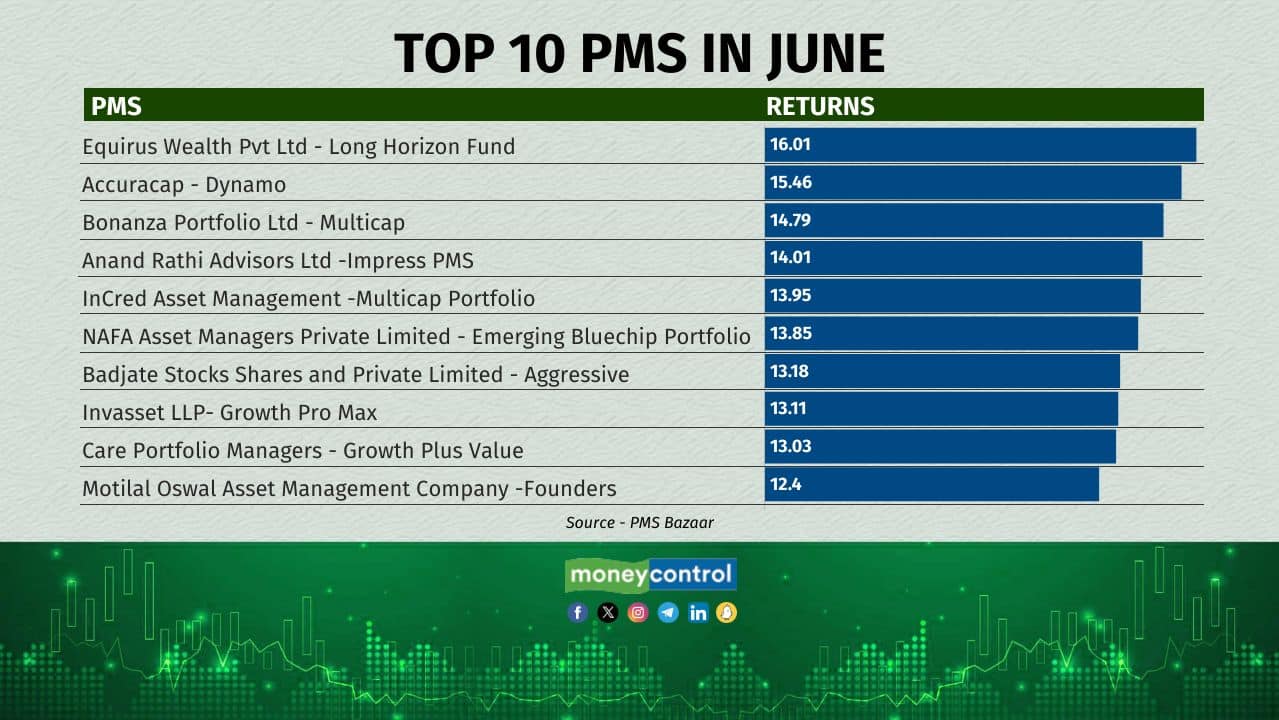

The Top 10 PMSs in June: Equirus Wealth leads with 16% returns

The top ten PMS in June have given returns between 12-16 percent. The first spot was taken by Equirus Wealth, followed by Accuracap, and then Bonanza.

1/11

The top 10 PMSs (portfolio management services) in June have delivered returns between 12-16 percent. The first spot was taken by Equirus Wealth, followed by Accuracap, and then Bonanza. We have calculated the top 10 in terms of returns for those who have disclosed their holdings.

2/11

The Equirus Wealth PMS looks for differentiated stock ideas that are overlooked in the near term. It tries to avoid over-owned stocks, unless they offer high risk-adjusted returns. The portfolio is managed by the firm’s Managing Director Viraj Mehta and was started in 2016. It has an AUM of Rs 850 crore.

3/11

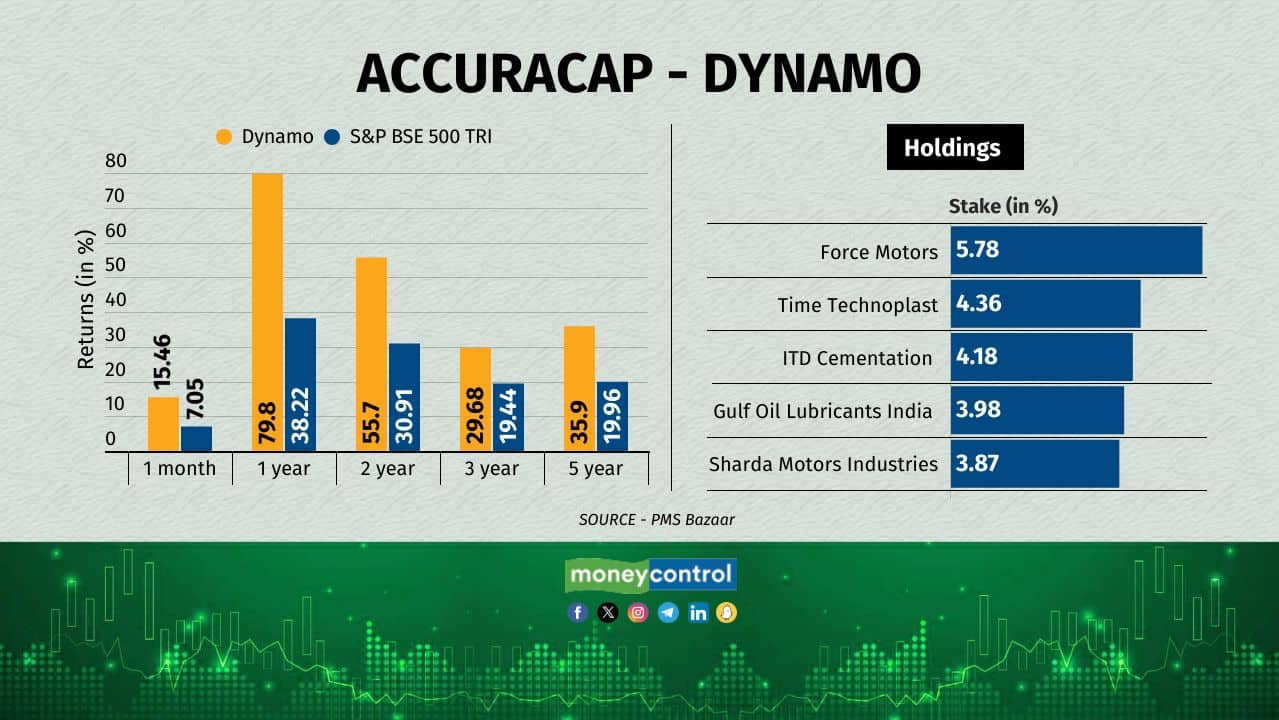

Accuracap PMS is managed by Ram Nagpal, who is the Chief Investment Officer. It was started in 2016.

4/11

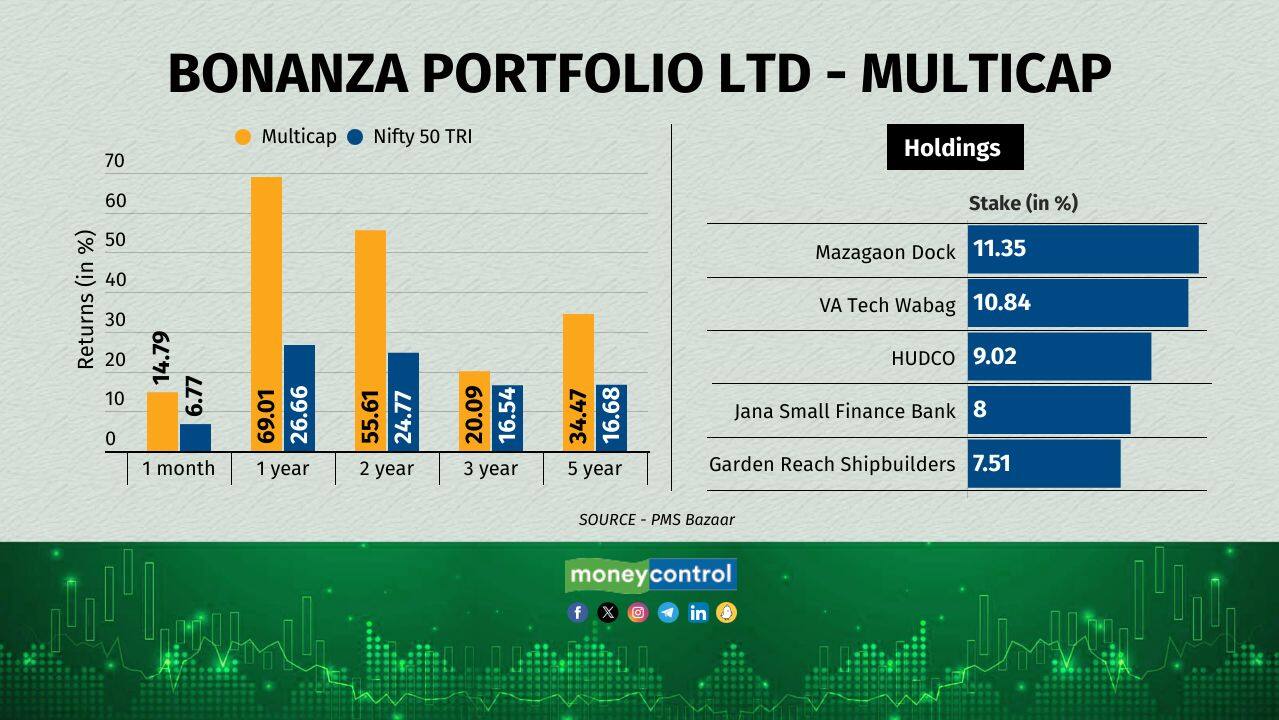

Bonanza PMS has exposure to capital goods, financial services, utilities, construction, and healthcare. The PMS invests 60 percent in smallcaps and 30 percent in midcaps. It was started in 2018.

5/11

The PMS is managed by Mayur Shah and was started in 2017. It has exposure to capital goods, FMCG, construction, consumer durables, and healthcare sectors.

6/11

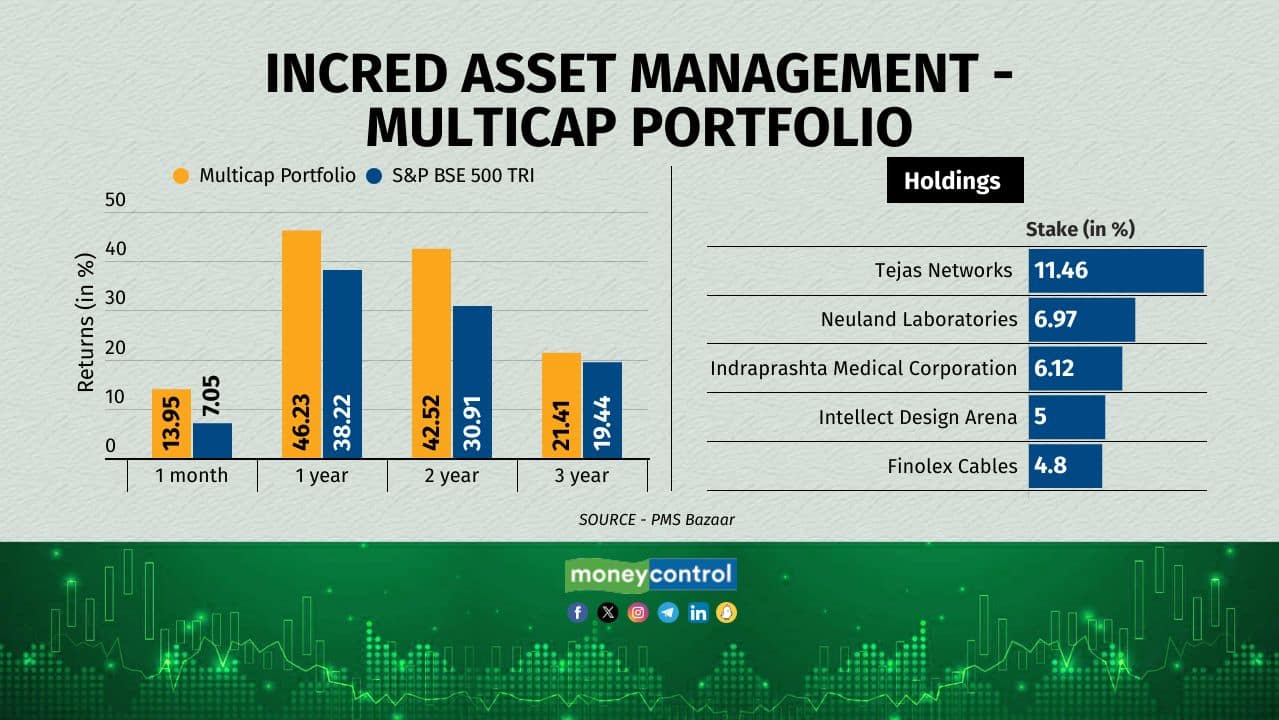

Incred PMS is managed by Aditya Sood and was started in February 2021. The fund has exposure to healthcare, financial services, IT, telecommunication, and consumer durables.

7/11

The portfolio is managed by Balaji Vaidyanath. The portfolio has exposure to sectors like FMCG, capital goods, auto and auto ancillaries, and banks.

8/11

The portfolio is managed by Arun Badjate and was started in July 2021. It has an AUM of Rs 81 crore. It has exposure to sectors like capital goods, financials, healthcare, construction, and automobiles.

9/11

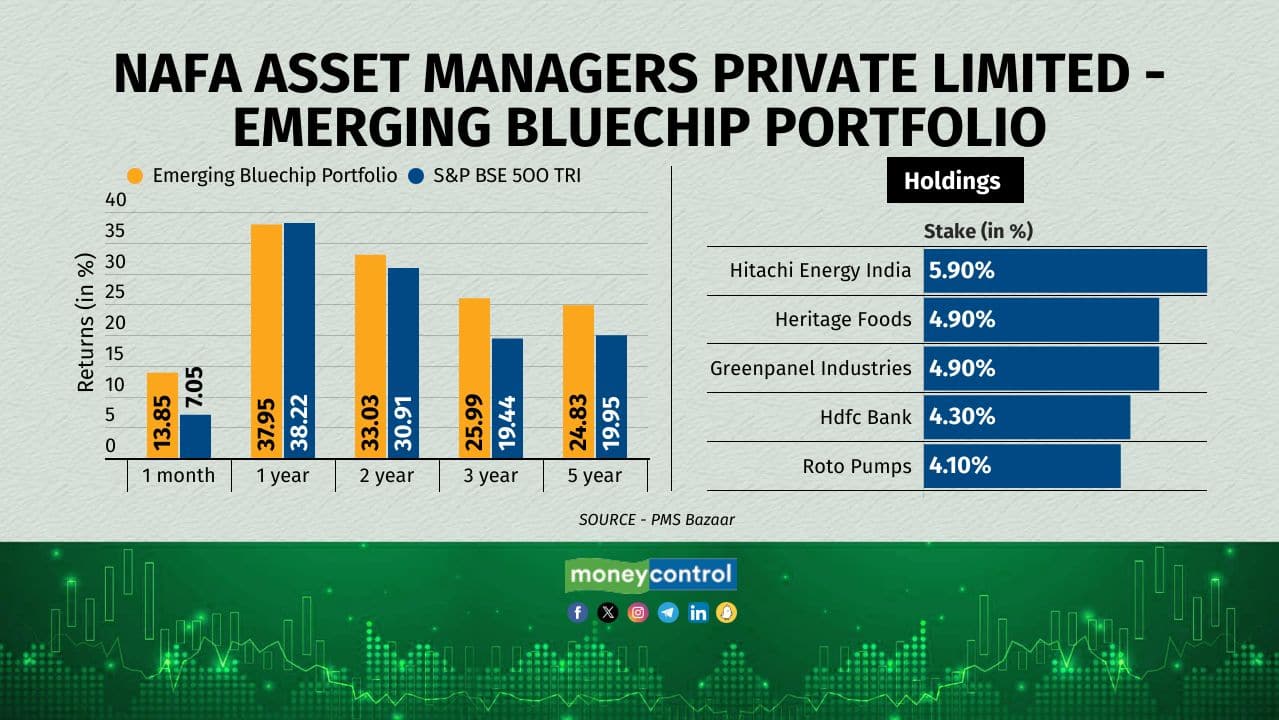

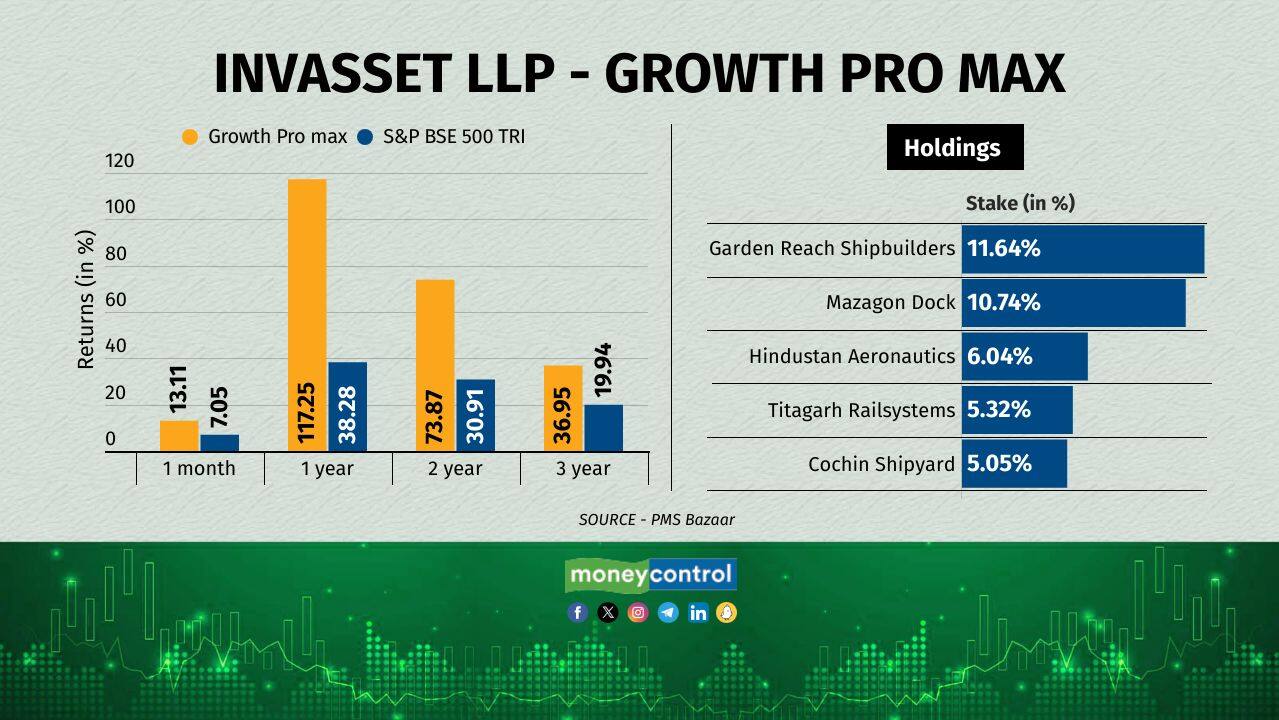

The PMS is managed by Anirudh Garg and was started in 2020. The PMS looks at beaten-down industry leaders that start to trade below their fair value during market meltdowns.

10/11

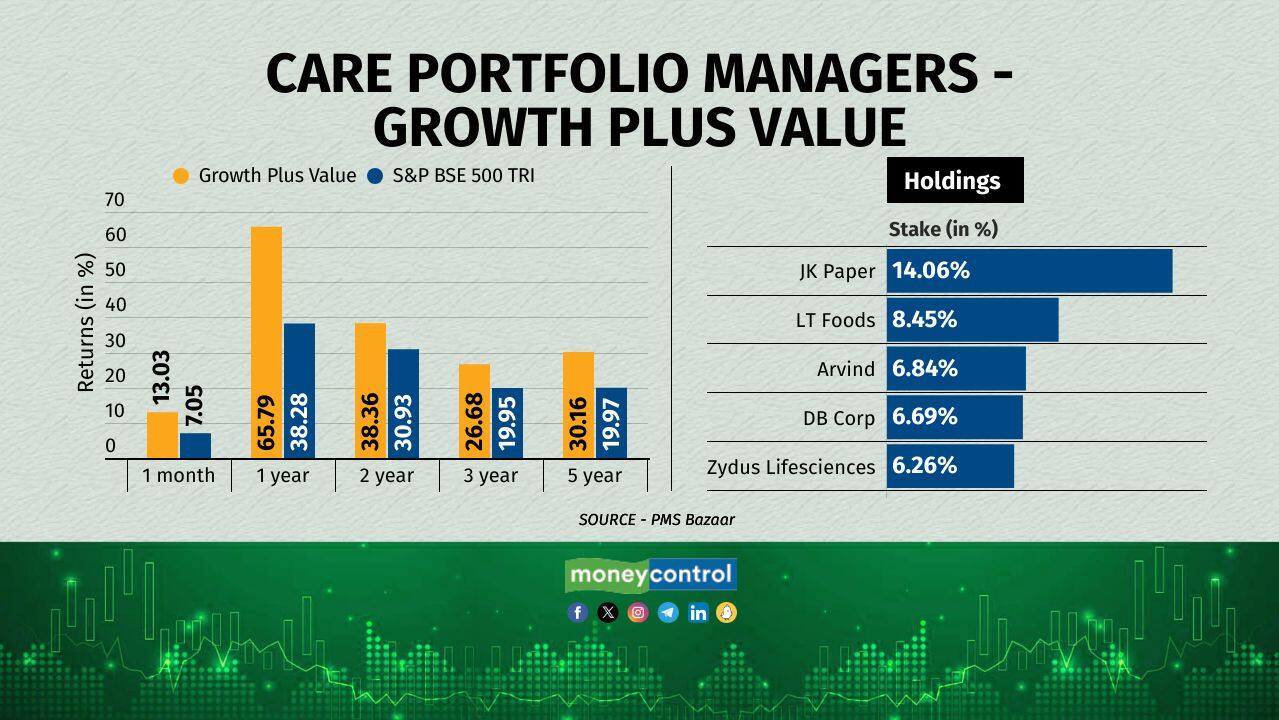

The portfolio is managed by Jayant Mamania and was started in 2011. It has an AUM of Rs 854 crore. The PMS' top five sectors are paper and packaging, textiles, pharma, packaged foods, and stationery.

11/11

The portfolio has exposure to capital goods, financial services, consumer durables, consumer services, and realty.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!