By Sudhir Kapadia

The topic which has generated maximum heat and dust in Budget 2024 has been the capital gains tax proposals. To be sure, before every Budget over the years, there would be widespread discussion and debate on the need and nature of changes required to be made in respect of capital gains tax provisions.

It is also obvious that there would be some level of asymmetry of thought amongst relevant stakeholders on any kind of changes attempted in the area of capital gains tax depending upon their individual interests. Undoubtedly, even much before the advent and subsequent scorching growth in investments in modern financial products like mutual funds, PMS, and AIFs, the provisions of capital gains taxation in India have been highly complex and contentious. Simultaneously, political parties, economists, professionals and academicians alike have periodically showered their wisdom on the ideal capital gains tax system for India and not infrequently, with inconsistent positions guided by expediency.

In this heady mixture of proliferation of capital market products, robust growth in capital gains due to sustained high levels of stock market valuations and plethora of piecemeal tinkering of provisions over the years, any attempt to simplify and rationalise capital gains tax provisions must be applauded and supported.

The background and design principle of the changes have been well explained in the Memorandum to Finance Bill 2024 and subsequent FAQs.

So the question which needs focus and attention is simple - why has there been so much angst and backlash rather than applause for the attempt to rationalise and simplify the capital gains tax structure in Budget 2024?

Anatomy of capital gains restructuring

Firstly, there will be only two holding periods - 12 months and 24 months for determining whether the capital gains is short term or long term. For all listed securities, the holding period will be 12 months and for all other assets, it shall be 24 months. Thus, units of listed business trusts (REITs and InvITs) will now be at par with listed equity shares at 12 months instead of earlier 36 months. The holding period for bonds, debentures, and gold will reduce from 36 to 24 months. For unlisted shares and real estate it shall remain at 24 months.

Secondly, the rate of short term capital gains on STT paid equity shares, units of equity oriented mutual funds and units of a business trust will increase from 15 percent to 20 percent ‘as the present rate is too low and the benefit from such low rate is flowing largely to high net worth individuals’. The rate of long-term capital gains will be 12.5 percent for all categories of assets. Thirdly, along with this reduced rate, benefit of indexation to calculate adjusted purchase price which is presently available for property, gold and other unlisted assets, will no longer be available. ‘This will ease computation of capital gains for the taxpayer and tax administration’. Further, ‘for the benefit of lower and middle income classes’, the exemption limit of long term capital gains will be increased from Rs 1 lakh to Rs 1.25 lakh.

Where is the data?

To begin with, the assertions made about the benefit of lower rate of 15 percent on short term capital gains flowing largely to high net worth individuals needs deeper scrutiny and analysis. There have been various data shared by market regulators and participants suggesting a broader and deeper proliferation of investors across the country beyond Tier 1 cities and increasingly encompassing middle class people. Thus, the foundational basis for the rate increase needs more empirical data, which if available with government authorities, should be shared in public domain to buttress this rationale.

For the same reasons, a modest increase in exemption limit to Rs 1.25 lakh for long term capital gains seems unlikely to provide any material benefit to the middle classes as the frequency and growth in SIPs and investments in equity oriented mutual funds would suggest far greater number of investors falling way above the enhanced exemption limit.

Indexation can’t be based on a template

Next is the question of ‘retroactive’ application of the prospective removal of indexation benefit for assets like real estate albeit at the lower rate of 12.5 percent. Whilst Ministry of Finance officials have taken pains to clarify its impact, the fact of the matter is that these clarifications are purely theoretical in nature as the application of the new basis of taxation will significantly differ across myriad factual situations across the country.

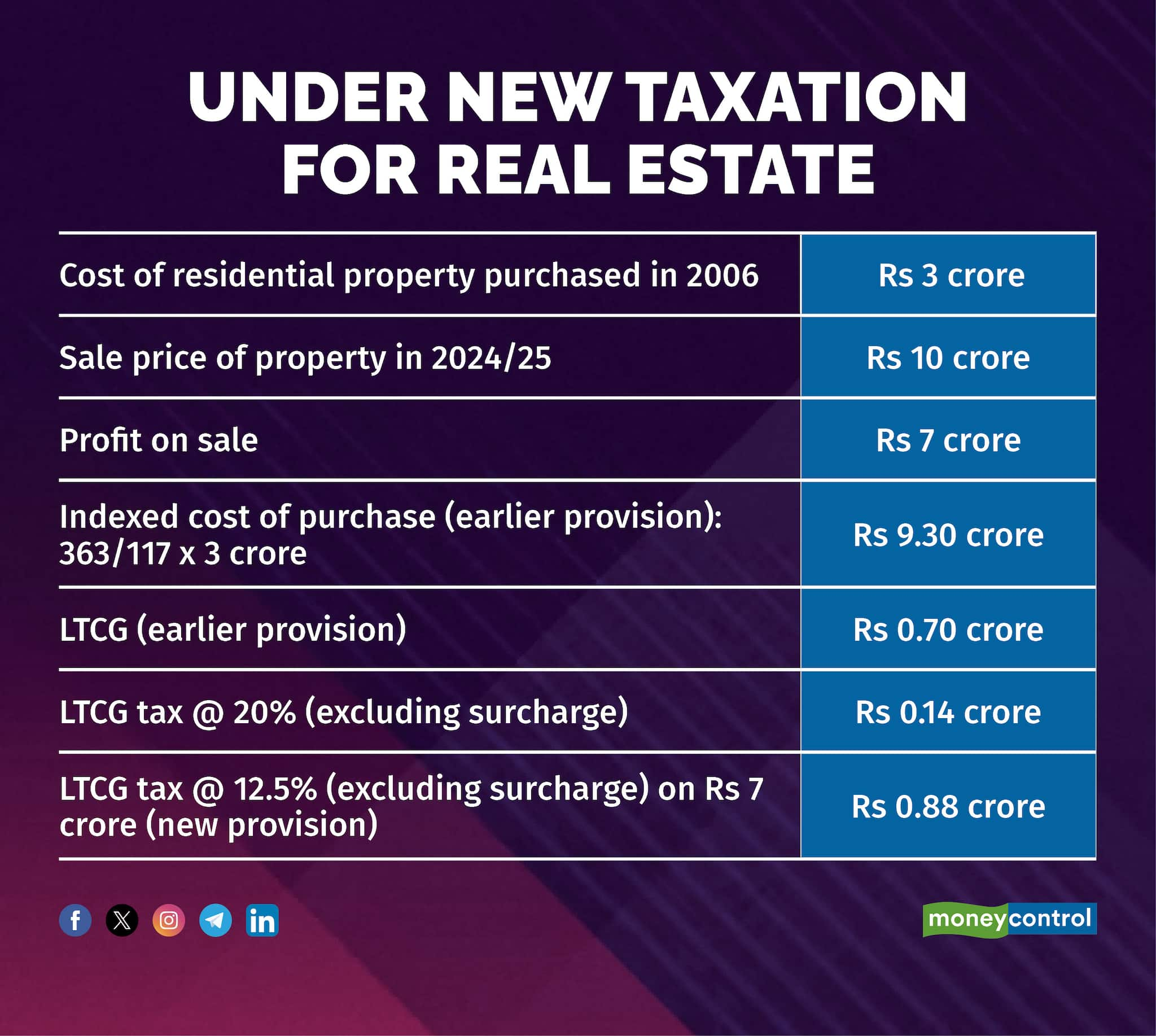

This is illustrated by the following typical example in a city like Mumbai:-

Thus, there is a steep increase of Rs 74 lakh for the taxpayer in the above scenario. Given the rapid pace of redevelopment of old properties in cities across India, it is not unusual for middle class home owners to monetise their older properties and create a safety retirement corpus with the liquid funds generation and these cases will be adversely impacted by the change in computation mechanism.

Let us take another example of investment in debt oriented mutual funds (like PSU and Bank Debt Fund) subscribed in 2020/2021 during the pandemic years. A typical example of this type of investment is given below:-

Since investments in debt oriented mutual funds made before 1st April 2023 were ‘grandfathered’ in Budget of 2023, many middle class investors who would be holding these kinds of debt mutual funds purchased earlier will now discover, to their dismay, that their returns are further diminished due to the additional tax outgo.

An alternative approach

It is eminently desirable to provide an option to taxpayers to calculate their long-term capital gains tax liability on real estate, gold and other unlisted assets under either higher rate of 20 percent (with indexation) or lower rate of 12.5 percent (without indexation) rather than force a potentially more detrimental scheme (like in cases outlined above) on a taxpayer.

The reason adduced for removing indexation benefit namely, ‘complexity in computation of capital gains’ seems rather tenuous as this computation mechanism has stood the test of time over the decades and there doesn't appear to be any serious disputes on the computation methodology.

As per post budget clarifications, it appears that the incremental tax revenues on account of these capital gains tax changes are a relatively modest Rs 15,000 crores. Therefore, government should seriously consider restricting the changes to the laudable simplification in definition of holding period (12 and 24 months across all asset classes) without any need to increase either the short term or long term tax rates on listed securities. Under this scenario the higher rate of 20 percent (with indexation benefits) can be retained for gold, real estate and other unlisted assets.

Government should consider a more comprehensive feedback mechanism from all stakeholders and defer any changes in capital gains tax scheme till the larger simplification of the tax laws as announced by Finance Minister is undertaken.

(The author is a senior board advisor.)

Views are personal and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.