By Jogendra Behera

After nearly two decades of regulatory uncertainty, India has finally paved the way for electricity derivatives. With SEBI approving their launch and both MCX and NSE set to roll out products, this marks a watershed moment for India's power markets, perfectly timed to address rising volatility in an increasingly renewables-heavy grid.

The idea of electricity derivatives was first mooted in 2005, but lack of clarity around regulatory jurisdiction between SEBI and CERC delayed progress. Meanwhile, global markets—from Australia to Europe—have adopted these tools to hedge risks in increasingly weather-sensitive, renewable-dominated systems.

India’s power market is undergoing rapid transformation, driven by aggressive renewable additions and technologies like rooftop solar, battery storage, and electric vehicles. These shifts are making the market more dynamic and less predictable. Derivatives can help manage this volatility while offering forward price signals critical for planning and risk mitigation across the value chain.

Volatility - The New Normal

A striking feature in recent times has been the surge in spot market volatility. Prices are frequently crashing to near-zero during solar-heavy hours and then spike in the evening. The “duck curve” and “shoulder effects” are no longer theoretical – they have become daily operational realities.

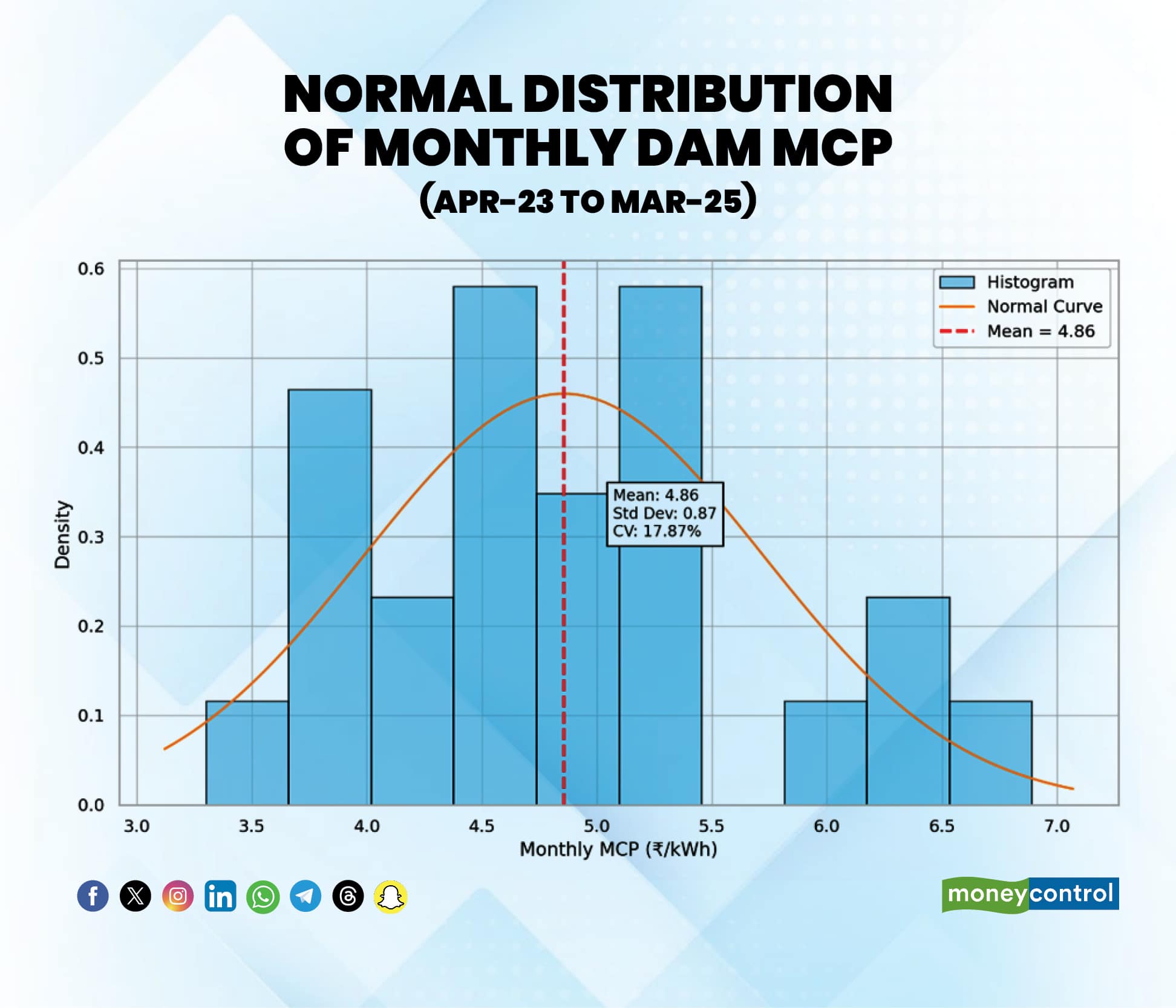

Weather unpredictability further compounds this. Fluctuations in temperature, rainfall, and humidity—often influenced by climate anomalies—have become frequent. For instance, in May 2025, an early monsoon caused a sudden drop in demand, pushing Real-Time Market (RTM) prices to zero during solar hours. Between April 2023 and May 2025, average monthly Day-Ahead Market (DAM) prices ranged from Rs 3.30 to Rs 6.89/unit with a standard deviation of Rs 0.87/unit—underscoring structurally volatile market.

Spot Market Growth Despite Risks

Ironically, even as volatility grows, so does reliance on spot markets. Spot markets now account for 7–8% of total power procurement and grew 20% last year. Discoms are using short-term markets to avoid locking into costly long-term PPAs. Large C&I consumers are tapping green open access, particularly during low solar-price hours.

Meanwhile, over 30 GW of renewable projects auctioned in the last two years are awaiting PPAs. In the absence of assured offtake, developers are turning to merchant options—G-DAM, G-TAM, and RTM—while new structures like Virtual Power Purchase Agreements (VPPAs) gain traction.

Looking ahead, hybrid and firm dispatchable renewable (FDRE) projects are expected to generate surplus beyond PPA obligations, which must be absorbed by the market. With rooftop solar, EVs, batteries, and demand response gaining ground, market complexity will deepen.

In this backdrop, electricity derivatives are no longer optional—they are essential. They allow sellers to hedge against price crashes and buyers to guard against spikes. As short-term exposure grows, derivatives will be vital for financial stability, procurement strategy, and investment planning.

Making Derivatives Work: Key Enablers

* Fit-for-Purpose Product Design

Monthly base-load futures are a good start, but products must evolve. Volatility in India is time-block specific—solar vs. non-solar hours. More granular products like hourly strips, weekday/weekend contracts, and seasonal futures will better match market needs. Over time, more sophisticated instruments like options, spread contracts, and weather-linked products should be introduced to build a diversified suite.

* Robust Settlement Index

Settlement prices must reflect actual exposure. With multiple market segments—DAM, G-DAM, RTM—a single credible, exchange-agnostic index is essential. For instance, a seller in G-DAM won’t benefit from a derivative settled on DAM prices. Weighted indices across platforms and products could offer more effective hedging.

* Smooth Onboarding & Capacity Building

Discoms, generators, and traders have little experience in financial derivatives, while financial market participants might lack power sector insights. Bridging this gap is key. Capacity building through joint workshops, sandbox trials, and simple onboarding (reduced fees, minimal documentation) can accelerate adoption.

* Regulatory Clarity for Utilities & Generators

Although discoms operate under cost-plus tariffs, derivatives can help lower procurement costs. Similarly, regulated generators with surplus or merchant capacity can benefit from hedging. CERC and SERCs should issue clear guidelines to facilitate participation without case-by-case approvals.

* Encouraging Speculator Participation

Speculators bring liquidity and enable effective price discovery. Early trades will often be between hedgers and speculators. One enabling step could be a gradual relaxation of the Rs 10/kWh spot price cap. With hedging tools in place, lifting the ceiling can help reflect true market dynamics.

* Institutional Coordination and Infrastructure

A robust ecosystem—featuring real-time data access, dependable price indices, and aligned clearing systems—is essential. Institutions like POSOCO, NLDC, and the exchanges must align financial and physical markets. The Joint Working Group between SEBI and CERC must actively resolve regulatory overlaps and provide effective oversight.

A Timely Opportunity

Electricity derivatives can become a cornerstone of India’s evolving power market. In a landscape marked by rising merchant activity and structural volatility, they offer essential tools for risk management, investment planning, and competitive price discovery. With the regulatory framework in place, the road ahead lies in refining the product mix, broadening market participation, and strengthening institutional support. If implemented well, electricity derivatives could make India’s power market more dynamic, resilient, and future-ready.

(Jogendra Behera, Head - Policy, Regulatory & Non-Utility Markets, Apraava Energy.)

Views are personal, and do not represent the stance of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.