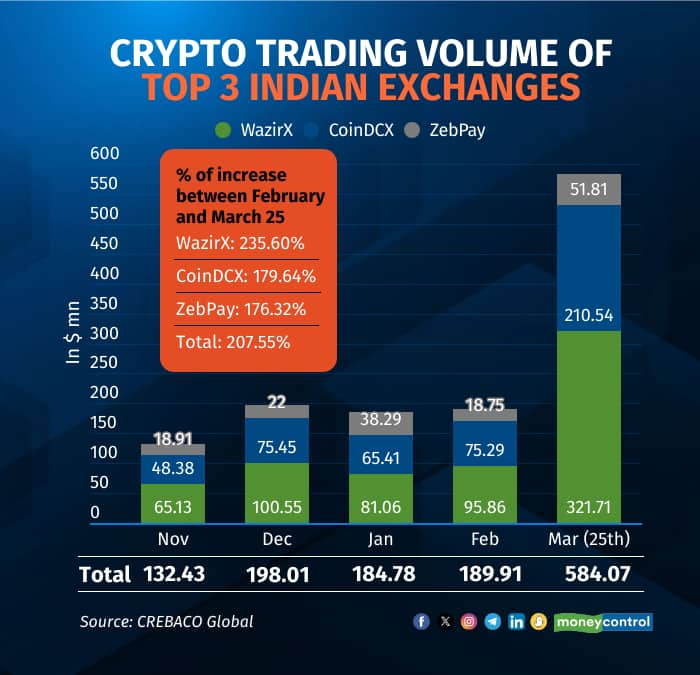

Crypto trading volumes across top Indian exchanges have cumulatively jumped by over 207 percent month-on-month (MoM) between February and March 25, reflecting a significant increase in trading activity in the last few days as the Bitcoin price rally continued.

The top three exchanges, including WazirX, CoinDCX, and Zebpay, have collectively surpassed trading volumes of over $584 million in March, compared to $189.91 million at the end of February, according to data from the crypto trading firm CREBACO Global, exclusively accessed by Moneycontrol.

For crypto investment platform CoinSwitch, while trade volumes increased by 36 percent MoM from January to February, by March, it shot up by over 200 percent, the crypto unicorn told Moneycontrol.

Industry insiders, however, said that these numbers are still far from the frenzy seen in the previous bull run in 2021, during which crypto trading volumes had crashed globally, including in India, driven by FTX’s downfall, regulatory concerns, and high taxes.

Rajagopal Menon, vice president, WazirX said while trading activity has increased dramatically, “retail investments have not come in fully and remained subdued due to sentiments around high taxation.”

“We are seeing 10X of our trading levels compared to the bear markets. New users are coming back, and our acquisitions are at the highest in two years,” he added.

According to Sidharth Sogani, founder and CEO of CREBACO, the overall recovery of investments from high net-worth individuals (HNIs) and institutions is yet to be seen in India, as tax policies continue to remain unfavourable in the country.

In 2022, the Indian government implemented a 30 percent tax on income or gains arising from transactions related to virtual digital assets (VDAs) and cryptocurrencies. Along with that, a 1 percent TDS (tax deducted at source) is charged on all transactions of Rs 10,000 and above.

The jump in trading volumes is mainly driven by Bitcoin prices reaching all-time highs of $73,000 after institutional investments started to pour in globally through Bitcoin Exchange-Traded Funds (ETFs) that were approved by the US Securities and Exchange Commission (SEC) in January.

Moreover, this year will also see Bitcoin halving next month, an event occurring roughly every four years, wherein the number of Bitcoins mined as rewards after solving a certain number of transactions halves.

“Around $1 billion worth of Bitcoins are being bought by ETFs every day, while only 900 Bitcoins are get minted each day. This will cause a supply shock in the market over the next three-four months. I won’t be surprised if Bitcoin prices cross $250,000-300,000 by the second half of 2025,” Sogani said.

New user sign-ups riseNot only did trading volumes increase, but exchanges like CoinDCX also saw a jump in new users joining the platform. Mridul Gupta, COO of CoinDCX, partially attributes this increase to several offshore exchanges being blocked in India in January. These exchanges were non-compliant with local money laundering regulations and had not registered with the Financial Intelligence Unit-India (FIU-IND).

“Since the FIU notification regarding non-FIU IND-compliant exchanges, we have witnessed a remarkable 150 percent increase in new user sign-ups. This growth has been further bolstered by the upward trends in both Bitcoin and altcoins,” he told Moneycontrol.

“Currently, our total signups have reached 1.6 crore, indicating steady growth in user adoption,” he added.

However, Edul Patel, co-founder, and CEO of the crypto investment platform Mudrex, which offers specially curated crypto indices called ‘Coin sets,’ similar to a Nifty index in the stock markets, said that while sign-ups have gone up on his platform, the number of first-time retail investors or new users entering the ecosystem has not changed much.

“The classic hallmark of a bull run is that large number of completely new users come into the market itself and the ecosystem. So at Mudrex at least, although our signups are growing month over month and we saw 5-6X more signups than in November- December; but most of them are actually existing crypto investors,” he said.

He added, “These investors mainly joined to explore newer crypto products we offer on our platform like simple deposits, UPI withdrawal and portfolio management tools that helps users manage their funds.”

‘Investors holding Bitcoins’Crypto startups unanimously agree that while there's been an increase in trading activity, early signs of a full-fledged bull run in India are still absent.

Sogani said that many Indian investors continued to hold onto their Bitcoin assets to avoid taxation at the end of the fiscal year in March.

WazirX is seeing a mixed response. “People who bought really early and have been holding on to their Bitcoins, some may sell their crypto to book profits while others are looking to ride till halving. So it’s a mix of both,” Menon said.

Many of CoinDCX’s users too continue to hold onto their Bitcoin as a long-term investment akin to gold, said Gupta. “Additionally, with reference to the upcoming Bitcoin Halving event, the general view is to wait and see how bull markets perform following halving,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.