With the increasing weakness in the market after the breaking down of the consolidation range as well as upward sloping support trendline and 50-day EMA (exponential moving average placed at 21,865), the market participants seem to be cautious now.

If the Nifty 50 fails to hold on to the 21,800 level in coming sessions, then is likely to extend a southward journey initially towards the 21,700 mark and then at 21,500, experts said, adding that in the case of a bounce back, the index may face resistance at 22,000 and 22,200 levels.

On March 19, the BSE Sensex lost 736 points or 1.01 percent to end the day at 72,012, while the Nifty 50 fell 238 points or 1.08 percent to 21,817 and formed a long bearish candlestick pattern on the daily charts with above-average volumes. The index has also broken the higher highs and higher lows formation on the daily charts by falling below 21,860 indicating more weakness.

"The Nifty has broken down from the rising wedge pattern on the daily chart, suggesting a potential reversal of the uptrend. Additionally, it has fallen below the critical short-term moving average, indicating weakening momentum," Rupak De, senior technical analyst at LKP Securities said.

The relative strength index (RSI) has also shown a bearish crossover, indicating increasing selling pressure. "Key levels to watch include resistance at 22,000 and support at 21,800. A drop below 21,700 could lead to further correction in the Nifty," he said.

Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas also feels daily and hourly momentum indicator has a negative crossover, which is a sell signal. "The next crucial support level comes in at 21,740 and below that potentially towards 21,530," Gedia added.

However, he believes that the Nifty is at the fag end of the fall and the selling may not be that sharp.

The Nifty Midcap 100 and Smallcap 100 indices declined 1.2 percent each on weak breadth.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty 50 may take immediate support at 21,792 followed by 21,748 and 21,678. On the higher side, the index may face resistance at 21,934 followed by 21,977 and 22,048 levels.

On March 19, the Bank Nifty fell 191 points to 46,385, extending a downward move for the eighth consecutive session and formed a Doji kind of candlestick pattern on the daily charts. The index has formed lower highs for the eighth straight session but negated lower lows for the last six consecutive sessions.

The 45,662 seems to be a crucial level for the continuation of higher highs and higher lows formation in the banking index.

"Bank Nifty closed the day on a negative note however it held on to the previous trading session low around 46,000 and witnessed rangebound action," said Jatin Gedia. Going ahead, he expects the Bank Nifty to recover 46,800-46,950 over the next few trading sessions.

According to the pivot point calculator, Bank Nifty is expected to take support at 46,284 followed by 46,203 and 46,072. On the higher side, the index may see resistance at 46,547 followed by 46,628 and 46,759.

The weekly options data showed the maximum Call open interest was recorded at the 22,000 strike with 1.05 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,500 strike, which had 96.22 lakh contracts, while the 22,200 strike had 76.04 lakh contracts.

Meaningful Call writing was seen at the 22,000 strike, which added 68.22 lakh contracts followed by 21,900 strike and 22,500 strike, which added 50.82 lakh and 36.74 lakh contracts, respectively.

The maximum Call unwinding was at the 22,900 strike, which shed 6.22 lakh contracts followed by 22,700 and 23,300 strikes, which shed 4.1 lakh contracts and 3.11 lakh contracts, respectively.

On the Put side, the 21,000 strike owned the maximum open interest, which can act as a key support level for the Nifty with 49.26 lakh contracts. It was followed by the 21,400 strike comprising 42.14 lakh contracts and then at the 21,800 strike with 40.85 lakh contracts.

Meaningful Put writing was at the 21,400 strike, which added 10.95 lakh contracts followed by the 21,800 strike and 21,500 strike adding 7.34 lakh and 6.75 lakh contracts, respectively.

Put unwinding was seen at 22,000 strike, which shed 23.76 lakh contracts followed by 21,900 and 22,100 strikes, which shed 10.81 lakh and 10.63 lakh contracts, respectively.

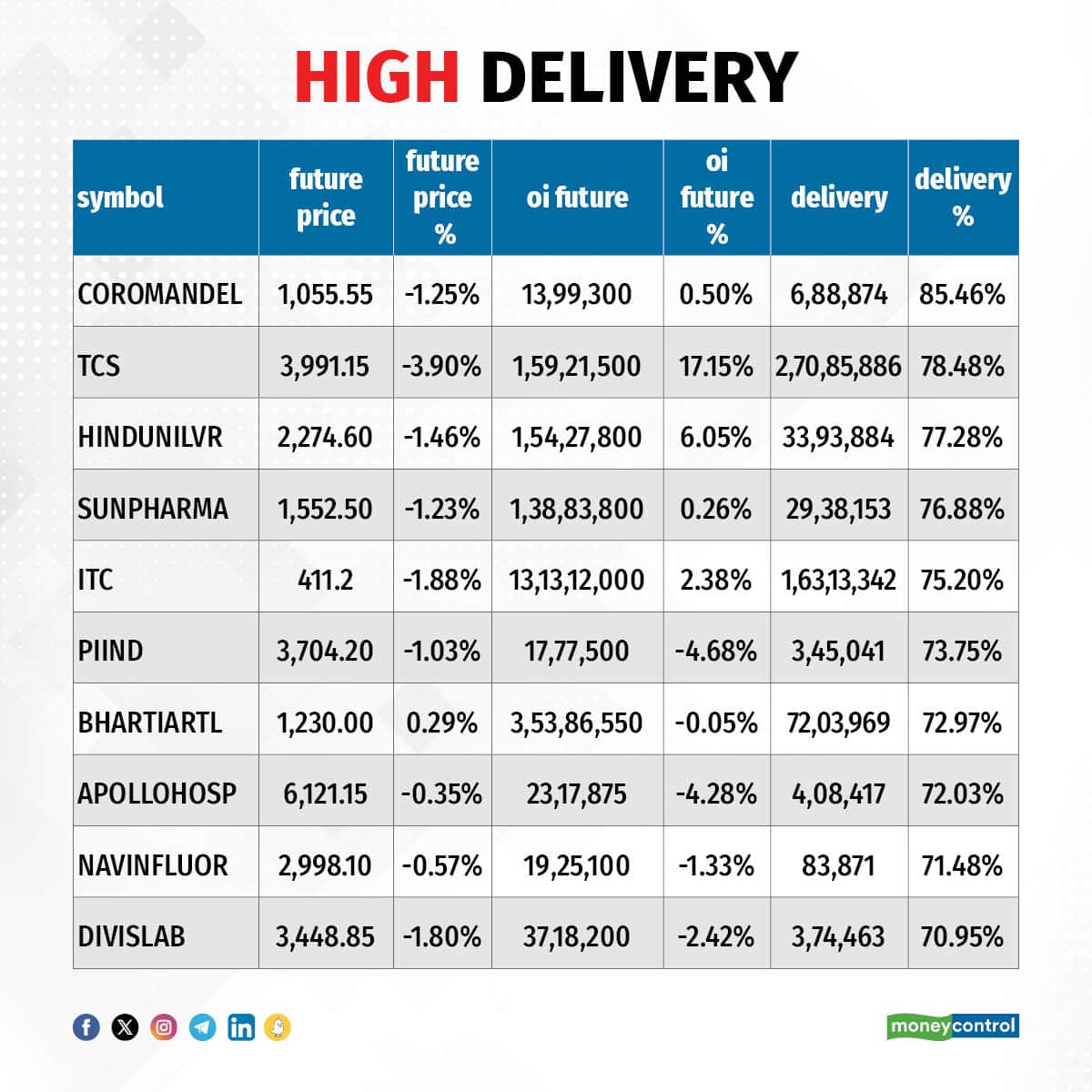

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Coromandel International, Tata Consultancy Services, Hindustan Unilever, Sun Pharmaceutical Industries and ITC saw the highest delivery among the F&O stocks.

A long build-up was seen in 4 stocks, which were Bajaj Auto, Eicher Motors, Balkrishna Industries and Hindalco Industries. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 58 stocks saw long unwinding. These include ABB India, PI Industries, Apollo Hospitals Enterprise, Pidilite Industries and Hindustan Copper. A decline in OI and price indicates long unwinding.

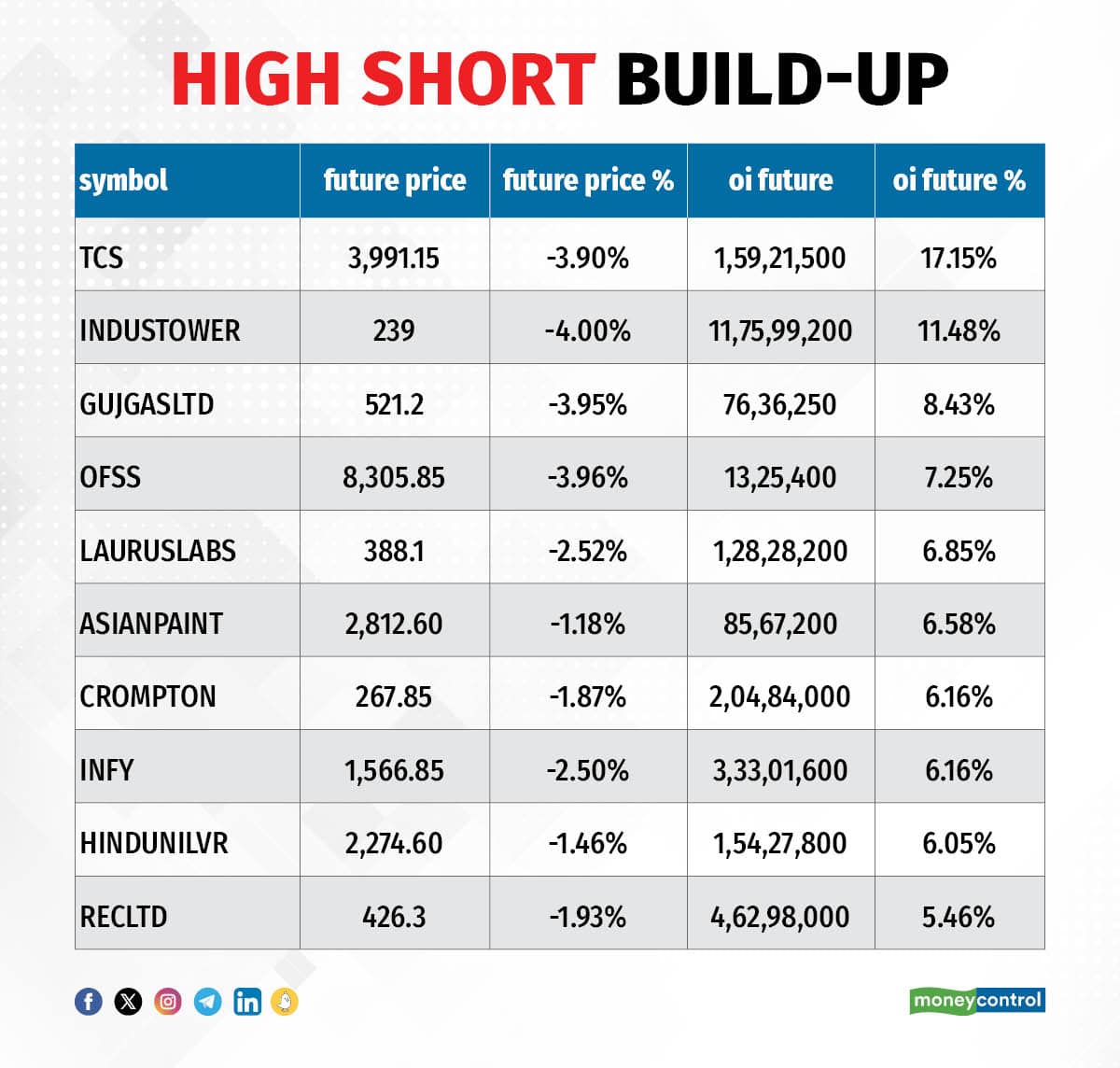

107 stocks see a short build-up

A short build-up was seen in 107 stocks, including Tata Consultancy Services, Indus Towers, Gujarat Gas, Oracle Financial Services Software and Laurus Labs. An increase in OI along with a fall in price points to a build-up of short positions.

17 stocks see a short covering

Based on the OI percentage, a total of 17 stocks were on the short-covering list. These included Balrampur Chini Mills, Oberoi Realty, ICICI Lombard General Insurance Company, Bajaj Finance and Escorts Kubota. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, fell sharply to 0.73 on March 19, from 0.95 in the previous session. Below 1 PCR indicates that the trading volume of Call options is more than Put options, which generally suggests a gradual increase in the bullish market trend ahead.

For more bulk deals, click here

Stocks in the news

Tata Consultancy Services: Central Bank, a leading Midwest regional bank in the US, will use TCS's BaNCS, the universal financial solution, to update its core technology infrastructure, drive innovation and strengthen customer relationships.

Aurobindo Pharma: The pharma company has received final approval from the US Food & Drug Administration (USFDA) to manufacture and market Mometasone Furoate Monohydrate nasal spray, 50 mcg/spray.

Aditya Birla Sun Life AMC: Promoters Aditya Birla Capital and Sun Life (India) AMC Investments Inc decided to exercise the oversubscription option (greenshoe option) to the extent of 4.47 percent of paid-up equity of Aditya Birla Sun Life AMC, in addition to the base offer size of 7 percent.

UltraTech Cement: The Competition Commission of India has given its approval to the acquisition of Kesoram Industries' cement business by UltraTech from Kesoram Industries.

Apollo Hospitals Enterprise: Madhu Sasidhar will be re-designated as President & Chief Executive Officer of the hospitals division with effect from April 1, 2024. Currently, Madhu Sasidhar is designated as Chief Strategy Officer of the company.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net bought shares worth Rs 1,421.48 crore, while domestic institutional investors (DIIs) purchased Rs 7,449.48 crore worth of stocks on March 19, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added Indus Towers to the F&O ban list for March 20, while retaining Balrampur Chini Mills, BHEL, Biocon, Hindustan Copper, Piramal Enterprises, RBL Bank, SAIL and Zee Entertainment Enterprises on the said list. Aditya Birla Fashion & Retail, Manappuram Finance, National Aluminium Company and Tata Chemicals were removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.