Madhuchanda DeyMoneycontrol Research

Latest quarterly numbers from Sun Pharma and Tech Mahindra have come as a shocker for investors. Both companies belong to sectors currently experiencing pain and in the midst of a major overhaul. Question is: Are the stocks good bargains at these levels or is buying them akin to catching falling knives?

Both Sun Pharma and Tech Mahindra have been major underperformers over the last year, falling 38 percent and 28 percent, respectively against an 18 percent rise in the Nifty.

Sun Pharma

Its US business (contributing to nearly 48 percent of total revenue historically) declined sharply by USD 127 million sequentially due to market share loss in Benicar AG and pricing pressure in gGleevec. Erosion in the base business as well as continued disruptions in Halol (the facility which is still under US FDA scanner) also added to the woes. For the past four quarters, Taro’s (its US subsidiary) revenues have steadily declined.

Besides US, the domestic business (historically contributing to 26 percent of revenue) grew a modest 6 percent. The 6.5 percent revenue decline, pricing pressure in the US base business, erosion in gross margin and inventory write-off of USD 45 million contributed to significant decline in operating margin to 21.7 percent (31 percent in the previous quarter and 33 percent in the year-ago quarter).

Management Guiding to a Difficult FY18

More worrying than the quarterly performance is the management’s indication that that aggressive price erosion in new launches is the new normal. Sun Pharma expects revenues to decline due to challenging environment in the US, assuming no new approval from Halol.

So, expect subdued numbers to continue for a while. In fact, we expect double-digit sales decline in the US business due to pricing pressure in Sun Pharma’s base business as well as that in Taro’s. Launches of Xelpros and Elepsia (process initiated to shift these products from Halol) and ramp-up of Bromsite and Odomzo and launch of gGlumetza, will partially help cushion the decline, but not by much.

Why We are Still not Writing Off Sun Pharma

Like technology, the pharmaceutical market is also changing fast and not everyone is ready to embrace the change. Analysts estimate that the generic growth opportunity will reduce to 1 percent by 2020 compared to 15 percent CAGR over 2010-15.

The period of readjustment is likely to be painful, which is reflected in the financials of India’s largest generic player.

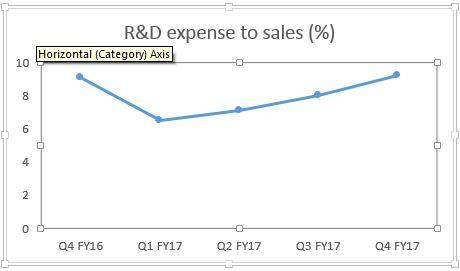

Sun Pharmaceuticals is gearing up to face the change. It has stepped up its investment in research and development and guiding to a higher R&D expense in FY18 at 9-10 percent of sales. In fact, its investment in speciality is offsetting the Ranbaxy synergies.

The company expects nearly 18 percent of revenue in FY20 to come from speciality business like dermatology and ophthalmology, around 6 percent from the branded drug business, and about 45 percent from the complex generics business that involves long-acting injectables and controlled substances.

Investors must remember that Sun Pharma continues to be the market leader in the chronic segment in India and is extremely well entrenched in specialities like cardiology, psychiatry, neurology etc.

Amid the near-term headwinds, the management is bullish about launches of Tildrakizumab and Seciera in FY19 and break-even of the speciality business in FY20.

While the US FDA resolution of Halol could ease near-term pain, long term investors should gradually accumulate the stock that is currently available at 17 times FY19 earnings for its transformative journey in a market where few players will meaningfully survive.

What about Tech Mahindra?

The technology sector is also in the midst of change and turmoil. Tech Mahindra’s journey from a telecom-focused company to a multi-vertical entity with multiple acquisitions on the way hasn’t been particularly smooth.

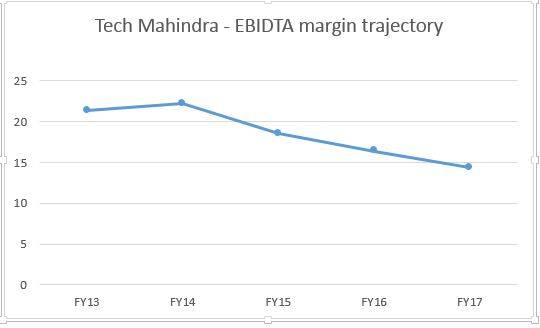

In the quarter gone by, the revenue performance was impressive – 1.4 percent dollar revenue growth on the back of 3.4 percent growth in enterprise and 0.8 percent decline in telecom. But the 370 basis points decline in EBIDTA (earnings before interest depreciation and tax) margin at 12 percent came as a nasty surprise.

Margin plummeted due to contract restructuring, LCC (Tech Mahindra had acquired US-based global telecom network services provider Lightbridge Communications Corp) business and currency. Tech Mahindra expects LCC to take another 2‐3 quarters to bottom out versus earlier expectation of Q4FY17.

When will Margins Climb to a Respectable Level?

While the Street would typically ascribe the margin decline to quarterly one-offs, we see it tough for Tech Mahindra to climb on to a more respectable margin trajectory like its large-cap peers (at least in the late teens). The company’s margin performance has been disappointing in the past two years.

Have They made Smart Acquisitions?

We are more concerned about the effectiveness of Tech Mahindra’s acquisition strategy to deliver the desired transformation that technology companies in India are grappling with.

The company’s expansion into the network management business through the acquisition of LCC has not worked out well so far.

The company has rightly shifted focus on legacy value plays to digital plays with the acquisition of HCI Group (US-based healthcare Information Technology consulting company), BIO Agency (UK-based digital transformation firm) and Target Group (one of the leading processing platform companies in the UK expected to strengthen its BFSI practice by access to IP and platform which helps automate end-to-end processes in the lending, investments and insurance market).

While these assets are good on a standalone basis, synergies for Tech Mahindra from these acquisitions have not been significant so far.

The company has plenty of margin levers to move up from the nadir it has touched in this quarter including improving utilisation from the current level of 81 percent, leveraging the pyramid and automation, and we expect the same to impact margins in the short term.

While the stock is trading at an undemanding valuation of 10.6X its expected earnings for FY19, we are still not convinced about its ability to ramp up its business to embrace the change in the technological landscape in a profitable manner.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.