It appears the humble Systematic Investment Plan (SIP) in mutual funds (MFs) is giving sleepless nights to Santosh Iyer, head of sales and marketing at Mercedes-Benz India.

Media reports say Iyer is worried that not many people are buying Mercedes cars these days because they’d rather invest in an MF through an SIP.

Iyer is reported having said that while there are 15,000 people inquiring about luxury cars every month, the actual order size is 1,500 units.

“So, there are still 13,500 customers who desire to own a Mercedes-Benz, but postpone their purchase thinking it’s fine, maybe, I should continue (with) my SIP or maybe the next dip (in markets) is there,” Iyer is reported as having said.

Here’s something for Iyer. An SIP doesn’t really prevent people from buying a Mercedes-Benz car. It actually helps them save today to buy the car tomorrow. Moneycontrol ran some numbers to show you how you can use SIPs to buy your dream car; yes, even a Mercedes-Benz.

Also read | Got your first pay? 5 simple rules for your investment journey

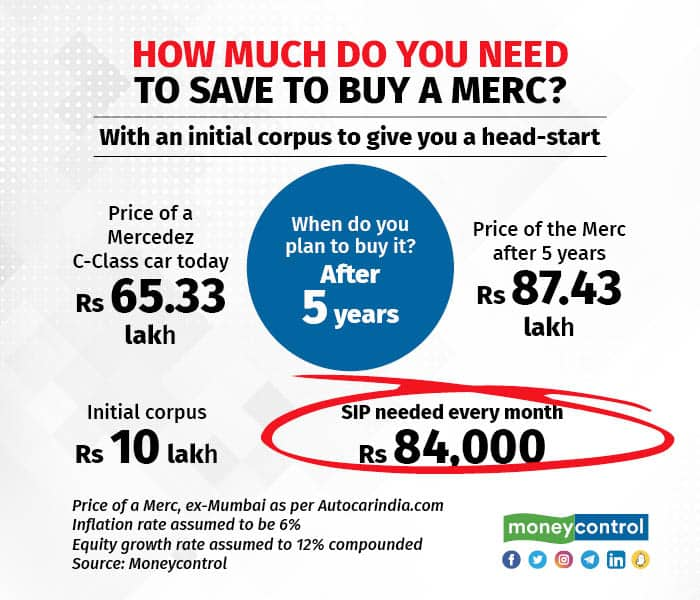

Planning your SIPSay the price of a C-class Mercedes-Benz in Mumbai today is Rs 65.33 lakh. If you wish to buy a Merc in, say, five years, the price is bound to go up. Assuming an inflation rate of 6 percent, the price is set to go up to Rs 87.42 lakh. That’s how much you need to buy a Merc after five years. How do you get there?

All you have to do now is work backwards to figure how much you need to put aside, every month, in an MF SIP. If you assume equity markets to go up by 12 percent on a compounded basis, you need to start a SIP of Rs 1.05 lakh. That’s what you need to set aside every month, for the next five years.

The key to fulfilling your financial dream is to estimate the cost (with inflation) and then working backwards to ascertain your required SIP contribution

The key to fulfilling your financial dream is to estimate the cost (with inflation) and then working backwards to ascertain your required SIP contributionBut if you have an initial corpus, it gives you a breather. An initial corpus gives you a head start. How much do you need? Let’s see.

Say, you have Rs 10 lakh to begin with. In this case, if you want to buy the same Merc 5 years later, all you need to put aside every month in an SIP is about Rs 84,000. If you have a headstart of Rs 20 lakh, then your monthly SIP requirement falls further, to just about Rs 62,000.

Your financial goals get closer if you have a head-start or top-up your SIPs, periodically.

Your financial goals get closer if you have a head-start or top-up your SIPs, periodically.Long-term investments get you close to your goals Equity funds work best if you have time by your side.

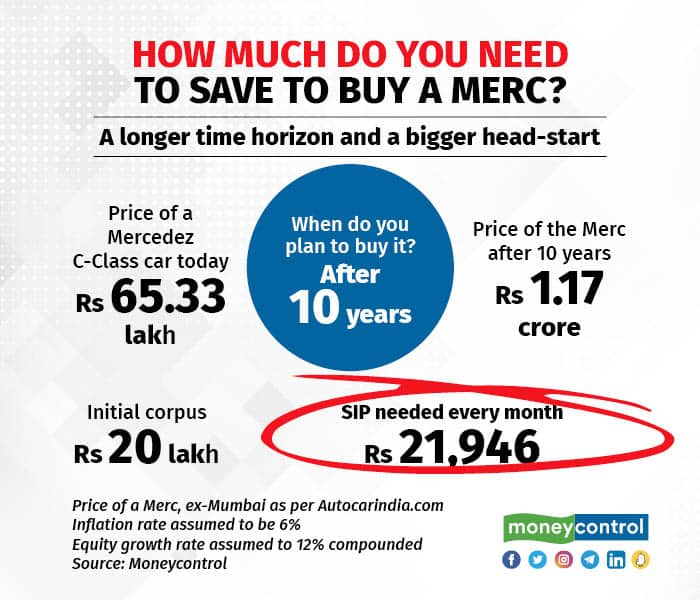

Say, you want to buy a Merc after 10 years. A C-class Merc that costs you Rs 65.33 lakh today, will cost you Rs 1.17 crore after 10 years due to inflation. All you need to put aside in your SIP is Rs 50,347 every month, down from Rs 1.05 lakh for a five-year goal.

Now assume you have a head start of Rs 20 lakh. Then, all you need to put aside every month is just Rs 22,000.

The sooner you start planning for your financial goals, the lower is your monthly SIP instalment.

The sooner you start planning for your financial goals, the lower is your monthly SIP instalment.Which funds to invest in? Experts say that for a financial goal of this nature, equity funds are the way to go, given that time is on your side.

Also read | Books that make you money-wise. A Moneycontrol recommendation

“Do your math and start off putting money away diligently, and I’m sure that you’ll be able to buy a Mercedes-Benz in 10 years’ time,” says Radhika Gupta, managing director and chief executive officer of Edelweiss Mutual Fund.

Gupta says that mid-cap and flexi-cap funds are better suited for such goals.

Gajendra Kothari, managing director and chief executive officer, Etica Wealth. Pvt Ltd, a Mumbai-based wealth management firm, has set his sights even higher.

He wants to buy a Rolls-Royce car by the time he turns 45. He is 42 at the moment. Kothari, who runs Etica with his younger brother, has been setting aside Rs 2 lakh every month for the past 10 years, for his dream purchase. His choice of fund: a small-cap fund.

“Buying a Merc or a Rolls Royce is a luxury purchase. It is not like saving for your child’s higher education or wedding that you need the money at a specific time and you must withdraw when the time comes, irrespective of where the markets would be at the time. If markets crash after, say, 10 years, you can postpone your SIP withdrawal till markets recover and you recover your interim losses. Hence a small-cap fund is fine, even if it gives you just 2-3 percentage points more than, say, a large-cap fund,” says Kothari.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.