India’s enduring infatuation with the movies might be on the rocks. The silver screen has enraptured Indians for the better part of a century. In the infancy of Indian cinema, millions flocked to single screen theatres for a temporary reprieve from the prosaic of everyday life.

Multiplexes sprung up soon after, and cable television became entrenched as an irreplaceable part of the average home. But Indians’ affinity for the theatrics has not dimmed, even with multiple suitors — their screens beaming the latest offerings from tinsel town — vying for their attention.

The film industry in India is expected to cumulatively clock a revenue of Rs 19,200 crore by 2020 compared with Rs 22,400 crore for digital in the same time.

This could represent an inflection point in the media and entertainment sector as dissemination platforms could eat into the revenue streams of established production houses.

YouTube, Netflix, and Amazon Prime, among others, boast of sizeable subscriber bases. Despite their substantial clout with end users, posing a credible challenge to Bollywood could yet be a pipe dream. Given that the amount of original content produced by these new players is much less than the hours of programming dished out by mainstream production houses, streaming services are reliant on licensing agreements to supplement their portfolio of syndicated content and original shows.

Cinema-goers wearing 3D glasses watch a movie at a PVR Multiplex in Mumbai November 10, 2013. Image credit: Reuters

Cinema-goers wearing 3D glasses watch a movie at a PVR Multiplex in Mumbai November 10, 2013. Image credit: Reuters

The exodus is not upon us yet, but the migratory trend in consumption preference poses an existential threat to the loosely organized cartel of production houses in Hindi and other regional languages. Income from distributors continues to be the biggest source of revenue for producers, but if cinema halls were to witness fewer footfalls, it could seriously affect their margins. Shying away from streaming platforms could keep content away from a substantial digital audience, but producers seem to be wary of an erosion in revenue that could arise from long-term licensing and royalty agreements with streaming platforms.

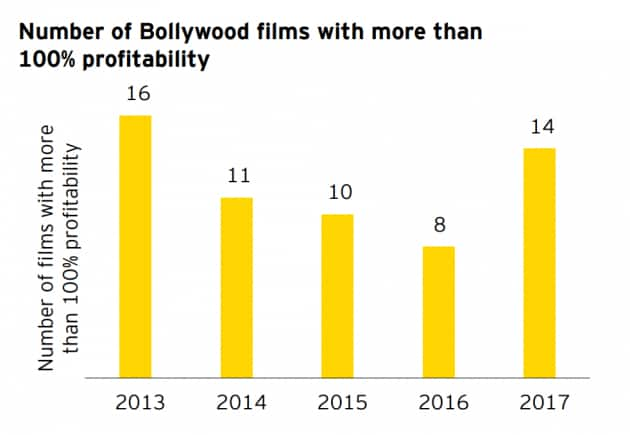

Source: Koimoi

Source: Koimoi

Hindi cinema continues to be profitable for producers with 2017 being a year of resurgence, with profits reversing the downward slope of the previous three years. According to the Bollywood news website Koimoi, the number of movies registering over 100 percent profit in 2017 stood at 14.

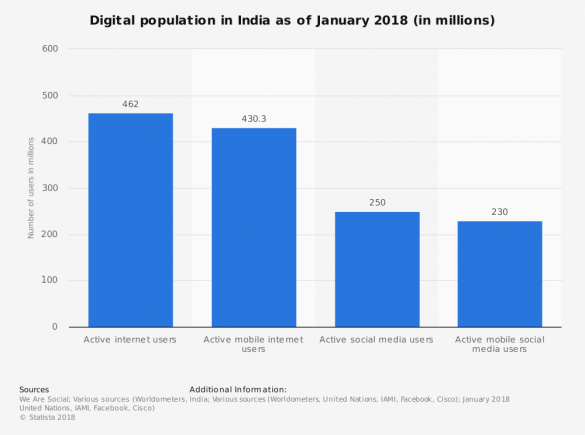

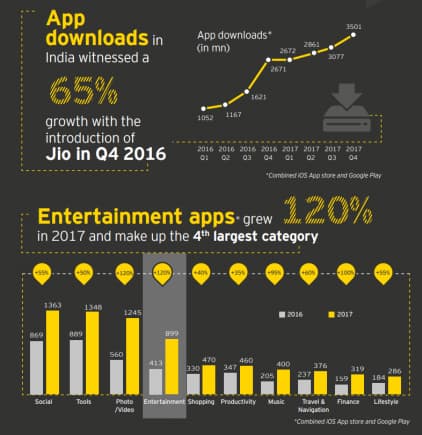

The number of active internet users has increased drastically over the last few years, aided by telecom companies’ competitive pricing. As of January 2018, 430.3 million users accessed the internet through mobile devices, 93 percent of the total number of internet users in the country.

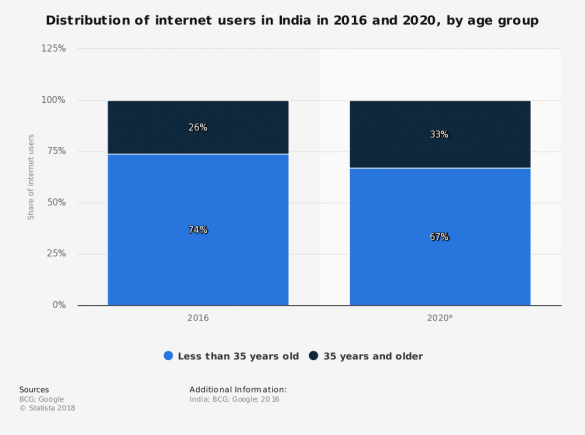

Source: BCG, Google

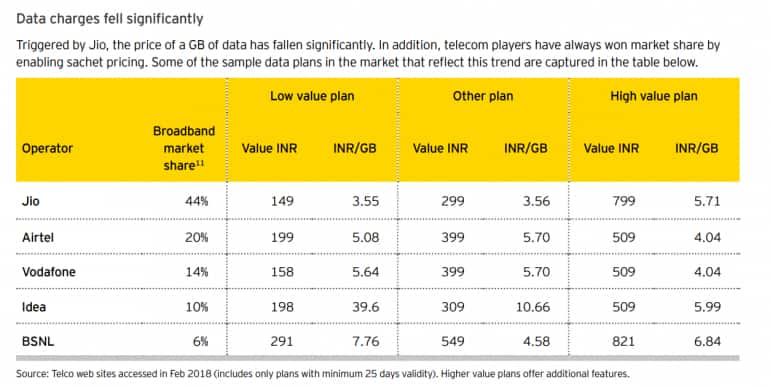

Source: BCG, GoogleResearch by Google found that in 2016, 74 percent of all internet users in India were under the age of 35. India’s demographic dividend may be rife for a digital breakout, but the prime facilitator for the shift in consumption of content to the digital space has been the fall in data tariffs. The EY-FICCI report found that for a low value plan, the price per gigabyte (GB) of data has dropped to as much as Rs 3.55 in 2017.

Even for high-value plans, the price per GB hovered between Rs 4.04 and Rs 6.84. This implies that users will have to pay less than Rs 10 towards internet tariff to stream a full-length feature film amounting to 1.4GB, in standard definition.

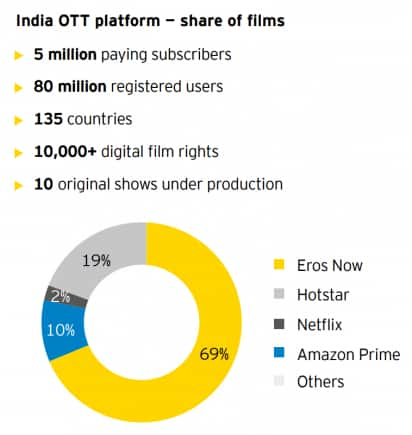

The film industry in India is not completely averse to experimenting with digital subscriptions. Eros Group, which has over 40 years of experience in the entertainment business, was one of the few Indian production houses to be ahead of the curve. They launched Eros Now, a digital content platform a few years ago, and with around 3.7 million paid subscribers, revenue from digital accounted for around 25 percent of their overall revenue in the past year, reducing the company’s reliance on the box office.

Source: EY-FICCI

Source: EY-FICCI

In terms of television shows, Hotstar and Netflix are ahead of the curve, but Eros Now has the lion’s share of original movies streaming on its platform. Eros Now holds the rights to 69 percent of all movies available for streaming in 2017, as opposed to 19 percent for Hotstar and 10 percent for Amazon Prime.

The streaming ecosystem in the country might still be in a nascent state, but India has the second largest online video audience, more than Brazil and the United States. Ernst & Young estimates that India had 250 million video consumers in 2017, 190 million of those who were between the ages of 15 and 34. An increase in internet speed, fall in data tariffs and greater internet penetration could double the number of digital video consumers to 500 million by 2020, according the EY analysis.

The preference of content on these platforms is also indicative of the geography of the user base. The EY-FICCI report found that only 7 percent of the total time spent on streaming platforms was in viewing English-language content. Screen time for videos in Hindi and regional languages were 63 percent and 30 percent respectively.

As more Indians are going online, the airwaves are emerging as the latest frontier in the battle for eyeballs. In 2017, digital media accounted for 17 percent of the total ad spend in India, up from 15 percent in the previous year. According to Zenith, India ranks fourth among the top 10 nations in terms of spending on advertisement, behind the United States, China, and Indonesia, in that order. Advertisement in video offerings amounted to Rs 3,800 crore in 2017.

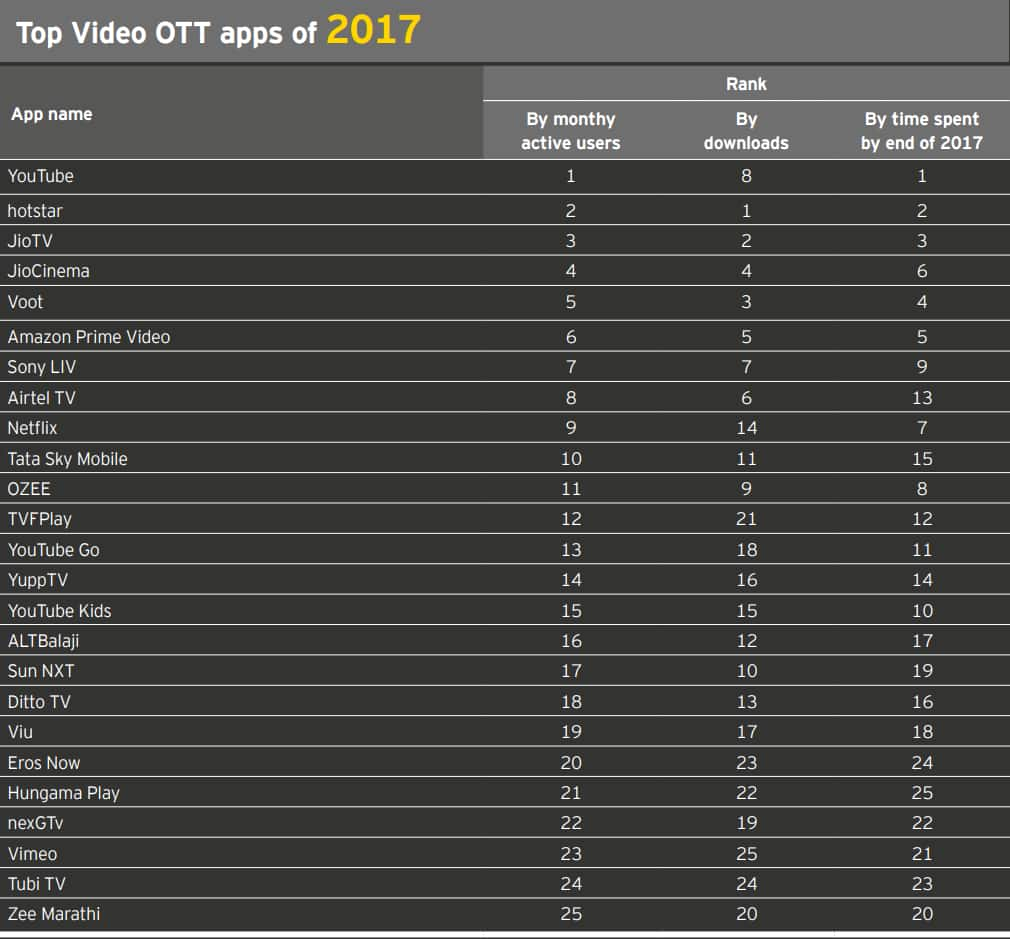

With many new launches premiering exclusively on a select platform, streaming apps are facing stiff competition for a common consumer pool. Amazon Prime held nearly 10 percent of the total over-the-top (OTT) streaming market in 2017, with 0.61 million subscribers, marginally more than the 0.52 million subscribers of Netflix, according to data shared by London-based IHS Markit with Quartz.

In a price-conscious market such as India, the likelihood of users holding multiple streaming subscriptions is low; attractive offers have also been effective in tempting potential customers into subscribing.

Bollywood producers are coming out of the woods. While digital streaming might be terra incognito for many in the domestic entertainment industry, some have embraced the new wave of content dissemination.

Netflix India on August 21 announced its first regional show Sacred Games, an adaptation of Vikram Chandra's novel of the same name.

Netflix India on August 21 announced its first regional show Sacred Games, an adaptation of Vikram Chandra's novel of the same name.

Powered by the deep pockets of Jeff Bezos, the richest man in the world, Amazon have been on a spending spree, acquiring rights to movies released by production houses such as Mukesh Bhatt’s Vishesh Films and Karan Johar’s Dharma Productions. Amazon also scored a coup by bringing on board Salman Khan, nabbing the right to exclusively stream his movies before they are released on satellite or TV channels. The e-commerce giant recently committed $300 million for the production of original content for the Indian market.

Image credit: Twitter

Image credit: Twitter

The streaming battle is far from being a two-horse race. While Amazon and Amazon Prime may have adopted an approach to differentiate their offerings from the competition by launching original content, Hotstar has clocked impressive numbers on the back of its acquiring streaming rights to popular sporting events such as the Indian Premier League (IPL), Pro Kabaddi League and the English Premier League (EPL).

Hotstar also has the digital rights to content produced by HBO, which is a major incentive for fans of television shows like Game of Thrones, with the option to stream episodes on the same day as it releases in the US.

In addition to shows produced by the array of the Star Network’s regional channels, Hotstar also has around 40-odd HBO shows in its catalogue. The premium version of Hotstar is priced at Rs 199 a month, making the cost over a year less than three times the subscription charge of Netflix, and eight times as much as Amazon Prime Video.

However, the usual suspects aren’t the biggest players in the market for streaming applications on smartphones. According the EY-FICCI report, users in India spent the most time on YouTube, with Hotstar, Amazon and Netflix occupying the second, fifth and seventh spots respectively.

With the Indian market far from attaining saturation, growth in the user base and digital advertisement bodes well for the entertainment sector. Consistent growth over the past couple of years indicate that streaming platforms represent more than just a passing flirtation for Indian consumers looking to satiate their love for cinema.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.