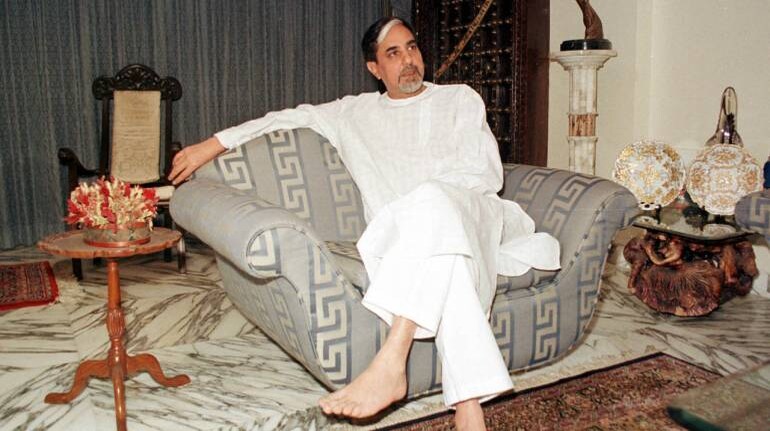

The National Company Law Appellate Tribunal (NCLAT) on July 25 closed the appeal by media baron Subhash Chandra against Indiabulls Housing Finance Limited.

The appeal was closed as Indiabulls and Vivek Infracon, the company for which Chandra had stood personal guarantee for a loan of Rs 170 crore from Indiabulls, settled their dispute. Furthermore, the court took note of the fact that the apex court is considering the constitutional validity of provisions of Insolvency and Bankruptcy Code, 2016 pertaining to personal guarantee insolvencies.

Indiabulls had moved a petition to initiate personal insolvency against Subash Chandra in 2022 after the loans it had given to the company had become non-performing assets. Chandra argued in the National Company Law Tribunal (NCLT) that the tribunal cannot rule on an individual's insolvency.

However, on May 30 2022, the tribunal ruled that it had the powers to rule on Chandra's solvency and appointed a resolution professional to consider Indiabulls' application.

Chandra challenged this order in the NCLAT. However, in the meanwhile, the Supreme Court started issuing stay on personal guarantee insolvency as a batch of writ petitions have challenged the validity of IBC's provisions as they do not give the guarantor any opportunity to put forth their case.

Since the lawyer for Indiabulls informed the appellate tribunal that they had settled the dispute with Vivek Infracon, the petition against Chandra does not survive.

The NCLAT, on hearing the submission, closed the appeal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.