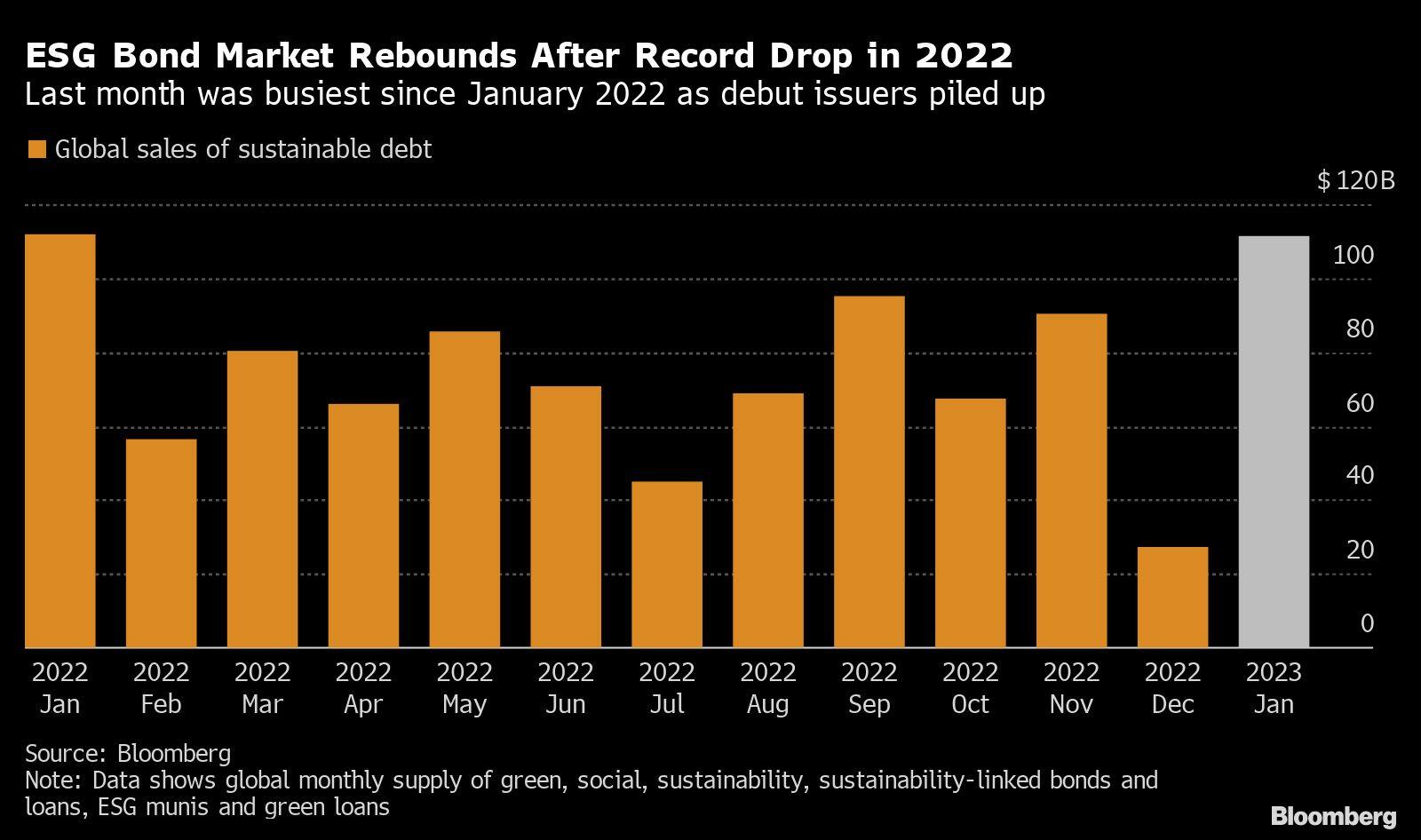

Strong bond returns and falling borrowing costs in the high-grade markets helped fuel an unprecedented debt-sale bonanza around the world, with a number of companies and governments tapping the sustainable debt market for the first time.

Green bond sales, the largest category of sustainable debt by amount issued, rose to $57.2 billion in January, the most since November, when borrowers raised $58.7 billion. The government of India borrowed $1 billion with its maiden sovereign green bond issuance to help fund the transition to cleaner energy.

Goldman Sachs Group Inc., JPMorgan Chase & Co., Standard Chartered Bank, BofA Securities, BNP Paribas, Citigroup, First Abu Dhabi Bank, HSBC Bank, Morgan Stanley, Credit Agricole CIB, GIB Capital, ICBC International Securities, Mizuho, SMBC Nikko and Societe Generale managed the PIF offering.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.