Few are saying it out loud, but it seems plenty of investment banking leaders think a big rebound in dealmaking and fundraising is around the corner. Even as advisory revenue at the biggest US banks has been at its weakest in years, a battle to keep rainmakers is bubbling away in the background.

James Gorman, Morgan Stanley’s chief executive officer, said it most clearly on Wednesday at the bank’s third-quarter results. There’s no need for the Federal Reserve to start cutting rates; companies and private equity firms just want to know they’ve peaked before they launch takeover bids or list companies.

“The minute you see the Fed indicate they’ve stopped raising rates is when the M&A and underwriting calendar will explode, because there is enormous pent-up activity,” Gorman said on the bank’s earnings call. “Unfortunately, I’m not going to be around to enjoy it,” because the bank is due to name his successor in the next few months.

His optimism failed to cheer investors. Shares sank as much as 9 percent after the bank said it produced less advisory fee revenue than analysts expected and saw an even bigger miss in wealth management revenue.

Still, there are signs of a hopeful outlook in the actions of many smaller advisory firms. Jefferies Financial Group Inc. expects to increase the number of senior bankers — also known as managing directors — by 20 percent by the end of this year, it said at an investor day on Monday. It actively hired in the previous two years as well. A string of others have also been on a recruiting spree in recent years, including Evercore Inc., Moelis & Co., PJT Partners Inc. and until this year Lazard Ltd., according to UBS Group AG analyst Brennan Hawken. The aggressive hiring could be helpful in the long term, but could mean higher compensation ratios — the share of revenue paid out to bankers — and lower returns to shareholders in the near term.

This activity is both spur and cover for big banks to boost pay too. Morgan Stanley wants to ensure it has the staff in place to tackle the hoped-for boom, so its staff costs have risen faster than revenue across the bank this year. In its investment banking and trading division, it boosted pay even though revenue fell in the third quarter, just like Goldman Sachs Group Inc did — although the latter also had to mollify internal unrest.

Compensation ratios have risen at both banks as a result, hitting their highest levels since 2019 or before. Bankers are meant to be paid for performance, but banks are looking past this to a degree because the whole market has been so poor.

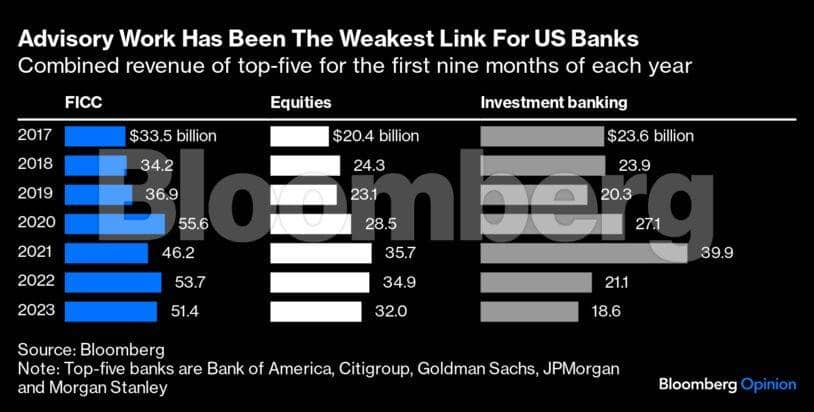

Economic and political uncertainty have been a boon to trading bonds, currencies and commodities over the past three years, but they have been a wet blanket for deals and stock sales. The top five US banks — Bank of America Corp, Citigroup Inc, JPMorgan Chase & Co, Goldman and Morgan Stanley — have collectively turned in six quarters of advisory fee revenue that have each been weaker than any other quarter in the past seven years except the first quarter of 2019.

The first nine months of this year produced the worst investment banking revenue for comparable periods in the last seven years. So the chances of some kind of pick-up must be reasonable unless the global economy hits a severe downturn. Gorman said he thought a US recession is unlikely.

Sharon Yeshaya, chief financial officer, added that the bank’s backlog of deals awaiting a green light had continued to build and was around the highest levels ever, although she didn’t put any specific numbers on what that meant. Key themes behind the pent-up activity were consolidation in the financial sector, investments in the transition to cleaner energy sources and how companies want to use technology, she said. Private equity firms too, with their vast pools of cash to be invested, are itching to get going.

But there are still obstacles that will limit ambition and activity. Higher-for-longer debt costs could cap the size of deals that executives can realistically contemplate. For private equity, the need for a larger share of cash and lower leverage will likely also reduce the number and size of deals compared with what was expected when they raised funds in the ultra-low interest rate era.

Many potential sellers still have to adjust their idea of what their businesses are worth, again because higher-for-longer interest rates cut the value that anyone will likely pay for future cash flows. At the very least, things couldn’t get much weaker. After 13 years of steady improvement in profitability and stock valuation under Gorman, Morgan Stanley’s next CEO will be under huge pressure just to not screw it up. The investment banking rebound that Gorman predicts would make that one job much easier.

Paul J. Davies is a Bloomberg Opinion columnist covering banking and finance. Views are personal and do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.