Nitin Agrawal

Moneycontrol Research

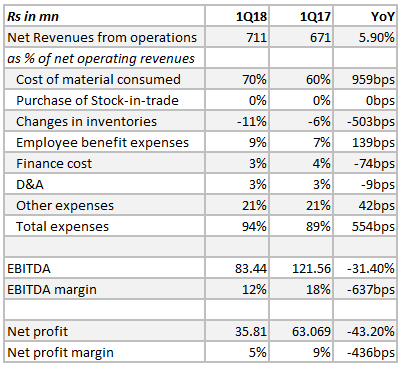

Rajratan Global Wire — the largest manufacturer of Tyre Bead Wire (TBW) in India — has posted a 6 percent growth in the net operating revenues, its EBITDA margin contracted by 637 bps in the first quarter of FY18. Volumes in India during the quarter were almost flat whereas Thailand business witnessed a 4 percent growth.

Hit by raw material prices

As forewarned in our earlier note, the contraction in EBITDA margin was mainly attributed to increase in the raw material prices which as a percentage of net operating revenues was up 959 bps. This was partially offset by the 503 bps decline in the changes in inventories.

Steel, a key raw material, had been witnessing a rise in prices until recently, eating into margins for the company. The effect of the increase is being seen in this quarter due to the usage of old inventories.

Rajratan management has mentioned that they usually approach their customers for a price increase on a quarterly basis and hence increase in raw material prices during the quarter under review would be passed on to the customer in the coming quarter. This lag led to margin pressure. The management also indicated that quantum of price increase ranges from 60-100 percent.

Normalcy after GST

The management blamed headwinds on account of factors like GST-led destocking for the Q1 show. With the completion of GST rollout, the management believes that the demand for the automobile would pick up which would have a positive rub off on its business.

Continue to add new clients

As indicated in our earlier note, that the company was in the final stage of approvals to get into agreement with Bridgestone. The management mentioned that the deal has gone through and they supplied 100 tonnes last quarter and will be supplying 300 tonnes this quarter. This is expected to increase, going forward.

Capacity expansion on track

The capacity expansion for Thailand plant is on track and would be completed in next three years.

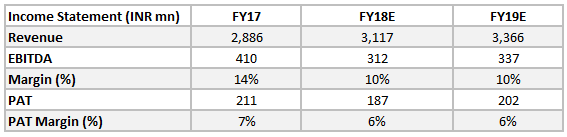

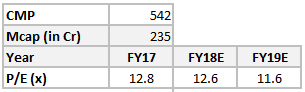

Estimates and valuation

In light of Q1 FY18 results, we have revised our estimates. Rajratan is trading at reasonable valuations of 12.6 and 11.6 times FY18e and FY19e projected earnings. We feel that the recent weakness in the stock gives investors an opportunity to accumulate the stock.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.