The total bids for five IPOs that opened last week surpassed Rs 2.5 lakh crore, excluding the anchor investors' allotment, which happens a day before the public offer opens.

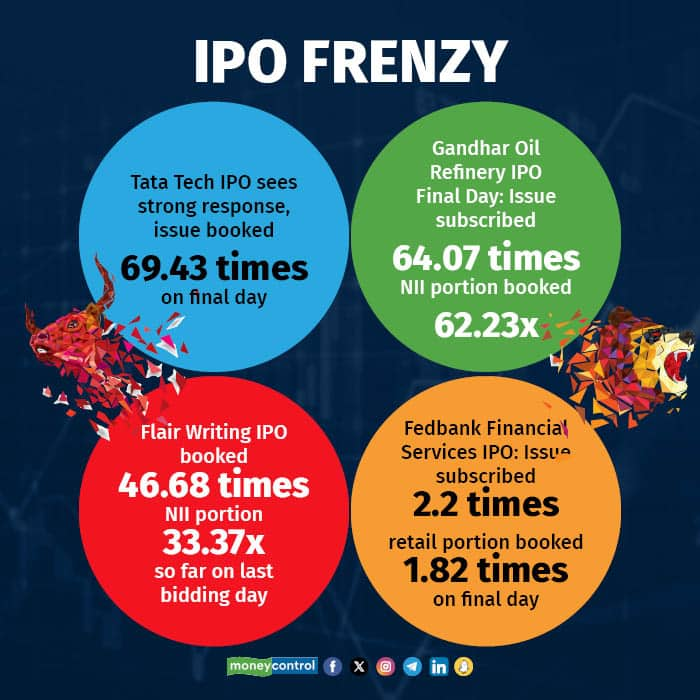

Tata Technologies’ public issue alone has garnered bids worth over Rs 1.56 lakh crore (assumed estimate at the upper end of the price band at Rs 500 per share), being oversubscribed 69.43 times the issue size. Tata Tech IPO got bids for 312 crore shares against 4.5 crore shares on offer.

Also Read: Tata Tech IPO sees strong response, issue booked 69.4 times on final day

The Indian Renewable Energy Development Agency's IPO, which closed on November 23, also garnered a robust response, getting subscribed 38.8 times, and receiving bids for 1,827 crore equity shares against the offer size of 47.09 crore. With a price band of Rs 30-32 per share, the bids are estimated to total Rs 58,470 crore at the upper end.

Also Read: IREDA IPO: Issue subscribed 38.8 times, retail portion booked 7.73 times on final day

Gandhar Oil Refinery's IPO was subscribed 64.07 times, with bids for 136.1 crore shares against 2.12 crore shares on the block. At the upper price band of Rs 169, the total bids are likely to be worth over Rs 23,000 crore.

Also Read: Gandhar Oil Refinery IPO Final Day: Issue subscribed 64 times, NII portion booked 62x

Flair Writing Industries was oversubscribed 46.68 times, with bids for 67.28 crore shares against an issue size of 1.44 crore, totalling over Rs 20,400 crore at the upper price band of Rs 304 per share.

Also Read: Flair Writing IPO booked 46.62 times, NII portion 33.36x so far on last bidding day

Fedbank Financial Services IPO lagged behind compared to Tata Tech and other issues opened this week. The issue saw a 2.2 times subscription -- modest in comparison to other public issues, with bids for 12.3 crore shares against an issue size of 5.6 crore, likely amounting to Rs 1,720 crore at the upper price band of Rs 140 per share.

Devang Mehta, Director of Equity Advisory at Spark Private Wealth, told Moneycontrol, that while secondary market sentiment has been improving, there is a good appetite for quality paper in the primary market as well.

Also Read: Rush for Tata Tech, Flair, Fedbank, Gandhar on final bidding day keeps IPO space abuzz

“High networth individual (HNI) clients are cautiously bullish on Indian equities amid the ongoing Israel-Palestine war impacting global market sentiment. They have been buyers on dips and have been wanting to allocate more and more money if there is a correction in the market,” said Mehta.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.