Madhuchanda DeyMoneycontrol Research

Thermax has been going through a rough patch for a long time as private capex cycle completely dried out in India. The JV with Babcock & Wilcox also proved untimely as order inflows in the BTG (boiler, turbine, generator) space came to a grinding halt.

For a company, which has been catering to broad segments of energy and environment and present in a whole gamut of engineering services, the worst may be behind it now.

To be sure, with its technological prowess, it is positioned rightly for the future.

The expansion plans/investments in new areas to reduce dependence on traditional businesses continued. The company is seeing nascent signs of recovery. Should investors put the stock back on their radar?

The difficult past

Thermax has been catering to broad segments of energy and environment, is present across a gamut of engineering services ranging from power and heating to hazardous waste treatment and waste to energy generation.

Thermax in the past was heavily reliant on power and steel segments for its core energy business. The decline in capacity addition took a big toll on financials that was difficult to be compensated from promising but small segments like chemicals and environment.

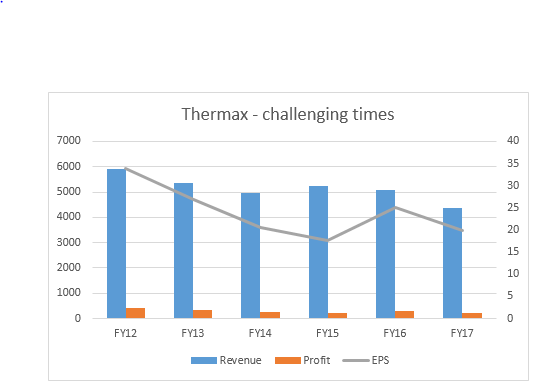

From FY12 to FY17, although the company ran a tight ship with optimising efficiency to the hilt, growth remained elusive.

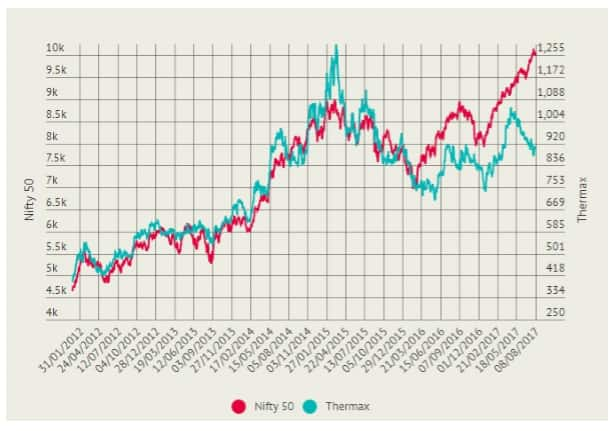

However, the company focused on making the right investments and taking futuristic initiatives. Nevertheless, the stock underperformed vis a vis the benchmark.

Unexciting Q1 FY18

The result of the first quarter is also not exciting though it was impacted by exceptional factors. For the quarter, at the consolidated level, Thermax posted a revenue of Rs 917 crore, down 10.5 percent. Profit after tax stood at Rs 40 crore (Rs 49 crore), down by 18.4 percent. Close to Rs 110 crore revenue couldn’t be booked on account of clients not taking delivery on account of GST. The malware attack in JNPT port also impacted exports.

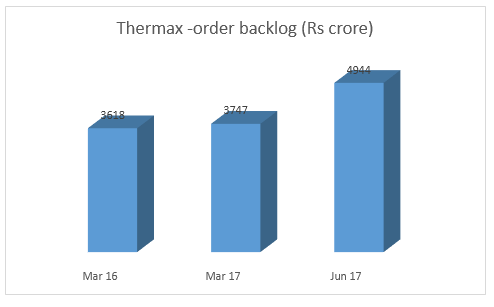

The only silver lining appears to be the significant improvement in order inflows driven largely by overseas orders.

Any green shoots in sight?

However, what caught our attention was the cautiously optimistic commentary on significant improvement in enquiries. The company feels that Indian investors are waking up to medium sized projects.

• Traction is building up in textiles – polyester, yarn, weaving and knitting especially from the Gujarat and Coimbatore belt.

• Brownfield expansion seen in light and commodity chemicals.

• Improved activity level in the food processing sector.

• Oil and gas sector has started investments towards quality improvement of petroleum products to conform to Bharat VI standards.

• Increasing enquiries are also coming from the fertiliser sector.

• With the revival of the steel sector, sponge iron sector is showing improvement in activity levels and enquiries are coming from waste heat recovery and captive power plants.

• The revival in steel industry looks more sustainable as the current geopolitical situation might ensure that the partial protection granted to Indian steel industry would continue.

• The company is also witnessing demand from cement sector with respect to waste heat recovery.

• Activity level appears to be picking up in Tier II cities. The hospitality sector has started spending on smaller sized water heaters, baby boilers etc.

• Tyre sector also shows signs of positivity.

While the aforesaid early green shoots makes us positive on Thermax’s base business, there are other opportunities in the horizon as well.

New engines of growth

Thermax has invested in three additional manufacturing facilities that will start contributing to incremental revenue.

The facility in Indonesia would be the manufacturing hub for the ASEAN region and should start contributing from the final quarter of the current fiscal. The market potential is around USD 400 million and the company aims to garner 14-15 percent market share.

The specialty resins plant in Gujarat (at Dahej) will also be ready for commercial production this year. The company plans to ramp up capacity in this highly remunerative specialised resins, where the revenue potential can go up to Rs 800 crore.

Work has already started at Sri City (Andhra Pradesh) for setting up a manufacturing plant for vapour absorption chillers. This will be a state-of-the-art facility, highly automated and would require much less manpower.

Futuristic Initiatives

The government’s new environmental norms – for emission control related to the reduction of sulphur oxides (SOx) and nitrogen oxides (NOx), and for combating water pollution through recycle and zero liquid discharge technologies – together with the agenda for clean cities are expected to provide opportunities for the company’s environment segment.

In India, the biggest emitter of greenhouse gases is the thermal power sector. The ministry of environment, forest and climate change (MoEFCC) has decided to impose strict norms for emissions of particulate matter (PM), sulphur dioxide, nitrogen oxides, mercury and reduced water usage by coal-fuelled thermal power plants. While the deadline has been extended from earlier timeframe of 2017, this remains a fairly large opportunity as all thermal power plants will have to adhere to this norm by 2019.

Thermax is also working on few futuristic products like triple effect absorption chiller; Combloc - the packaged boiler that offers fuel flexibility; BioCask- the compact sewage treatment system for industrial-commercial establishments and housing projects and spent wash boilers to generate energy from distillery waste. The company has also developed an integrated solar thermal technology.

Thermax has seen success in fluidised bed gasification technology which can effectively gasify high ash Indian coal. Gasified coal can provide improved efficiency, water requirement, CO2 emission, nitrogen and sulphur oxides (NOx and SOx) reduction is also possible.

Time to turn positive?

Coming out of a difficult past, the presence in upcoming areas (especially the clean & green technology) and the early green shoots from the macro makes the company worth a look for the conservative long-term investors. The healthy balance sheet is an added positive. Albeit the heady valuation at 28X FY19 projected earnings, we see merit in accumulating the stock when the going is tough.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.