Dragged down by factors such as a weak rupee, rise in crude prices and trade war fears, the market ended the June series on a subdued note. The Sensex lost close to a percent, while the Nifty corrected over 1.5 percent.

Maximum cuts were seen in state-run banks, metals, real estate, infrastructure as well as midcaps. The Nifty PSU bank index was down 7 percent, while the real estate index fell over 9.5 percent. The Bank Nifty fell over 2 percent, while the midcap index lost around 6 percent.

In the June series, stocks such as JSW Steel, Dabur India, Britannia Industries and Century Textile & Industries saw the most rollovers. About 38 stocks saw short covering during the month, followed by 170 stocks which saw long unwinding.

“It (Nifty) traded in a 343 points range between 10,550 and 10,893 levels, inside the trading range of its May series. It consolidated for most part of the series. In the last two sessions, it slipped from 10,800 to close to 10,550, which was the lowest level in the June series. Open interest in June series fell series on series. The July series has begun with total future open interest of 1.91 crore shares. The Nifty has seen rollover of 64.05 percent from the June to July series, with a negative rollover cost of 0.17 percent,” Chandan Taparia of Motilal Oswal Securities said.

There were a few F&O stocks, which managed to deliver flat to positive returns. These positive returns are based on their trades in the cash market.

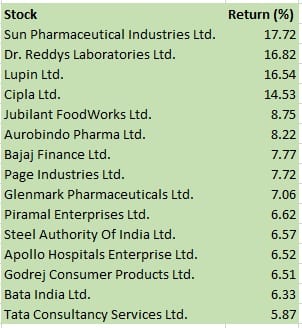

Over 40 of 200 stocks in this list managed to end the series in the green, while the rest managed to deliver negative returns. For the June series, Sun Pharmaceutical Industries gained the most, returning almost 18 percent, followed by Dr Reddy’s Laboratories, Lupin, Cipla and Jubilant FoodWorks, which gained between 14.5 percent and 17 percent.

Source: AceEquity

Among the losing pack, stocks such as Reliance Communications, Hindustan Construction Company, Reliance Naval & Engineering, NCC, IDBI Bank and Jet Airways managed to erode investor wealth up to 29 percent.

Source: AceEquity

“Traders are going light as the index is somehow stuck in a range, while the upside seems to be limited. Historically, the July series usually belongs to the bulls. But given the current scenario of volatile crude prices, weakness in global indices and rupee weakness, the market’s upmove could be limited,” Taparia added.

He expects select IT, pharma and FMCG stocks to see some buying interest and state-run entities and many midcaps to continue to remain weak.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.