Steel Strips Wheels share price was up 4 percent intraday on January 12 after the company declared its Q3 numbers.

The company reported a net profit of Rs 28.7 crore in the quarter ended December 2020 against Rs 6.3 crore in the year-ago. Revenue jumped 52.7 percent at Rs 524.5 crore against Rs 343.6 crore.

Steel Strips reported EBITDA which was up 53.5 percent YoY at Rs 65.5 crore against Rs 42.7 crore, while EBITDA margin stood at 12.5 percent against 12.4 percent.

The stock was trading at Rs 671.00, up Rs 22.95, or 3.54 percent at 13:12 hours. It has touched an intraday high of Rs 687.80 and an intraday low of Rs 651.60.

The scrip also witnessed a spurt in volume by more than 4.92 times and was trading with volumes of 35,556 shares, compared to its five day average of 7,076 shares, an increase of 402.47 percent.

The company has been a leading supplier of steel wheel rims to major auto names including Tata Motors, Maruti Suzuki, Ashok Leyland and Mahindra & Mahindra among others.

It has been targeting export market aggressively and has been receiving orders from Europe, the UK and the US. It has a strong order book from the export market.

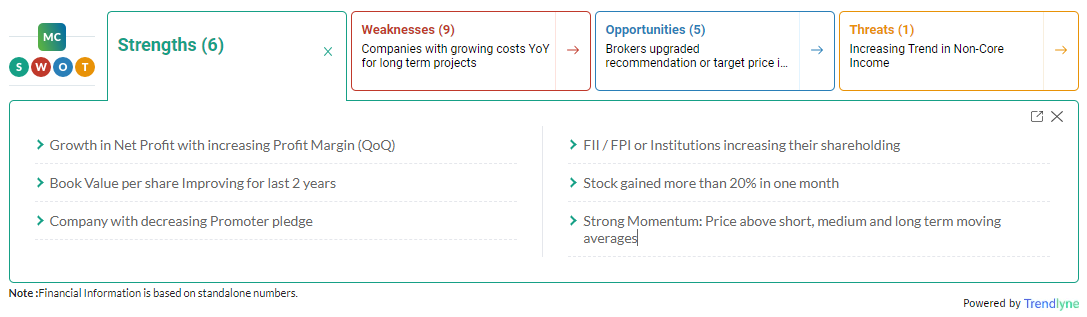

According to Moneycontrol SWOT Analysis powered by Trendlyne, the stock is showing strong momentum: price above short, medium and long term moving averages. The Company has decreasing promoter pledge with FII / FPI or institutions increasing their shareholding.

Moneycontrol technical rating is very bullish with moving averages and technical indicators being bullish.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.