Hyperlocal delivery player Zepto has become the first quick-commerce company to introduce a platform fee. The fee is Rs 2 per order and applies to a select set of users. So far, platform fees have been more common in slightly more mature categories like e-commerce and food delivery.

To be sure, Zomato-owned Blinkit and Swiggy Instamart – both of which directly compete with Zepto – don’t levy such a fee currently on grocery orders. The two companies, however, collect a platform fee from customers who place food delivery orders. While companies initially began by charging a nominal fee of Rs 2, they have pushed up the fee in some cases as adoption increased and some even teased a significantly higher charge – of Rs 10 – during peak times to capitalise on the surge in demand, implying that there are chances even Zepto tests a higher fee in the future.

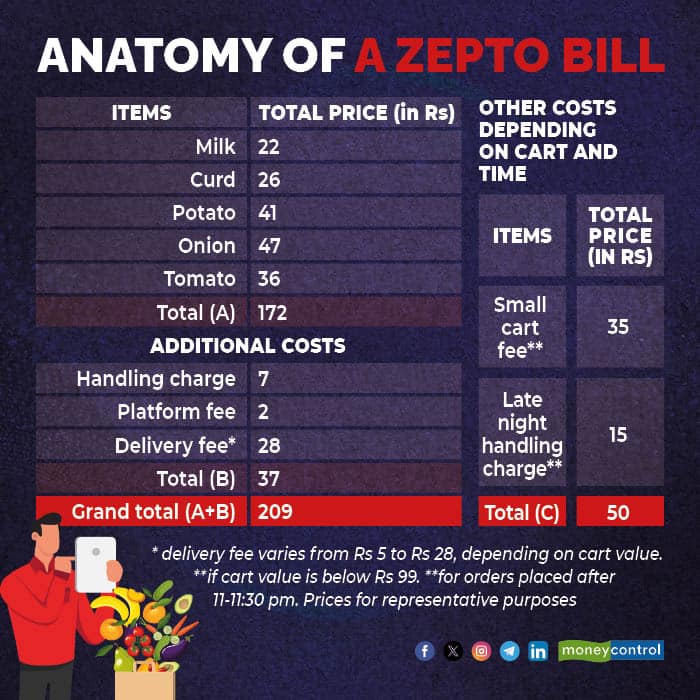

A platform fee isn’t the only additional charge Zepto is levying on customers. The company also collects a ‘late night handling fee’ of Rs 15 on orders that are placed after 11 pm in certain cases. The Y Combinator-backed company has also done away with free deliveries for select users. It now charges anywhere between Rs 5 and Rs 28 as delivery fee, depending on the cart value, to make each order more profitable as it aims to turn EBITDA profitable by May 2024. Deliveries were initially free for cart values above Rs 99 or Rs 199, depending on the transaction frequency of customers.

"We don’t believe in being over dependent on delivery fees to be profitable. We believe in core operating efficiency and cost reduction to be profitable. We are on track to achieve the EBITDA positive milestone even with much lower delivery fees- Zepto Pass is the quintessential example of this," a company spokesperson said.

Zepto's bill summary

Zepto's bill summaryEven rivals like Blinkit and Swiggy Instamart have been experimenting with a nominal delivery fee in certain pockets of India, as per reports. While peers have a food delivery vertical to fall back on, Zepto is the only major player that operates a standalone quick-commerce business. In an effort to create multiple revenue streams, it is also developing brands like Relish, its in-house meat division.

“Blinkit and Instamart can likely fall back on food delivery customer base and cross-sell quick-commerce…While Blinkit has the largest market share currently, our checks indicate that Zepto is getting aggressive to gain share. Also Zepto has the lowest delivery rates in most places,” analysts at BofA said in a report published earlier this week, which lines up with Zepto’s latest moves to push up costs.

Zepto is the third-largest quick commerce player with a market share of about 20 percent, behind Zomato’s Blinkit (40 percent) and Swiggy Instamart (37-39 percent), analysts at Bernstein said in a report published in January.

The additional costs come weeks after the company launched Zepto Pass – its loyalty programme – through which it promises free deliveries and better discounts. The company claims subscribers have increased their monthly spend on the app by more than 30 percent during Zepto Pass’ pilot phase.

“Companies want to make each order more profitable and instead of levying a large fee under one single category, they’ve broken the amount down into smaller fee components across different heads like platform fee, delivery charges and convenience cost to play with the user’s minds,” said Sachin Dixit, lead analyst, internet, at JM Financial.

The additional fee is unlikely to deter purchases right now.

“The fee will continue rising up to the point where platforms notice that customers are refusing to move ahead with the carts when they see the total payable amount,” Dixit added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.