Ride-hailing firms Ola, Uber, and Rapido have removed the in-app wallet payment feature from their platforms for auto-rickshaws, facilitating direct payment to drivers amid rising churn in auto drivers shifting to platforms like Namma Yatri and to save GST taxation costs on each ride.

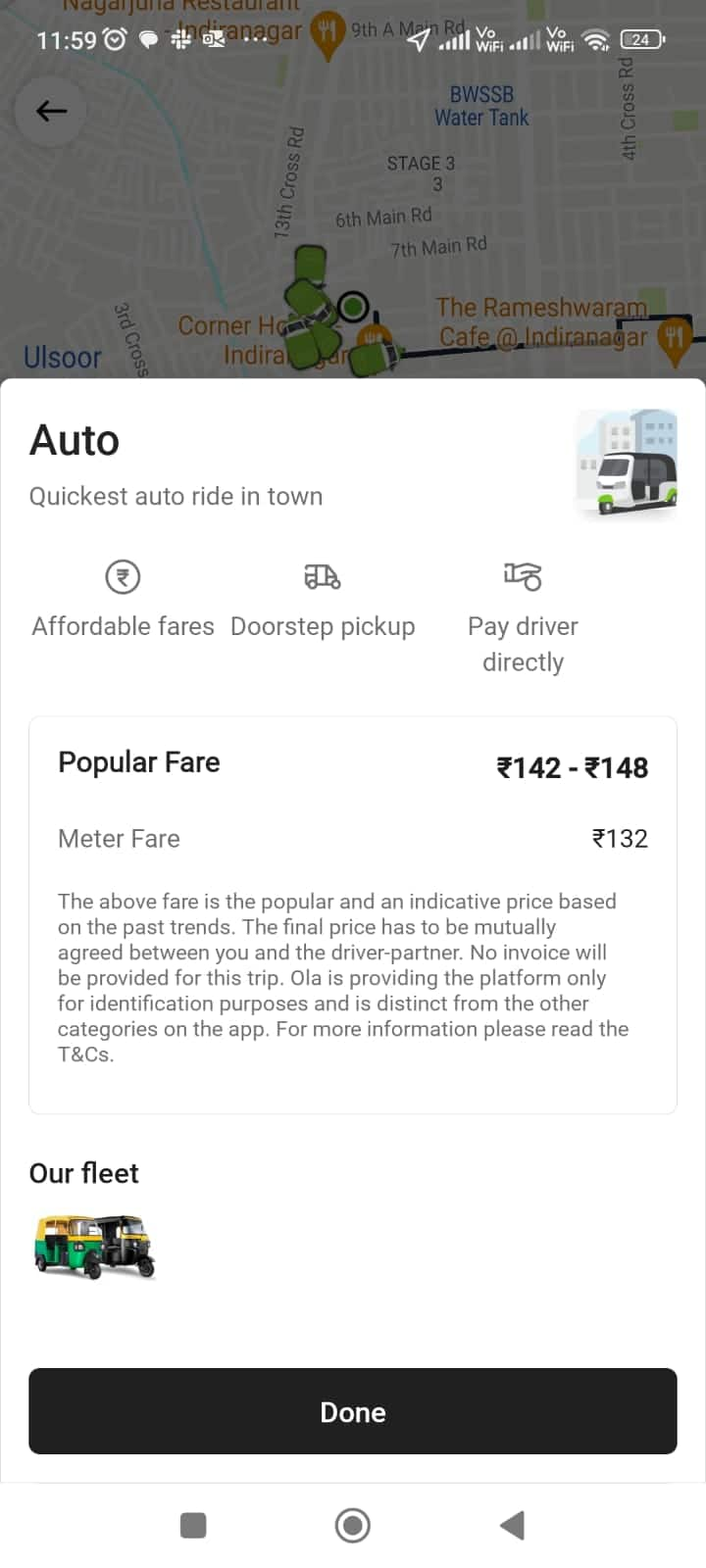

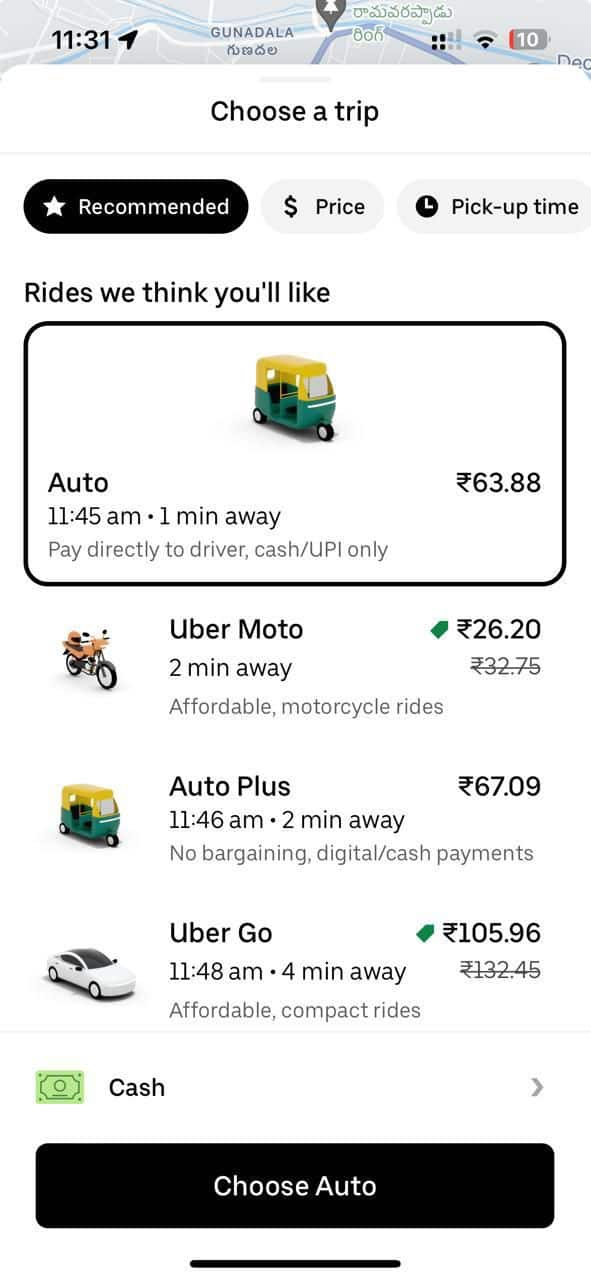

The apps, which have wallet payment options for customers such as Ola Money, Uber Cash, or Rapido Wallet, now offer only cash/UPI direct payment options.

“This is purely to establish a level playing field. There is an app that is offering this direct payment feature to drivers and is saving tax costs, why can’t the other do the same," a top executive of a ride-hailing firm told Moneycontrol on the condition of anonymity.

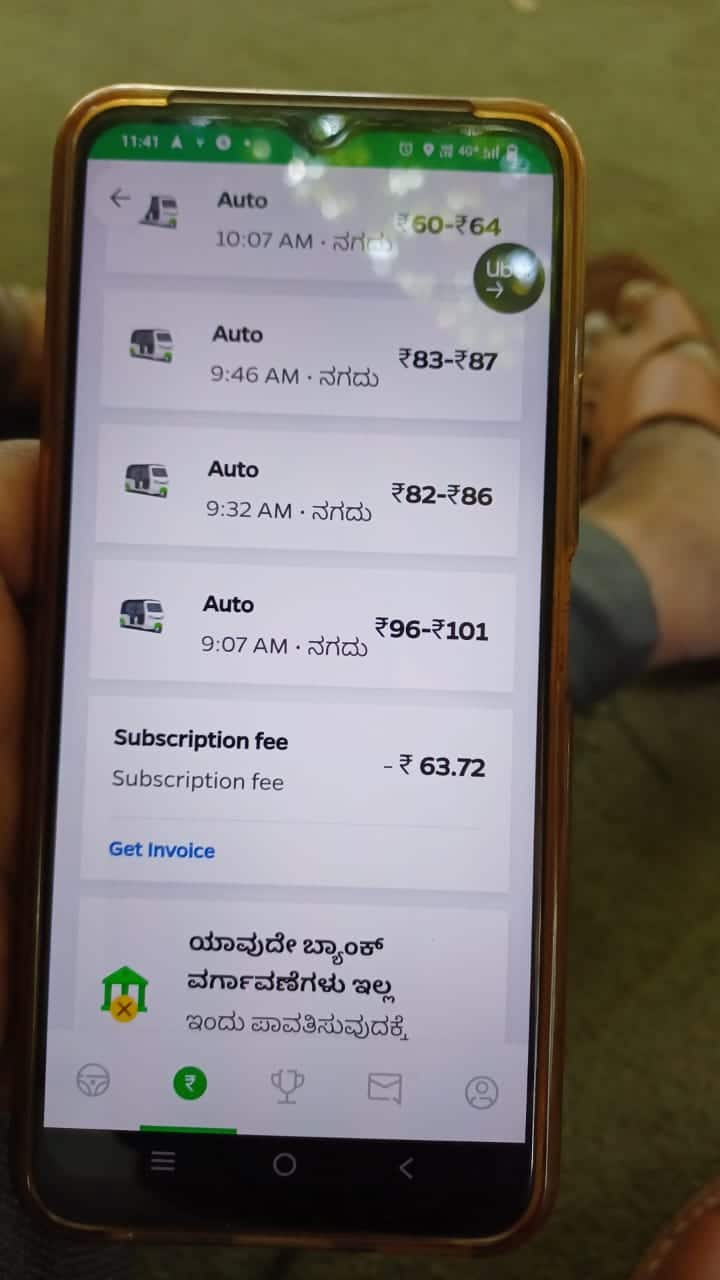

Instead of charging a commission per ride for drivers, Ola, Uber, and Rapido have moved to a subscription model.

Moneycontrol reported the developments first on March 12th.

An Uber spokesperson confirmed that the ride-hailing company has launched the SaaS model service on Autos in more than half a dozen cities as it wants to give optionality to riders since many of the companies are already operating on this model.

The feature is yet to roll out across the states, however, firms are testing the feature. While Rapido implemented this option in February, Uber still provides the option to choose between ‘Auto’ and ‘Auto Plus’ which shows a difference in the ride estimation cost.

"Following Namma Yatri, many aggregators are implementing subscription fees and allowing drivers to directly collect fares from passengers,” Said C Sampath, General Secretary of the Adarsha Auto and Cab Drivers Association, in Bengaluru.

The GST ConundrumThe main motive, as industry sources say is to save costs on GST payments and to help retain drivers to the platform.

As per the Central GST Act, a tax rate of 5% is applicable for ride-hailing firms. The companies will have to collect and pay tax on behalf of the service providers who are drivers, listed on their apps.

The taxation falls on Ola, Uber or Rapido because they operate as platforms that connect riders and drivers together as well as facilitate payments, and to keep this running they charge a commission from drivers.

However, since Namma Yatri came into operation in November of 2022, the market dynamics have changed.

Also Read:How Namma Yatri works: Can it break Ola and Uber's duopoly?

Namma Yatri was touted as an app for drivers with ‘Zero-commission’ and later the firm introduced a subscription model. Through this Namma Yatri charges an upfront commission from drivers to use the software and it do not control pricing, surge or even the trips. It basically acts as a provider of software that connects drivers with riders.

Last year, Namma Yatri had sought an advance ruling, where the The Authority for Advance Ruling noted that Namma Yatri is not liable to pay GST as it would merely connect auto driver and passengers and its role shall end on such connection.

“Further, the applicant would not collect consideration and have no control over actual provision of service by service provider and neither it would take responsibility for operational and completion of ride. Thus, the said supply of services would not be through electronic commerce operator. Therefore, it was held that the applicant would not satisfy conditions of section 9(5) for discharge of tax liability by electronic commerce operator and shall not be liable for discharge of tax liability under section 9(5),” the advance ruling said.

Going the Namma Yatri wayNamma Yatri’s strategy of direct payment with zero commission has attracted several drivers so much so that market dominants like Ola and Uber started witnessing a churn.

“Several drivers moved to Namma Yatri although there is no exclusivity in this industry there was a disruption,” told an independent mobility expert. “Firms are moving towards this model because it is a competitive disadvantage to other players in terms of pricing and taxation,”.

Drivers are also getting attracted by the ‘zero-commission’ model promised by new-age ride-hailing firms such as Namma Yatri, Myn and Yaary.

Also Read: Spotlight on zero-commission models after Namma Yatri, auto union break tie-up

According to cab unions that Moneycontrol spoke to, Ola and Uber are now facing stiff competition in Hyderabad as well. This is after the launch of Yaary, Namma Yatri, Volta, and Ok Chalo in the city.

"After the launch of these four firms, which promised a zero commission model, many drivers from Ola and Uber have shifted to these platforms.

When drivers are not available in an app, customers will also shift. The presence of more commission-free aggregators is good for the drivers," said Shaik Salauddin, National General Secretary, and co-founder of the Indian Federation of App-based Transport Workers. IFAT is a federation of trade unions representing ride-sharing and other gig transport workers.

Some challenges remain for consumers and driversWhile this model of direct payment is better for drivers and for the platforms offering this services, some consumers face challenges like dealing with bargain culture.

“Now the apps don’t show the exact estimation and because this is direct payment the drivers end up asking for Rs 20- Rs 30 more and this is becoming a hassle,” told Priyadarshini a regular Ola/Uber user.

While some drivers are benefitting from the direct payment mode, some say that there is lack of transparency.

“It is better than the previous commission-based system however, there is no transparency. Each aggregator sets different subscription fees, which fluctuate daily, making it difficult for many drivers, especially those who are not well-educated or tech-savvy, to keep track,” said C Sampath said.

According to drivers, Namma Yatri charges Rs 3.50 per ride for up to 10 trips, with subsequent trips being free. Another plan offers unlimited rides for Rs 25 per day, with the first ride free.

Another auto driver in Bengaluru, who prefers to remain anonymous, said that Ola charges Rs 2 per ride, Rapido charges Rs 5 per day and Uber has an unlimited Rs 49 per month plans.

While the model is now restricted only to auto-rickshaws it will be interesting to see how things evolve as Namma Yatri is also entering the cab service space, the mobility expert quoted above added.

Also Read: Namma Yatri pilots taxi-hailing service in Bengaluru

On April 12th, Moneycontrol reported that Namma Yatri has launched taxi services in Bengaluru. The Namma Yatri app in Bengaluru offers two types of taxis — Eco, which is non-AC, while Comfy cabs will be air-conditioned.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.