ITC has over the years sought to position itself as a complete consumer company. It tried shedding the “cigarette” tag by diversifying into other businesses, especially in areas with strong linkages to the farm economy. While FMCG has grown to a decent size, the company hasn’t yet commanded the exact valuations of the sector. ITC's recent AGM further shed light on the company’s future path away from cigarettes.

After successfully establishing packaged food brands, ITC is also foraying into perishable segments and investing in supply chain infrastructure. Is the market taking note of these changes?

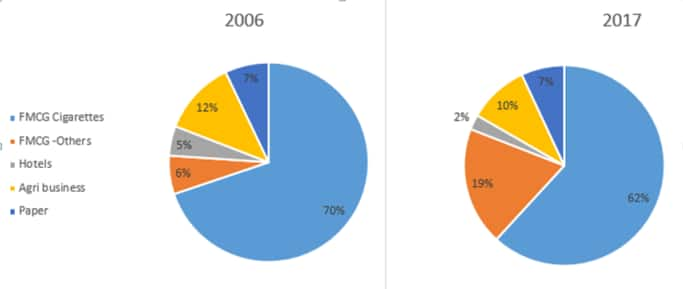

Focus on FMCG business drives diversificationIn the last 11 years, ITC’s sales from its FMCG business (excluding cigarettes) has increased substantially to Rs 10,512 crore. In 2005-06, the FMCG business used to contribute about 6 percent of gross sales which has now increased to 19 percent. Augmenting the non-cigarettes business is a conscious choice as the company attempts to diversify and capture the entire value chain of the consumption cycle.

Chart: Segment level exposure at gross revenue level

Another way to look at it is in terms of the management’s changing priority in capital allocation. In 2006, a third of the capital expenditure was for the cigarettes business and only 14 percent for the FMCG business. In contrast, last year, the company deployed 46 percent of capital expenditure, amounting to Rs 1,153 crore, for the FMCG business.

Branded packaged food leads foodITC says that consumer spend (FY 2017) on the brands from the new FMCG businesses are now close to Rs 14,000 crore with major brands such as Aashirwaad and Sunfeast garnering Rs 3,500 crore and Rs 3,000 crore of sales respectively. Branded packaged foods category in particular clocked a CAGR (compounded annual growth rate) of 26 percent during FY2006-17. ITC is targeting a turnover of Rs 1 lakh crore from the new FMCG businesses by 2030.

In line with the focus on expanding the non-cigarettes business, the ITC management reiterated at the recent AGM their commitment to harnessing value chain of “Farm to Consumer”.

ITC has been a key player in linking agri-commodities sourcing with the processing industries and delivering food brands such as Aashirvaad, Sunfeast, Bingo! and B Natural. In continuation with that strategy, the company recently launched “ITC Master Chef” brand of spices.

Further, its landmark initiative of e-Choupal in 2000 helped in providing host of services to farmers related to agriculture best practices, know-how and weather-related information.

Need for post-harvest infrastructurePrimed by the huge annual agri-wastage of about Rs 92,000 crore, company has emphasised the dire need for the infrastructure, ranging from post-harvest logistics, processing, and packaging. The company says that about 20 integrated consumer goods manufacturing and logistics facilities are under various stages of development.

Expansion of food business into perishable segmentsITC is also strengthening its focus on food processing. The company now plans to foray into perishable segments such as fruits, vegetables etc. It mentioned that investments are underway to create climate-controlled infrastructure for an efficient supply-chain. In pursuance with this objective, ITC Master Chef Frozen Prawns have recently been launched in select markets. Further, investments have also been made in farming for aromatic and medicinal plants.

A brand new segmentAt the AGM, the company also took approval for a healthcare business wherein it targets establishing a multi-specialty hospital for starters. Further, details on the investment outlay and time frame are yet to be finalised. However, the foray into healthcare is seen as another initiative by the company to emerge as a health-oriented business conglomerate.

Overall, the company’s new initiatives to expand the product portfolio particularly in the FMCG and food business should be seen as continuation of the strategy of product diversification. What remains credible is the company’s multi-decade linkages with the farm sector that are now getting integrated with new investments in logistics and food processing. This can go in a long way in establishing ITC as a leading player in the FMCG business. There is no denying that the low=level of food processing in India at 10 percent leaves enough room for growth.

For the long term investors, ITC, in our view, continues to hold a prospect of quality growth and is available at reasonable valuation (30x FY 2018 earnings).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.