In this piece, we look for the logical basis for the GST Council’s decision to levy 28 percent Goods and Service Tax (GST) on the full value or the contest entry amount in case of online gaming. There could be the moral logic of treating ‘gaming’ as a non-merit service and hiking tax rates to levels that would make it unaffordable to all but a very few rich and obsessively addicted consumers. But this logic would run contrary to the clear distinction, made repeatedly in established jurisprudence, between games of skills and games of chance.

Multiple high courts and even Supreme Court judgements have held that fantasy gaming, which is one of the most popular categories in real money gaming, is a game of skill and not of chance. For example, an online gaming company provides a platform for hosting chess games where participants are charged an entry fee and at the end of the game, they have a chance to win prize money greater than they paid as the entry fee. According to the GST Council’s recent decision, winners in this platform who used their mind and analytical skills to win prize money will be treated in a similar manner as the winner of a lottery who just won by virtue of chance. Chess is only one such example of games of skill that can be designed in real money gaming format and which have several positive externalities like developing the players’ analytical, decision-making and problem-solving skills etc. Games of skill are now often used in training institutes for developing and honing such skills. Therefore, the GST Council’s decision to treat gaming as a non-merit service clearly fails on moral logic.

Revenue CalculationsThere could then be the fiscal logic of raising tax rates to their highest possible level in an attempt to maximise revenues and reduce the fiscal deficit even as public capital expenditure is kept as high as possible while trying to compensate for the slack in private capital formation. The revenue secretary is on record estimating revenues from GST levy on online gaming to rise from the current Rs 2,000 crore to Rs 20,000 crore, a whopping 10 times over the next few years. This assumes demand for gaming to be completely price inelastic. This cannot be right by any stretch of the imagination. Most addictive consumption habits, like cigarettes and alcohol, display some price elasticities. Gaming can hardly be the sole exception.

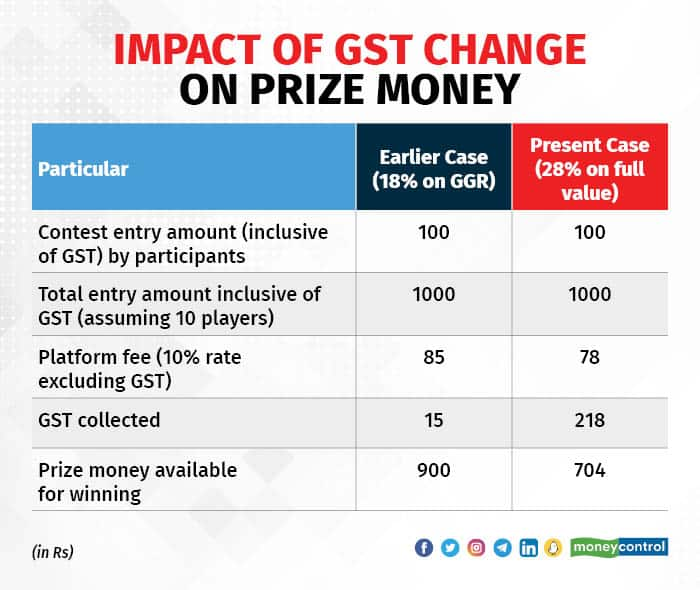

Moreover, there is also the even stronger aspect of higher taxation of 28 percent charged on the full value or the contest entry amount, drastically reducing the reward incentive for participants in the game. The GST Council’s decision will worst affect the real money game segment of online gaming, which contributed 77 percent of India's gaming sector revenues of Rs 13,500 in 2022. Prize money is most often the driving factor for participation in the game. Now since the tax is on full face value, it implies that even before the game begins, gamers are set to lose 28 percent of their entire prize money. This result substantially decreases the prize money even before the game begins. This is illustrated in the table below.

A 22 percent decline in available prize money even before games begin will force online gaming companies to increase the contest entry amount passing the GST burden on players for the same prize money. Or, they have to decrease the number of winners to maintain their net revenues. Both scenarios will reduce participation further.

The combined impact of the expected negative price elasticity and the strong disincentivisation for player participation will ensure that the gaming industry growth is jeopardised and the fanciful revenue expectations will not materialise. Thus, the Council’s decision fails on the fiscal logic as well.

Taxing Value AddedThird, we are at a loss to understand if the decision to tax the full value of the game does not go against the very principle of the logic of the GST regime. Isn’t the fundamental principle underlying the GST regime to levy tax on the value-added at each stage of the supply/production chain? Prior to the decision by the 50th GST Council meeting, the online game of skill was charged at 18 percent of gross gaming revenue (GGR). The GGR is the total amount of money a gaming business brings in through bets minus the amount paid out for winning. Thus, the earlier practice was akin to taxing the value-added by the service providers, which is in line with the logic of the GST. This also accords with the international practice where tax is collected on GGR and the prize component is untaxed.

Online gaming platforms act as intermediaries hosting a gaming platform where participants deposit contest entry amount to play games and win prizes. Intermediaries are responsible for ensuring fair play, collecting deposits and settling prize claim for which they charge platform fee which is akin to brokerage in the case of a mutual fund or portfolio management fee. Now GST is charged on brokerage or portfolio management fees and certainly not on the entire value of an investment. Taxing full value or contest entry amount in the case of online gaming, especially in the case of a game of skill fails on this fundamental GST logic as well.

Moreover, taxing the full values also defies the long-standing convention of not taxing the same service twice. The amount won as prizes will again be taxed at 30 percent income tax. Thus, the prize component of the contest entry amount suffers from double taxation, which is never a good practice.

Tough On BusinessesFinally, the decision runs completely counter to the logic of developing and nurturing sunrise sectors in the economy. The move to levy 28 percent taxation on full value will potentially deal a death blow to this sunrise sector. With falling participation rates, lower revenues and higher tax outgo, even the more established players may find it difficult to survive. In any case, such high taxation will inevitably lead to the shutting down of small players and negatively impact employment with its direct and indirect effects on overall tax collection.

An added fear is that offshore gaming companies functioning outside Indian jurisdiction will gain as the online gaming business by definition will not respect national boundaries and shift to foreign platforms. Domestic online gaming companies will be the losers. Higher taxation, as in the case of high import tariffs, will also ultimately lead to the proliferation of illegal gaming without regulations and outside the jurisdiction of the Indian revenue administration. Once driven underground, the entire business will be increasingly unregulated with far higher risks for participants. Thus, there are multiple negative consequences of this decision, which should logically be rescinded.

Rajiv Kumar is Chairman and Harshvardhan Singh is Research Associate at the Pahle India Foundation. Views are personal, and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.