How could you assess whether your investment decisions are due to skill or pure luck?

Investing successfully consistently over a long period of time requires discipline, solid research, and patience.

2023 was a bullish year in which the Midcap 100 Index was up by 46%. Roughly 100 stocks in the midcap category were up by 80% on average.

Such years create investors who think they know it all and it may lead them to an illusion that the profits are due to their investment research and stock picking skills. However, the returns generated may be just due to the overall market run-up.

Portfolio analysis plays an important role during such times to understand where the profits are coming from.

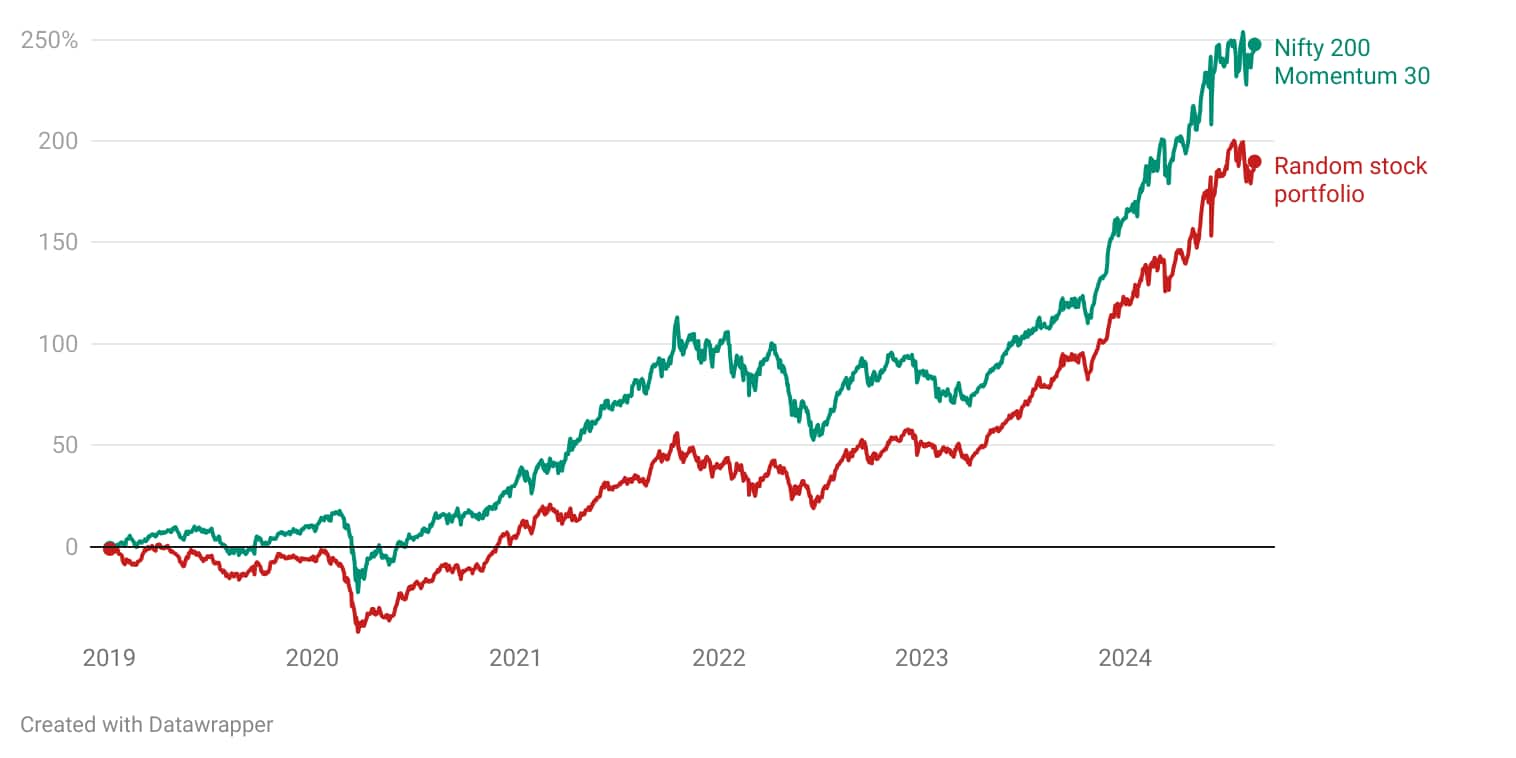

Case Study: Let's take 2 portfoliosPortfolio 1: A randomly generated portfolio of 30 stocks.

30 random stocks were picked from the Nifty 200 Universe at the beginning of every year since 2019. All stocks were given an equal weight.

Portfolio 2: Nifty 200 momentum 30 Index.

This Index aims to track the performance of 30 high momentum stocks across large and mid-cap stocks. The Momentum Score for each stock is based on recent 6-month and 12-month price return, adjusted for volatility.

Detailed rationale can be found here.

Investing in a smart Index like Nifty 200 Momentum 30 is a much better approach than picking random stocks as the Index has generated more returns for lesser risk, consistently.

Randomly picking stocks may work better in bullish years like 2021, 2023; however, when the market breadth does not perform well it could be difficult to generate alpha from stock picking.

In conclusion, ask these questions next time you think the profits in your portfolio are too good to believe:

What was the process used to generate the profits?

Are the profits consistent or concentrated in certain time periods?

How much risk have you taken for the reward generated?

How spread out were your investment bets?

Have you just made money on a few stocks or the overall portfolio?

The outcome of a bad process is luck.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.