Joe Biden has laid it on the line, asking voters to make a head-to-head comparison between him and Donald Trump. Who, the President asked, has been more successful at bringing manufacturing jobs back to America? Simply comparing new investment in factories under the two administrations gives the clear edge to Biden. Still, Trump could argue that Biden’s incentive programs are larger and enjoyed the backing of Congress, while he had to fight the free traders within his own Republican party.

A fairer comparison would be between Bidenomics as practiced and the more comprehensive tariff plan Trump says he would implement if he were to regain the White House than what he enacted during his first administration. Unfortunately for the former President, economic analysis still comes out against him. The broad tariffs envisioned by Trump simply don’t provide the same bang for the buck as Biden’s targeted incentives.

Biden’s two major incentives come from the Inflation Reduction Act, which provides an estimated $212 billion in tax incentives for corporations to invest in clean energy, and the CHIPs Act, which provides $52 billion for companies that expand semiconductor activity in the US. Of the two, it’s the CHIPS Act that has produced the most pronounced effect on US manufacturing investment. The semiconductor industry has announced more than $200 billion in new domestic manufacturing projects, and construction spending on factories has risen 50 percent since Biden took office in 2021.

By comparison, there was a modest 10 percent bump in manufacturing investment after Trump increased tariffs on commodities and manufactured goods from China through a series of executive orders beginning in 2018. To be sure, Biden has kept most of those tariffs in place, and Trump could argue that Biden’s success is due in part to the groundwork laid by the former President.

The truth is that both parties are moving toward a much more aggressive role for the federal government in determining the future of US manufacturing. However, they have drastically different visions. Trump wants to rely primarily on tariffs. His big economic proposal for his next term in office is a 10 percent tariff on all imports into the US. Such a universally imposed tariff of that size could be expected to raise around $300 billion in revenue annually. Trump is reportedly looking to use that revenue to fund direct payments to American households rather than reduce the government’s ballooning deficit.

Trump’s thinking here is surely driven by the considerable economic pain that tariffs would cause. The Tax Foundation estimates that Trump’s proposed tariff would raise prices and reduce wages throughout the economy, leading to a 1.1 percentage point decline in gross domestic product. That would have equaled $280 billion in 2022.

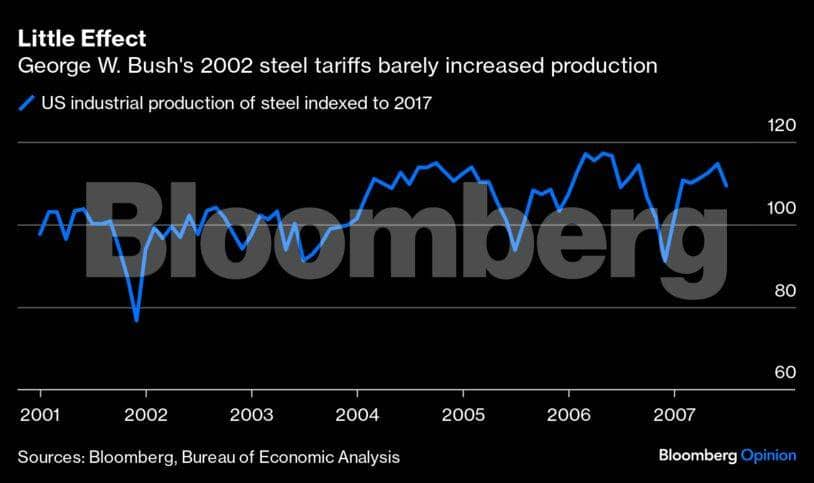

The question is, however, could such a measure realistically be expected to revive US manufacturing? Besides the modest effect of Trump’s own tariffs, the next best source of evidence are the steel tariffs imposed under George W. Bush. Those were done with the specific intent of reviving the US steel industry and ranged from 8 percent to 30 percent, making them as large or larger than Trump’s tariffs. America’s industrial production of steel, however, rose only about 15 percent from 2002 to 2005.

Again, what we see is only a modest impact from the imposition of tariffs. The reason why is clear: investing in the development of a new factory entails significant risk. Large amounts of capital must be sunk into investments today with no guarantee of what the demand for the factory’s output will be over its lifetime. Tariffs help boost demand for as long as they are in place, but they can be removed in the future, or their effect mitigated by retaliatory tariffs.

Biden’s incentives, on the other hand, directly offset that risk by providing grants and credits for the actual construction, reducing the risks for manufacturers. Moreover, by encouraging simultaneous investment by multiple companies, the US’s standing in the global supply chain gets elevated, making issues associated with disruptions like was seen during the pandemic less likely.

The downside is that incentives add to the budget deficit, which is why it’s crucial to structure them in a way that strengthens and bolsters the economy. The CHIPs act does precisely that by focusing on grants and tax credits that offset the cost of new factories. The other half of Biden’s manufacturing efforts, the Inflation Reduction Act, could have been made more effective by making its longer-term incentives mimic the more tightly focused construction cost offsets in the CHIPs act.

If America is committed to reviving its domestic manufacturing capacity, then the only effective means will be through direct construction-related incentives. That means taking the most impactful part of Bidenomics -- the CHIPS act -- and expanding on it, rather than returning to the weak and economically costly tactic of raising tariffs.

Karl W. Smith is a Bloomberg Opinion columnist. Views are personal and do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.