The market sentiments seem to be in favour of bears given the lower highs, lower lows formation on the daily charts and the negating higher highs formation for the first time in the last 12 consecutive weeks with the formation of a long bearish candlestick pattern on the weekly charts for yet another week ending January 25, the monthly expiry day for January futures & options contracts.

Hence, in the coming days, 21,100, the low of last week is expected to be a key support area for the Nifty 50 and below the same, the index may try hard to take support at the psychological 21,000 mark, whereas, on the higher side, 21,400 is an immediate resistance, followed by 21,500, the crucial hurdle, experts said.

On January 25, the BSE Sensex fell 360 points to 70,701, while the Nifty 50 was down 101 points at 21,353 and for the week it declined 1 percent.

"With the immediate resistance being at 21,400 mark, we expect the market to go down further towards 21,100 and 21,000 eventually, and if it breaks the 21,000 level we can witness more selling pressure up to 20,900-20,500 levels," Prashanth Tapse, Senior VP (Research) at Mehta Equities said.

Any trend change would happen only once the Nifty surpasses the 21,500 mark, he feels.

According to Rupak De, senior technical analyst at LKP Securities, the sentiment may continue to lean towards the bears as the Nifty struggled to surpass the 21,500 mark, where Call writers held substantial positions. Nevertheless, a decisive breakthrough above 21,500 could propel the index towards 21,700/22,000 in the short term, he said.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty and Bank Nifty

The pivot point calculator indicates that the Nifty is likely to take immediate support at 21,272, followed by 21,222, and 21,141 levels, while on the higher side, it may see an immediate resistance at 21,372, followed by 21,484 and 21,565 levels.

Meanwhile, on January 25, the Bank Nifty broken the 200-day EMA (exponential moving average - 44,570) but managed to defend the same for yet another session. The index also defended 44,500 mark at the close, which can be crucial for further downside.

The banking index fell 216 points to 44,866 and formed a bearish candlestick pattern with long lower shadow on the daily charts, indicating a smart recovery from day's low. The index cut down losses by more than 400 points from the day's low.

"On the hourly charts, we can observe that there is a positive divergence and a positive crossover which indicates loss of momentum on the downside and indicates that there can be a relief rally going ahead till 45,500- 45,700. On the downside, 44,600 – 44,500 is the crucial support zone," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

As per the pivot point calculator, the Bank Nifty is expected to take support at 44,540, followed by 44,372 and 44,101 levels, while on the higher side, the index may see resistance at 44,931, followed by 45,250 and 45,521 levels.

As per the monthly options data, the 21,300 strike owned the maximum Call open interest, with 1.49 crore contracts, which can act as a key level for the Nifty in the short term. It was followed by the 21,400 strike, which had 1 crore contracts, while the 22,000 strike had 90.55 lakh contracts.

Meaningful Call writing was seen at the 21,300 strike, which added 1.17 crore contracts followed by 21,400 and 22,600 strikes adding 61.53 lakh and 2.54 lakh contracts, respectively.

The maximum Call unwinding was at the 21,700 strike, that shed 38.57 lakh contracts followed by 21,600 and 22,000 strikes which shed 29.43 lakh and 28.07 lakh contracts.

On the Put front, the maximum open interest was seen at 21,300 strike, which can act as a key level for Nifty, with 91.35 lakh contracts. It was followed by 21,000 strike comprising 68.06 lakh contracts and then 21,200 strike with 61.71 lakh contracts.

Meaningful Put writing was at 21,300 strike, which added 15.06 lakh contracts.

Put unwinding was seen at 21,400 strike, which shed 48.08 lakh contracts, followed by 20,500 strike which shed 31.45 lakh contracts, and 21,500 strike, which shed 24.07 lakh contracts.

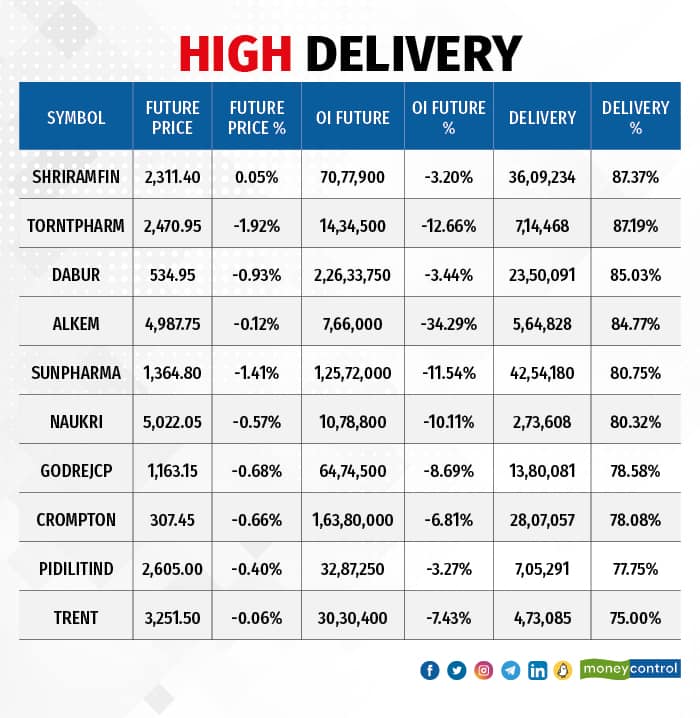

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Shriram Finance, Torrent Pharmaceuticals, Dabur India, Alkem Laboratories, and Sun Pharmaceutical Industries saw the highest delivery among the F&O stocks.

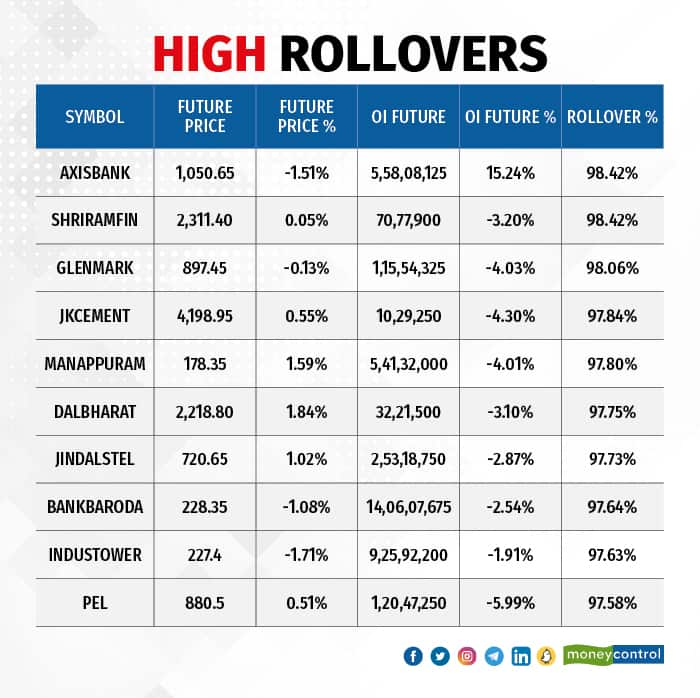

Here are the top 10 stocks which saw the highest rollovers on expiry day including Axis Bank, Shriram Finance, Glenmark Pharma, JK Cement, and Manappuram Finance with around 98 percent rollovers each.

A long build-up was seen in 12 stocks, which included National Aluminium Company, ACC, ICICI Bank, IndusInd Bank, and SAIL. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 109 stocks saw long unwinding which were ONGC, Alkem Laboratories, United Breweries, Bharti Airtel, and Britannia Industries. A decline in OI and price indicates long unwinding.

12 stocks see a short build-up

A short build-up was seen in 12 stocks including Axis Bank, HDFC Bank, InterGlobe Aviation, State Bank of India, and AU Small Finance Bank. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 53 stocks were on the short-covering list. This included Hindalco Industries, Hero MotoCorp, Muthoot Finance, Oracle Financial Services Software, and Ramco Cements. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, climbed to 1.04 on January 25, from 0.92 levels in the previous session. The above 1 PCR indicates that the Put volumes are higher than the Call volumes, which generally indicates an increase in bearish sentiment.

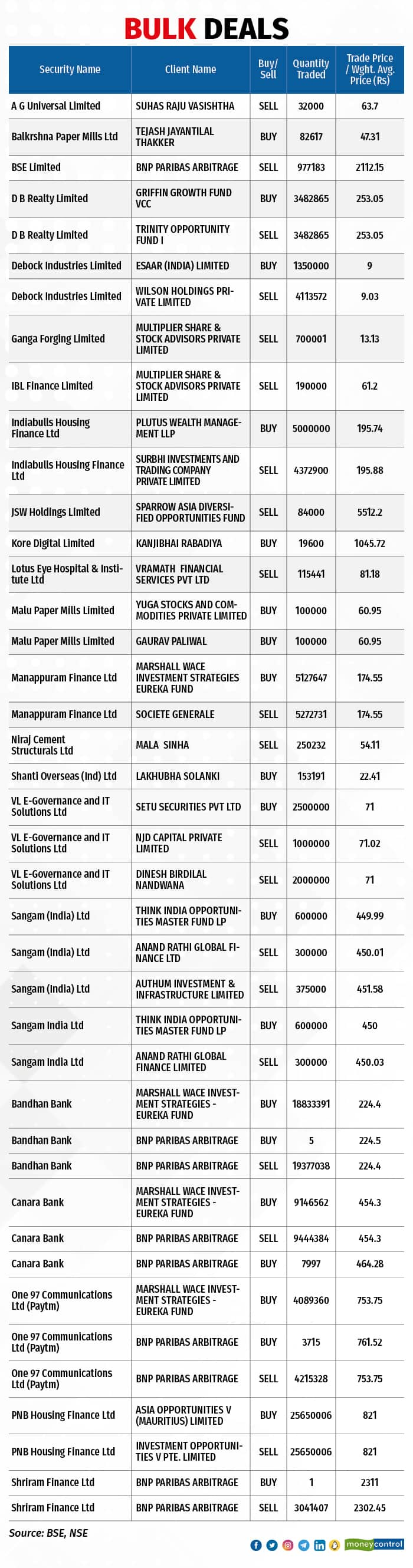

For more bulk deals, click here

Stocks in the news

Adani Power: The Adani Group company has recorded more than 300-fold jump in consolidated net profit to Rs 2,738 crore for quarter ended December FY24, compared to Rs 8.8 crore in the year-ago period, backed by healthy topline and operating numbers. Consolidated revenue from operations grew by 67.3 percent year-on-year to Rs 12,991.4 crore.

SBI Cards and Payment Services: The credit card issuing company has recorded a 7.8 percent on-year growth in profit at Rs 549 crore for October-December FY24, partly impacted by higher impairment on financial instruments. Revenue from operations for the quarter surged 31.8 percent to Rs 4,622 crore compared to year-ago period.

Tata Technologies: The global engineering services company has registered a 14.7 percent year-on-year growth in consolidated profit at Rs 170.22 crore for quarter ended December FY24. Revenue from operations also grew by 14.7 percent to Rs 1,289.5 crore compared to year-ago period.

Vedanta: The mining company has reported an 18.3 percent on-year decline in profit at Rs 2,013 crore for the third quarter of FY24 despite healthy operating numbers, impacted partly by finance cost. It had an exceptional gain of Rs 903 crore in Q3FY23. Revenue from operations grew by 4.2 percent YoY to Rs 35,541 crore for the quarter.

SJVN: The company has secured full quoted capacity of 100 MW solar power project through eReverse Auction conducted by Gujarat Urja Vikas Nigam (GUVNL).

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) continued to be net sellers in the cash segment for seven days in a row, offloading shares worth Rs 2,144.06 crore, while domestic institutional investors (DIIs) bought Rs 3,474.89 crore worth of stocks on January 25, provisional data from the NSE showed.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.