-

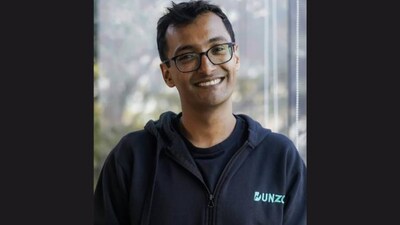

Dunzo co-founder Kabeer Biswas to leave Flipkart in less than a year since joining

Kunal Gupta, Vice President at Flipkart, will now lead Flipkart Minutes to ensure a seamless continuation of the business and operations. Gupta has been with Flipkart for over a decade.

-

Lightspeed, Prosus back Mukund Jha's AI startup Emergent with $23 million in Series A round

Emergent plans to use the Series A funds to expand its team, deepen research into AI coding agents, and grow the platform globally.

-

Irrational exuberance? Quick commerce firms may face challenges in scaling past top markets, per Blume’s Indus Valley report

Quick commerce firms are likely to face hurdles such as a low total addressable market (TAM), tapering growth in monthly transacting users (MTUs), and increased competition from e-commerce players

-

Dunzo’s Kabeer Biswas to head Flipkart Minutes

Biswas heading Flipkart Minutes is to give the Walmart-owned company an edge over other quick commerce majors as he has cut his professional teeth in the sector for over a decade, even before rapid delivery emerged as a hot sector only a few months ago.

-

Dunzo's Kabeer Biswas may join Flipkart Minutes to lead operations

If talks go through, Biswas heading Flipkart Minutes is likely to give the Walmart-owned company an edge over other quick commerce majors as he has cut his professional teeth in the sector for over a decade, even before rapid delivery emerged as a hot sector only a few months ago.

-

End of an era: Dunzo co-founder Kabeer Biswas to quit

Dunzo was in talks with BigBasket, Swiggy among others for a strategic investment earlier. While it pioneered the hyperlocal commerce space, excessive cash burn and a competitive market took a toll.

-

Dunzo investor Lightbox gives up its board seat

Siddharth Talwar represented Lightbox on Dunzo’s board but decided to move on from the VC fund in August 2023. Lightbox is not keen on nominating another person on the company’s board, Moneycontrol has learnt

-

Swiggy delivery agent buys medicines for woman experiencing cramps. What internet said

The woman shared a photograph of her medicine along with the Swiggy bill, thanking the delivery agent for his help in an X post.

-

Rocky road? Lightrock India partner and CFO Kushal Agrawal to leave by month-end

This comes at a time when Saleem Asaria has also stepped back from daily operations, per sources who added that Raghav Rungta has already left Lightrock. Ashish Garg left in September 2022 to join a startup.

-

Dunzo's woes deepen as November salaries remain unpaid

This is despite the company having tied up with OneTap, a revenue financing firm, earlier this year.

-

Dunzo moves employees from Google Workspace to Zoho to bring down costs

Google, also one of Dunzo’s largest investors, charges at least Rs 1,600 per user per month for its suite of offerings under the enterprise plan but Zoho charges only Rs 489 for the same arrangement.

-

Deloitte casts doubt on Dunzo's ability to continue as going concern

A company is typically considered a 'going concern' if it has sufficient resources to continue to operate indefinitely and to avoid any potential bankruptcy risks. This is not, however, the case with Dunzo.

-

Dunzo’s loss mounts to Rs 1,800 crore, revenue at Rs 226 crore in FY23

Dunzo marketed its services during the Indian Premier League which resulted in higher expenses but translated to a marginal increase in revenues.

-

Dunzo's head of finance becomes latest to exit cash-strapped startup

In fact, in one of the townhall meetings, Mukund Jha, co-founder and chief technology officer of Dunzo, admitted that not hiring a chief financial officer earlier was a big mistake.

-

Dunzo to settle dues of ex-employees in 3 months; firm restructuring underway

The development comes after Dunzo raised USD 75 million in April, and fired about 300 employees in the first half of this year as part of cost-cutting measures.

-

New day, new timeline: Dunzo asks former employees to wait another 4 months for pending salaries

The fresh delay, this time by around four months, comes even as Dunzo is lining up funds. In the past the company had delayed payouts only by a few weeks.

-

Dunzo co-founder Mukund Jha set to exit startup

Jha, who joined the hyperlocal delivery player in 2015, played a key role in communicating with employees and letting them know about delay in salaries and layoffs.

-

Dunzo co-founder Dalvir Suri to exit cash-strapped startup

Sources at the company highlighted that Suri has tried exiting the firm earlier, but had stayed back after discussions with CEO Biswas. Suri has no stake in Dunzo and took home just a salary with some ESOPs, like several other employees.

-

Dunzo close to securing $25-$30 million in capital to steady ship

While the valuation is still undecided, key investors like Lightrock and Lightbox are participating in the round.

-

Cash-strapped Dunzo to give up office space in Bengaluru to cut costs

The move to vacate its headquarters on Wind Tunnel road in Bengaluru comes at a time when Dunzo has been struggling to manage its cash flow situation

-

Dunzo partners with OneTap to ensure August salary payments amid challenges

Dunzo said employees can expect to receive salaries by September 14 or September 15 at the latest.

-

Dunzo delays payments to employees by another few days

Dunzo had promised that current employees would receive their August salaries on September 4 but has now said it will be paying salaries in batches.

-

Dunzo further delays salary payments to October as funding talks make little progress

The startup was earlier scheduled to make payments on September 4, which was already an extension from its July 20 deadline initially.

-

A contrasting tale of two startups

Dunzo’s struggle to raise funds comes in the same week as CaratLane’s founder made a successful exit

-

Dunzo holds talks with debt investors to alter credit terms

Dunzo is reportedly also simultaneously seeking new capital from existing and new investors, as partners reduce per delivery charges, affecting the company’s revenues