Krishna Karwa

Moneycontrol Research

With its growing population and a large proportion thereof in the working age bracket, India remains a lucrative yet under-penetrated market for insurance products. In this backdrop, the initial public offer (IPO) of the country’s largest private non-life insurer ICICI Lombard assumes importance. While the company’s past growth has been impressive, the future holds promise. Hence, despite the optically heady valuations, long-term investors willing to participate in this consistent growth theme shouldn’t ignore this offer.

Background

ICICI Lombard General Insurance Company Ltd (ICICIL), is joint venture between ICICI Bank Limited and Fairfax Financial Holdings. It is a multi-product general insurance player and has a market share (based on GDPI - gross direct premium income) of 8.4 percent among all non-life insurers and 18 percent among private-sector non-life insurers. The company enjoys leadership position in domains such as motor, health, crop, fire, marine, and engineering insurance.

The Issue

The issue size of Rs 5,700.9 crore is an offer for sale from the promoter ICICI Bank (Rs 2,099 crore) and Fairfax (Rs 3,601 crore). The price band is Rs 651-Rs 661 per share and will remain open for subscription from September 15 to 19.

Why should one look at the offer?

Industry tailwinds – India’s non-life insurance penetration, currently at 0.77 percent, is one-fourth of the global average and considerably lower than peers like China (1.81 percent), Brazil (1.76 percent) and Thailand (1.70 percent). India’s per capita non-life insurance premium, at USD 13, is also one of the lowest among its peer group and much lower than the global average of USD 285.3. Hence, the opportunity size is large. Furthermore, India’s insurance industry seems to be growing at a healthy pace.

The size of the Indian non-life insurance sector was Rs 1.28 lakh crore on a GDPI basis as on March 31, 2017. Indian non-life insurance sector GDPI grew at a CAGR of 17.4 percent between fiscal 2001 and 2017.

The demographic dividend – Currently, India’s population is among the youngest globally, with a median age of 28 years. 90 percent Indians are likely to be below the age of 60 by 2020. A high share of working population, coupled with rapid urbanisation, nuclearisation of families, labour mobility, and rising affluence is expected to propel India’s non-life insurance sector to a whole new level.

Leadership premium - ICICIL is the largest private-sector non-life insurer in India by GDPI in fiscal 2017, a position they have maintained since 2004. The company has grown faster than the industry, with its GDPI growing at a CAGR of 26.7 percent from fiscal 2015 to 2017 compared to a CAGR of 22.8 percent for the industry.

The company has a diversified range of product offerings and operates as a one-stop insurer for various customer requirements in fields such as motor, health and personal accident, crop/weather, fire, marine, and engineering insurance.

Strength of the distribution channel - The company adopts multiple distribution channels including direct sales, individual agents, bank partners, other corporate agents, brokers, and digital platforms. This multi-channel network has enabled it to offer products to customers with varied requirements/expectations across geographies. Over the years, ICICIL has moved from a largely corporate focused business to a more retail-oriented one. In fiscal 2017, retail (including SME), corporate and government business groups contributed 60.4 percent, 17.5 percent, and 22.1 percent of GDPI, respectively.

Effective leveraging of technology - ICICIL has been at the forefront of adopting technology to improve reach and penetration. In fiscal 2017, 87.5 percent of their new policies were initiated online, either by distributors or customers. Consequently, employee productivity, measured in terms of GDPI per employee, has increased. Moreover, claim settlement and grievance redressal processes have been effected at a quicker pace too despite the increase in number of policies written over the years.

Adept management of the investment book – ICICIL’s investment assets increased from Rs 10,200 crore on March 31, 2015 to Rs 15,079 crore on March 31, 2017, thus making it the private-sector non-life insurer with the largest total investment assets in India.

Since fiscal 2004, the company’s listed equity portfolio’s annualised return stood at 30.8 percent, compared to 17.5 percent of the S&P NIFTY index.

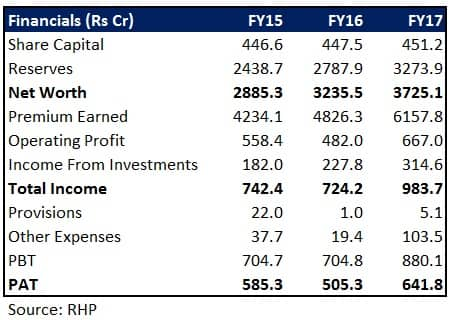

Healthy financials - ICICIL has a strong capital position with a solvency ratio (size of its capital relative to all the risk the company has taken, which is all liabilities subtracted from total assets) of 2.10x as on March 31, 2017, as against the regulatory requirement of 1.50x.

The company’s Combined Ratio (sum of loss ratio and net expense ratio) has been generally stable, improving from 104.9 percent in fiscal 2015 to 104.1 percent in fiscal 2017. During the same period, the loss ratio has improved from 81.4 percent to 80.6 percent.

The company has managed to clock healthy returns on equity (ROE) in excess of 15.5 percent for each fiscal year since FY15. For the year ended March 31, 2017, the ROE was at 16.7 percent.

In the past four years, while the premiums have grown at a CAGR (compounded annual growth rate) of 11 percent, profitability grew by 16 percent.

Nevertheless, ICICIL’s business could be impacted by regulatory changes, macro challenges, and natural calamities, among others. However, despite the strong moats stated above, a valuation multiple of 34.7x FY18 earnings (annualised) and 7.6x book value may not result in substantial short-term gains. The company but definitely worth a look for long-term investors.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.