Generative Artificial Intelligence (AI) may be the buzzword but it is still insignificant in terms of business volumes for some of India's largest software service providers. Going by the numbers and narrative on generative AI for the third quarter ended December 31, these companies’ Gen AI deal pipelines were stagnant in terms of the number of ongoing proofs of concept (PoCs) and opportunities compared to the previous quarters.

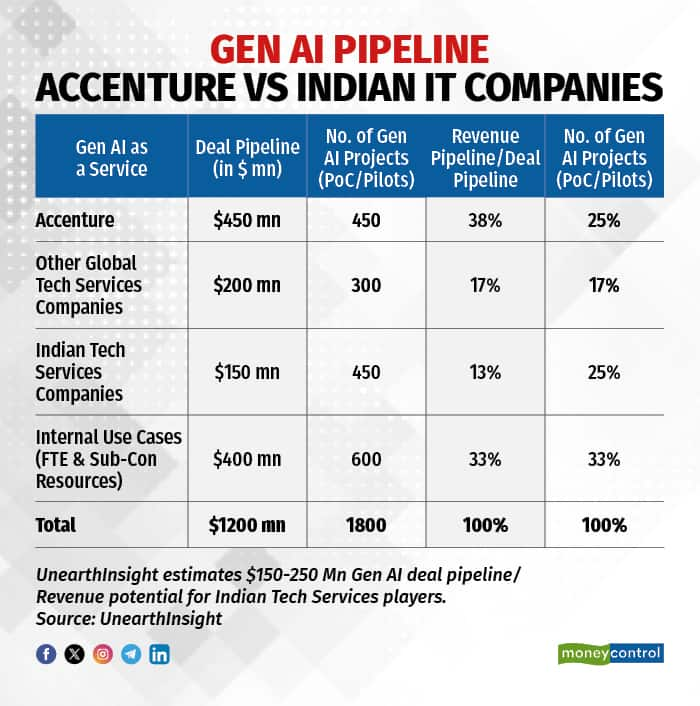

At present, the top 10 Indian IT service companies together have around 450 Gen AI projects and PoCs in the pipeline, which would amount to an estimated current deal pipeline of $150-250 million, according to data accessed by Moneycontrol from market intelligence firm UnearthInsight. In contrast, global rival Accenture alone as of its first quarter (it follows a September-August financial year) has a pipeline worth $450 million and an estimated 450 projects and PoCs.

For Accenture, this was a 50 percent jump in Gen AI opportunities in the pipeline from $300 million in the last six months of FY23 to $450 million in the September-November quarter or the first quarter of FY24.

Though the managements of most top companies including Accenture and its Indian competitors Tata Consultancy Services (TCS), HCL Technologies (HCLTech) and LTIMindtree among others threw in a caveat that the project sizes continue to remain smaller at sub-$1 million, average projects sizes for domestic IT services companies are even smaller.

Some projects being at PoC stages with existing long-standing clients may not also generate revenue immediately, and some experimentations are being done free of cost as well, analysts said

According to UnearthInsight’s estimates, Indian IT companies are seeing relatively smaller average revenue of around $0.4-0.6 million per generative AI project compared to $0.8-1 million revenue per project clocked by global counterparts.

According to TCS, it has close to 250 different initiatives and proposal programmes around Gen AI in the pipeline, the same as Q2. The company has heavily invested in training more than 150,000 associates in AI capabilities. TCS is also setting up an AI arena to train more employees, though CEO K Krithivasan has shared that these are small projects.

When asked if competition from companies like Accenture is a concern, he told Moneycontrol last month, “We are engaged with our customers in almost all verticals across multiple geographies. I don't think we are behind there. As more and more proof points emerge and business cases are able to be worked out, you will see more of them coming into production.”

Last month, Accenture’s chief executive Julie Sweet said that the company invests $1 billion annually on training its workforce on generative artificial intelligence. Moreover, Accenture is investing $3 billion over the next three years into its data and AI practice.

HCLTech, at present, is working on around 170 Gen AI PoCs across various industries. During the company’s Q3 earnings conference call last month, CEO C Vijayakumar had said, “While we see great potential in generative AI in the near term, the programmes in this segment will be small. We signed 31 deals in Gen AI but most of them were sub-million-dollar kind of ticket sizes. We are expecting them to ramp up in the coming quarters.”

Infosys’ last updated number was from its annual general meeting in June 2023, where the company said it had about 50 active client projects that were leveraging Gen AI capabilities. Infosys did go on to win some big deals with Gen AI as a component of the offering, such as the $454-million Danske Bank one.

Speaking to Moneycontrol last month, Infosys CEO Salil Parekh had said that the company’s clients are charged up about Gen AI and how it could transform their businesses. “Generative AI is a fundamental change in technology and we are fortunate that we are in somewhat of a leadership position,” he said.

Wipro meanwhile is investing $1 billion over the next three years to advance its AI capabilities, and plans to train 250,000 employees in AI skills.

According to Phil Fersht, CEO, consultancy HFS Research, the industry is going through an inflection point where AI capabilities are becoming the key factor in technology investments, as opposed to the old model of merely investing in a greater number of developers and support personnel.

“This pivot will take several quarters to mature and reap financial outcomes based on co-innovation partnerships and provider investments in their capabilities,” he said.

He added, “Currently all the big four Indian heritage firms understand this shift but the reality will be which of them can make the right investments and keep hold of their capable executives. It is not clear this year which of them are going to emerge from this the strongest.”

Is Accenture really outperforming?While it is too early to declare a clear winner in the Gen AI race, analysts do believe Accenture to have an edge over rivals for now.

To give a comparison, Accenture has invested in 50,000 Microsoft Co-Pilot licences, while the top four Indian IT firms have barely each invested in a few hundred, Fersht highlighted.

“The ground reality is that enterprise clients do not expect to pay a lot for generative AI projects (average spend is about $1-2 million per client), and expect a lot of free proof-of-concept work. Meanwhile, Accenture is betting the farm on generative AI and will help drive the market for the rest of the industry,” he said.

According to Gaurav Vasu, founder and CEO, UnearthInsight, Accenture has four distinct differentiators. It has a matured data and analytics practice which helps identify potential clients with generative AI adoption readiness. The IT services major also has a consulting practice that gives it an edge as it can help provide end-to-end strategy to execution services to return on investment (ROI)/business impact, Vasu said.

“Accenture has early-mover use cases and generative AI talent. It has a team of over 1,000 Gen AI experts, which built vertical and functional Gen AI use cases across industry. This falls under the 80,000-plus data and AI trained team. The company has already acquired more than 10 AI-first companies, helping quickly strengthen capability stack and talent,” he told Moneycontrol.

Accenture has also been marketing its AI gains well, said Ray Wang, CEO of strategic advisory services firm Constellation Research. “We see a difference in how generative AI profits are counted. Indian service providers are in many deals but Accenture has been out-marketing the competition,” he said.

However, while Accenture and its peers may have a strong pipeline of PoCs at work, seeing consistent revenue generation will still take some time. Also, not all PoCs will ultimately go into long-term production converting into multi-year deals.

“There are many pilots under way but it seems clear that the vast majority of these will not enter production in 2024. Another complicating factor is that at this time it is not clear that Gen AI will unleash the 4X multiple of tech to services spending that other tech lead waves have resulted in,” said Peter Bendor-Samuel, founder of management consulting firm Everest Group.

Bendor-Samuel said that till date the revenue generated for services firms from Gen AI has been modest. He doesn’t view the $450-million pipeline from Accenture as indicative that it will be ultimately able to unleash a gusher of revenue from generative AI.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.