In the 1967 movie classic The Graduate, the aimless 21-year old played by Dustin Hoffman is told he could have a bright future in plastics. A modern remake would probably recommend “heat pumps.” A career installing these efficient home-heating contraptions looks like a sure thing. Manufacturers are sitting pretty for now, but may end up getting squeezed by lower-priced competition.

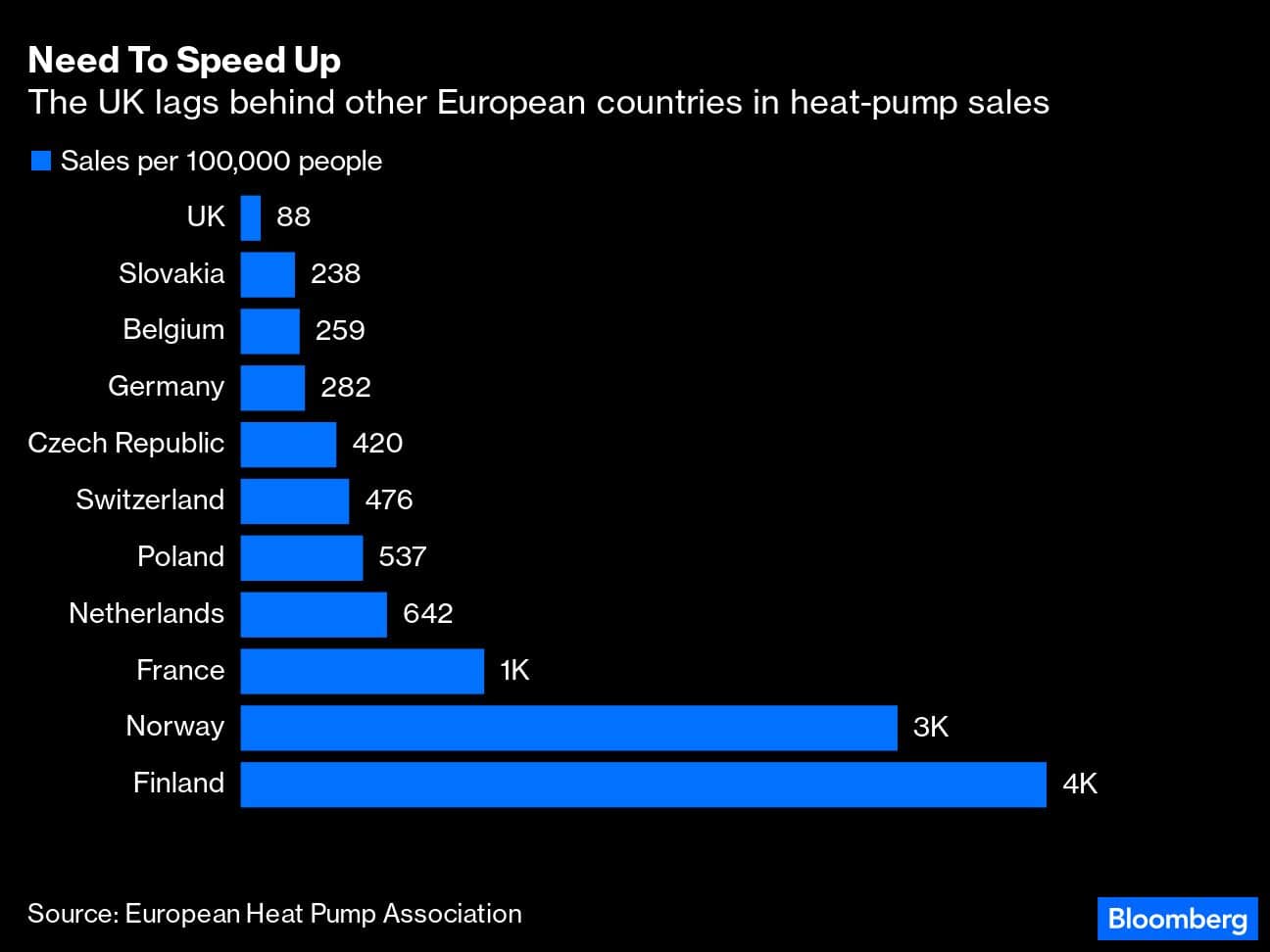

Heat pumps use electricity to transfer heat from outside (from the air, ground or water) via a refrigerant into the home. They are flying off warehouse shelves on both sides of the Atlantic as governments ban new gas and oil systems, set ambitious installation targets and offer generous incentives to boost adoption.

Though more expensive than installing a gas boiler — costs vary widely by country and technology but typically exceed €15,000 ($16,000) in Germany — heat pumps can lower monthly energy bills and carbon pollution, while reducing Europe’s dependence on hostile hydrocarbon exporters like Russia.

Installers have months’ long order backlogs and lack qualified staff, while manufacturers see heat pumps as a potential gold mine; even Elon Musk’s Tesla Inc. has talked about joining the fray.

“It's literally a once-in-a-generation opportunity,” Carrier Global Corp.’s Chief Executive Officer David Gitlin said when announcing a €12 billion takeover of German rival Viessmann Group’s heat-pump business last month. European governments are “basically forcing you to transition from legacy fossil-fuel boilers to heat pumps and you're going to be charging about up to 4x the price for that replacement.”

Heat-pump manufacturers currently enjoy high profit margins as demand outstrips their ability to deliver, but a global race is underway to add factory capacity and companies are pursuing takeovers to achieve economies of scale. The “technology itself is not sophisticated” and the attractiveness of the European market “isn’t lost on the competition,” Phil Buller, who analyzes industrial companies for Berenberg, told me.

Peers were shocked by Viessmann’s decision to sell, as family-owned German firms typically prize independence more than money. But the German group didn’t fancy its chances of fending off much larger Asian and US rivals. The 34-year old fourth-generation CEO, Max Viessmann, accepted Carrier shares and a seat on the US company’s board, but 80% of the purchase price was in cash.

We’ll soon find out whether this was a weak or wise move. A price war has kicked off in the UK, and in the longer term there’s a risk European heat-pump manufacturers meet a similar fate to solar companies who were displaced by lower-priced Chinese imports.

Consumers should welcome this jostling for market share, because shortages of labor and components have tended to push up the already high cost of heat-pump installations; lower prices are needed to spur greater adoption and maintain public support for the energy transition.

For now, investors aren't too worried and have bid up the shares of the small number of publicly traded companies in this sector. Swedish heat-pump manufacturer Nibe Industrier AB has gained around 1700%, including dividends reinvested, in the past decade. The stock trades on more than 40 times estimated earnings, around three times dearer than the Stoxx Europe 600 benchmark index.

Nibe’s management sounded confident after announcing bumper first-quarter earnings this week. Heat-pump sales increased more than 40% year-on-year, while price increases contributed to a widening of the climate division’s operating profit margin to 17.5%.

Though Nibe dropped out of the race to acquire a stake in Japanese air conditioner and heat-pump maker Fujitsu General Ltd. in March, it this week reiterated a commitment to “further offensive acquisitions,” and is investing to double production. “We are going to hustle and we are going to do our damnedest to participate in growth,” management told an investor call. “We have been waiting for this opportunity for some 20 years.”

Other European manufacturers are also putting up a fight: privately owned Stiebel Eltron GmbH & Co KG, Vaillant Group and Robert Bosch GmbH have announced big factory investments in Europe to capitalize on their golden ticket. The trouble is so have Japanese giants Daikin Industries Ltd, Mitsubishi Electric Corp. and Panasonic Holdings Corp., as well as China’s Midea Group Co. Ltd.

Heat pumps are technologically similar to air conditioners, which Asian companies have been mass producing for decades. Asian companies (and their overseas subsidiaries) manufactured 75% of the heat pumps sold globally in 2021, according to the International Energy Agency.

European companies do have some defensive advantages. The importance of local knowledge and equipment tailored to a country’s unique heating and building characteristics should offer a bigger edge to domestic businesses than exists in the solar industry, says Matthew Trewhella, CEO of UK ground-source heat-pump manufacturer Kensa Group, which this week announced a £70 million ($88 million) investment from Legal & General Capital and Octopus Energy Ltd.

European homes will often require hydronic systems — water-based distribution mediums like radiators — rather than the forced-air systems more common in other parts of the world. That may support a "slightly more regional market for heat pumps than for other clean energy industries,” says Meredith Annex, head of clean power at BloombergNEF. Homeowners may prefer to purchase a higher-priced German system, rather than cheaper Chinese kit, on the basis their property might then be worth more when they sell it.

And while the technology itself might not be difficult to master, you still need someone to install it: Carrier says Viessmann’s close connection to tens of thousands of technicians who favor its products creates a defensible “moat.” Carrier investors don’t seem convinced: its shares have declined more than 5% since news of the deal emerged.

My advice to anyone seeking a career that’s not at the mercy of artificial intelligence is to consider becoming a heat-pump installer. But with global companies keenly eyeing Europe’s burgeoning market, I don’t blame Viessmann for cashing in most of his plastic chips.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.