Technically, the market looked strong given the healthy recovery from 21-day EMA (exponential moving average) and continuation of higher highs formation for seven days in a row. Even the index took a good support at upward sloping trendline and rebounded. Hence, 22,300 is expected to be an immediate hurdle for the Nifty50 on the higher side followed by 22,500 mark, while immediate support at 22,000 and crucial at 21,875, the low of February 22, experts said.

On February 22, the benchmark BSE Sensex rallied 535 points to 73,158, while the Nifty 50 gained 163 points to end at a record closing high of 22,218 and formed a Bullish candlestick pattern with a long lower shadow on the daily charts, indicating buying interest at lower levels.

"Nifty crossing the all-time high, which was 22,250, was a big surprise. The index has formed a bullish reversal on the daily chart and based on that Nifty is set to move above 22,500 in the near term, however, on an immediate basis 22,300 will be the biggest hurdle," Shrikant Chouhan, head of equity research at Kotak Securities said.

He further said the strategy should be to buy on dips to 22,150-22,175, with a stop-loss at 22,050 levels. "A close above 22,300 can make it easier to move towards 22,500 or 22,600. Below 22,050, the Nifty may weaken to 21,950 or 21,850," he added.

According to Mandar Bhojane, Research Analyst at Choice Broking, if the price breaches the 22,250 level, there is potential for a further move towards 22,400 and 22,500. "On the flip side, the immediate support for the Nifty is identified at 21,900," he said.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty and Bank Nifty

The pivot point calculator indicates that the Nifty is likely to take immediate support at 21,971 followed by 21,882 and 21,738 levels, while on the higher side, it may see immediate resistance at 22,252 followed by 22,348 and 22,492 levels.

Meanwhile, on February 22, the Bank Nifty corrected for yet another session, falling 100 points to 46,920 and formed a Doji or Pin Bar kind of candlestick pattern on the daily scale with a long lower shadow as buying is visible at lower zones but relatively it underperformed the broader markets.

"Now it has to continue to hold above 46,750 level for an up move towards 47,350 then 47,500 levels whereas on the flip side, support is expected at 46,750 then 46,500 level," Chandan Taparia, Senior Vice President | Analyst-Derivatives at Motilal Oswal Financial Services said.

As per the pivot point calculator, the Bank Nifty is expected to take support at 46,562 followed by 46,421 and 46,193 levels, while on the higher side, the index may see resistance at 46,975 followed by 47,159 and 47,387 levels.

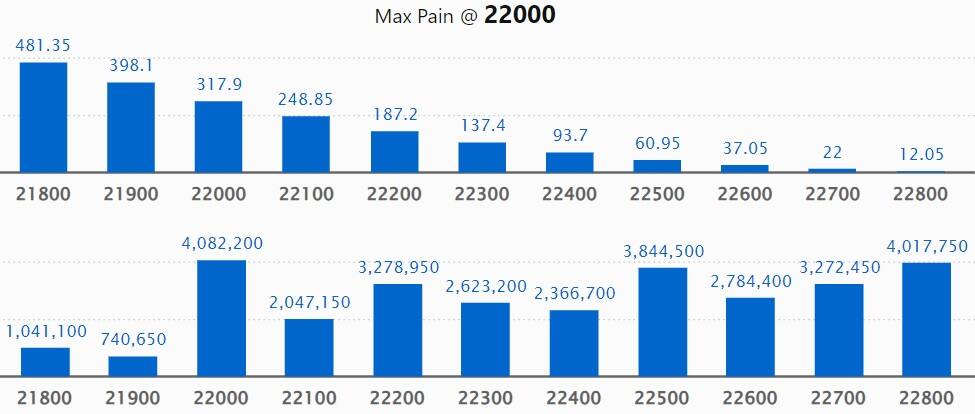

On the weekly options data front, the maximum Call open interest was seen at 23,000 strike with 1 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,000 strike, which had 40.82 lakh contracts, while the 22,800 strike had 40.18 lakh contracts.

Meaningful Call writing was seen at the 23,000 strike, which added 29.54 lakh contracts followed by 22,800 and 22,700 strikes adding 19.25 lakh and 18.66 lakh contracts, respectively.

The maximum Call unwinding was at the 23,600 strike, which shed 47,700 contracts followed by the 21,600 strike, which shed 6,200 contracts.

On the Put side, the 21,000 strike owned the maximum open interest, which can act as a key support level for Nifty, with 72.03 lakh contracts. It was followed by the 22,000 strike comprising 63.33 lakh contracts and then 21,500 strike with 43.45 lakh contracts.

Meaningful Put writing was at 21,000 strike, which added 31.96 lakh contracts followed by the 21,900 strike and 22,000 strike, which added 21.43 lakh contracts and 20.19 lakh contracts.

Put unwinding was seen at 23,000 strike, which shed 27,300 contracts followed by the 22,800 strike, which shed 4,100 contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Crompton Greaves Consumer Electricals, Dalmia Bharat, Pidilite Industries, Max Financial Services and IDFC saw the highest delivery among the F&O stocks.

A long build-up was seen in 98 stocks, which included ABB India, Eicher Motors, Siemens, Maruti Suzuki India and Oracle Financial Services Software. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 2 stocks saw long unwinding, which were Biocon, and Titan Company. A decline in OI and price indicates long unwinding.

28 stocks see a short build-up

A short build-up was seen in 28 stocks including SAIL, Bata India, Jubilant Foodworks, Kotak Mahindra Bank and Cholamandalam Investment & Finance. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 58 stocks were on the short-covering list. This included RBL Bank, Ashok Leyland, Piramal Enterprises, National Aluminium Company and PVRINOX. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, rose to 1.19 on February 22 against 0.85 levels in the previous session. The PCR above 1 indicates that the trading volume of Put options is higher than the Call options, which generally indicates increasing bearish sentiment.

Bulk deals

For more bulk deals, click here

Results on February 23

Rain Industries, Sanofi India, Valecha Engineering, Enkei Wheels (India) and Foseco India will be in focus ahead of quarterly earnings on February 23.

Stocks in the news

Olectra Greentech: Consortium of Olectra Greentech and Evey Trans (EVEY) has received a Letter of Award (LOA) from Brihan Mumbai Electric Supply & Transport Undertaking (BEST) for supply, operation and maintenance of 2,400 electric buses on a gross cost contract basis. These buses, valuing Rs 4,000 crore, will be delivered over 18 months.

Indian Railway Catering and Tourism Corporation: IRCTC has tied up with Bundl Technologies (Swiggy Foods) for the supply and delivery of pre-ordered meals through IRCTC e-catering portal as a PoC (Proof of Concept) in the first phase at four railway stations i.e. Bengaluru, Bhubaneswar, Vijayawada and Visakhapatnam. The eCatering service through Bundl Technologies may be available soon.

Vodafone Idea: The telecom operator said the board of directors will be meeting on February 27 to consider all proposals for raising funds in one or more tranches by way of a rights issue, further public offer, private placement including preferential allotment, qualified institutions placement or through any other permissible mode.

Oil India: The company has signed a Memorandum of Understanding (MoU) with Fertilisers and Chemicals Travancore (FACT), a public sector company, to explore opportunities in the domain of green hydrogen, including Green Ammonia/Green Methanol and other derivatives.

Texmaco Rail & Engineering: The railway company said the Board of Directors will be meeting on February 27 to consider proposals for raising funds.

Funds Flow (Rs crore)

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,410.05 crore, while domestic institutional investors (DIIs) bought Rs 1,823.68 crore worth of stocks on February 22, provisional data from the NSE showed.

Stocks under F&O ban on NSE

The NSE has added Aditya Birla Fashion & Retail, and SAIL to the F&O ban list for February 23, while retaining Ashok Leyland, Balrampur Chini Mills, Bandhan Bank, Biocon, GMR Airports Infrastructure, GNFC, Hindustan Copper, Indus Towers, National Aluminium Company, Piramal Enterprises, PVR INOX, RBL Bank, and Zee Entertainment Enterprises to the said list. Canara Bank and India Cements were removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.