India’s home loan market, currently valued at about Rs 24 lakh crore, is expected to double in the next five years, mirroring the overall trend in the country’s aspirations to become a $5 trillion economy by then, State Bank of India said in a report.

The share of housing loans in bank credit increased to 14.4 percent in June from 13.1 percent in March 2020, with the maximum number of disbursements in tier-3 and tier-4 cities, according to the SBI report.

Analysts said that the fear of further rate hikes and loosing out the opportunity to buy properties will drive the customers to invest in homes.

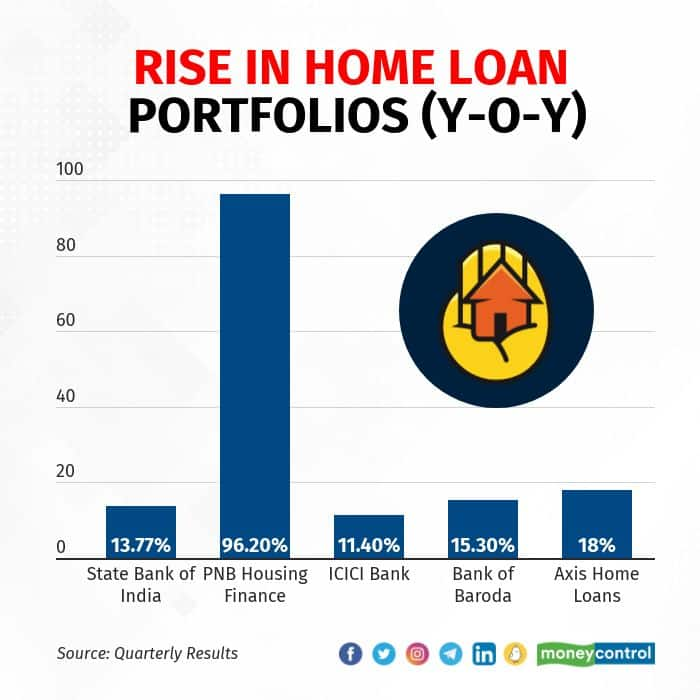

SBI, PNB Housing Finance and Bank of Baroda are among those that recorded significant growth in their home loan portfolios, according to their latest quarterly results.

Analysts said once the interest rate hike cycle starts, people tend to take home loans faster because they anticipate further hikes and fear that the longer they wait, the more expensive home loans will become.

The Reserve Bank of India has increased the benchmark interest rate by 140 basis points since May to curb inflationary pressures in the economy.

Disbursal of housing loans rose significantly in the April-June quarter and contributed almost half of the total personal and retail loans disbursed, according to SBI’s data.

Post-COVID security

When the RBI announced the rate hikes, analysts predicted that credit growth in the housing sector might get affected. However, the rate hikes created a positive impact in the last quarter.

“Firstly, it takes around three to four quarters to reflect the real impact of rate hike on loans. Now, banks have become more proactive as housing loans performed well in the last few quarters. Moreover, after COVID, people are now looking for safety and having his/her own house gives a sense of safety,” said Prakash Agarwal, director & head financial institutions at India Ratings & Research.

Moreover, analysts pointed out, banks convince customers to take loans at the earliest, before the interest rate goes up further, and this resulted in the rise in home loan disbursals.

Non-metropolitan areas

The report showed that growth in loans disbursed was primarily in non-metropolitan areas.

The total home loan portfolio (outstanding) grew by more than 10 percent in FY22, with tier-3 and tier-4 areas growing at a faster rate than tier-1 and tier-2 districts after the COVID-19 pandemic, according to the SBI report.

The average loan size increased more in the smaller towns. The report noted that growth of loans in the Rs 30 lakh to Rs 50 lakh and the Rs 50 lakh to Rs 100 lakh brackets was higher in tier-3 areas than in tier-1 districts.

“If we also look at the coverage of the Pradhan Mantri Awas Yojana – Urban scheme, which focusses on bridging the housing demand-supply mismatch in the country, the share of the Top 50 districts is a mere 21 percent in overall number of houses sanctioned. This clearly suggests the well-distributed nature of the PMAY-U scheme and one of the prime reasons for growth of housing finance across geographies beyond top cities,” said Aniket Dani, director, CRISIL Research.

According to analysts, the metros have become super-saturated and extremely expensive. So people now look for property that is affordable yet spacious.

“It may not be possible for an individual to buy a 2BHK apartment in Mumbai. But a bigger apartment will be affordable for him or her in Nashik or other districts. With the advantage of work from home, people don’t mind coming once in a while to office in the metros and then work remotely,” said Prakash Diwan, analyst and director at Altamount Capital Management.

It's mostly people who have spent a long time in the metros who choose to live in the smaller towns with better climatic conditions, more space and good accessibility, the analysts said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.