Anubhav SahuMoneycontrol research

India Inc reported tepid earnings in the season gone by, with valuations looking expensive. With the earnings season drawing to a close globally, it’s worth looking at earnings and valuations across the globe. Can India’s fan following still be taken for granted, or will investors’ eyes wander?

The United States posted robust earnings growth and the Eurozone is witnessing higher fund flows on more attractive valuations and improving growth visibility. EM (emerging markets) is another object of investor interest, partly driven by the performance of the commodities sector.

The bottomline appears to be that the strong performance of alternatives combined with the lacklustre earnings and stretched valuations at home could dim global investors’ ardour for India.

Positive US earnings season but stock reaction muted

In our earlier global earnings updates, we had highlighted that US corporate earnings season has been quite decent, compared to consensus expectations, leading to positive revisions for sales and earnings. In particular, average sales beat was in the range of 70 percent, ahead of long term average of 54 percent.

However, interestingly, stock reaction to the positive earnings surprises was the weakest since Q2 2011. On an average stocks consolidated, hinting at profit booking, given that valuations are stretched and US policy uncertainty remains high.

Robust domestic growth, international earnings keeps the lead

US corporate sales and earnings growth attributed to international territory was ahead of that coming from its domestic territory. Earnings growth from S&P 500 companies having higher international exposure (More than 50 percent Sales from non-US regions) registered 14 percent YoY growth. It is worth noting that foreign sales account for 43 percent of total aggregate sales of the S&P 500 companies.

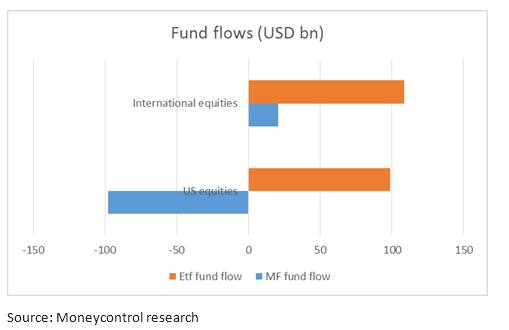

Fund positioning: Flows to international regions continues, Eurozone favorite

US investors who are positioning themselves for international equities (non USA) remains positive with about USD 23 billion making its way to Mutual funds and ETFs in the last four weeks.

US & UK equities losing to Eurozone, Japan and EM

At the global level, fund managers continue to reduce their allocation to US and UK equities and assign higher weightage to Eurozone, Japan and EM equities. As per BofA ML (Bank of America Merrill Lynch) survey, fund managers overweight to Eurozone equities has increased to 56 percent (54 percent in July 2017).

Eurozone: supportive macro and micro offsets currency headwinds

Increasing attention to Eurozone equities is underpinned by solid fundamentals both at the macro and micro level. Q2 GDP reading has been revised upward to 2.2 percent (previously 2.1 percent) ahead of forecast. Latest credit growth data has been positive, particularly for the household sector. The ECB’s Q2 bank lending survey also points towards easing credit standards for loans to enterprises.

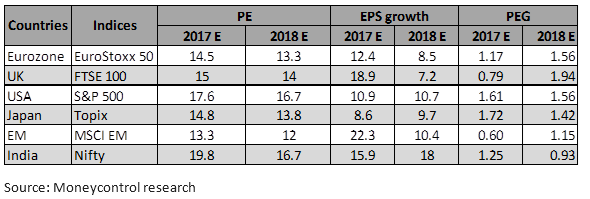

To add to the positive macro, Q2 earnings has been solid with 60% earnings beat so far. Further, though earnings revisions are slightly weighed by currency headwinds, relative lower valuations (2017E PE of 14.5 vs. 17.6 for USA) adds to its attractiveness.

India: High valuation premium and lower earnings makes it vulnerable

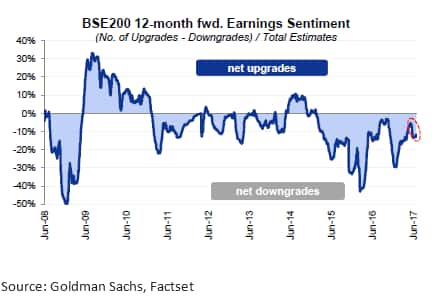

Indian corporate earnings season, in contrast, has been disappointing largely due to GST transition. Amongst BSE 200 stocks where about 80% of the companies have reported earnings, the growth in profitability has been a mere 2 percent YoY. Significant slowdown in sales was observed for staples, consumer discretionary and healthcare sectors that was partially offset by the growth in energy and metals & mining.

While GST was the significant factor, other factors like regulatory (financials), competitive intensity (telecom, staples), sectoral structural headwinds (IT, healthcare) and weak macro environment in Middle East (staples) also weighed on earnings.

Against this backdrop, the persistent trend for earnings downgrades is not surprising. Healthy restocking post-GST holds the key for revival. The high valuation premium of the Indian benchmark indices (Nifty at 19.8x for 2017E) makes it vulnerable. In last five trading sessions, there has been an outflow of funds from FIIs (foreign institutional investors) to the tune of $1 billion, though equally matched by inflows from DIIs (domestic institutional investors).

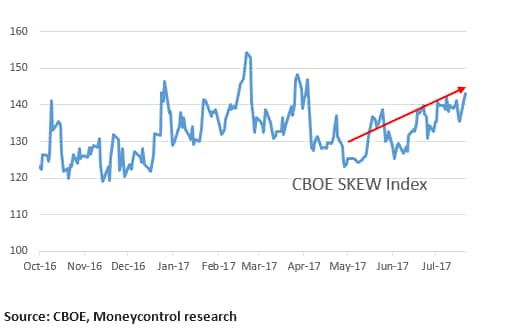

Investors assigning higher probability of tail risk

So while global indices have rebounded from recent lower levels, looking at the options data on S&P 500 index suggests that investors are assigning higher probability of a tail risk – i.e. higher chances for outlier return in near term and therefore buying low strike put options. Recent volatility has led to increased downside protection at the lower levels.

Investor note: CBOE SKEW Index (SKEW) measures the deviation of S&P 500 return distribution from the normal distribution and its reading vary between 100 and 150. If the reading is 100 then the perceived distribution of S&P 500 log-returns is normal. However, if the SKEW reading is higher, it means probability of outlier returns (more than 2 std. dev) is higher.

Countdown starts for Jackson Hole

While the next set of central bank meetings are scheduled in September 2017, the Fed’s annual symposium in Jackson Hole (24th -26th August) would be closely watched. This symposium, as always, has provided avenues for assessment of monetary policy for the major economies. Markets would look for further hints on the normalization of interest rates across the globe.

If major central banks, particularly the ECB, join the chorus signaling an end of accommodation, it would be positive for bond yields and so could weigh on equities. And so one cannot rule out a correction in Indian equities in a risk-off environment, on account of its expensive valuation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.