Aditya Birla Fashion and Retail Limited (ABFRL) shares have underperformed its peers in the apparel industry over the last year. Trent, Raymond, and Shoppers Stop have given investors returns of 30-96 percent in the last 12 months. ABFRL, however, continues to disappoint investors, having lost 25 percent since August 2022.

Why are investors unhappy with ABFRL?

ABFRL’s recent plans to acquire a controlling stake in ethnic wear brand TCNS clothing has left investors displeased. The company is planning an open offer to acquire a 29 percent stake from public shareholders and purchase around 30 percent from the promoters. The price offered per TCNS share is Rs 503, almost twice the previous day’s closing price i.e May 4 when the acquisition was announced. ABFRL announced the acquisition of TCNS Clothing in a two-step deal worth Rs 2,900 crore, which is 10 percent below TCNS’s current market cap of Rs 3,220 crore, as per Motilal Oswal's report dated May 7.

“Investors were not happy with the acquisition as ABFRL is acquiring TCNS for an expensive valuation,” said an analyst, on condition of anonymity. He added that TCNS has a weak business that has disappointed investors. TCNS’s net loss widened three times to Rs 18 crore in FY23. “We believe that TCNS’s earnings revival would be challenging and that building scale internally could have been a good alternative for ABFRL,” said Motilal Oswal.

Also read Aditya Birla Fashion and Retail Q1 results: Net loss of Rs 161.62 crore from year-ago profit

Core brands not strong yet

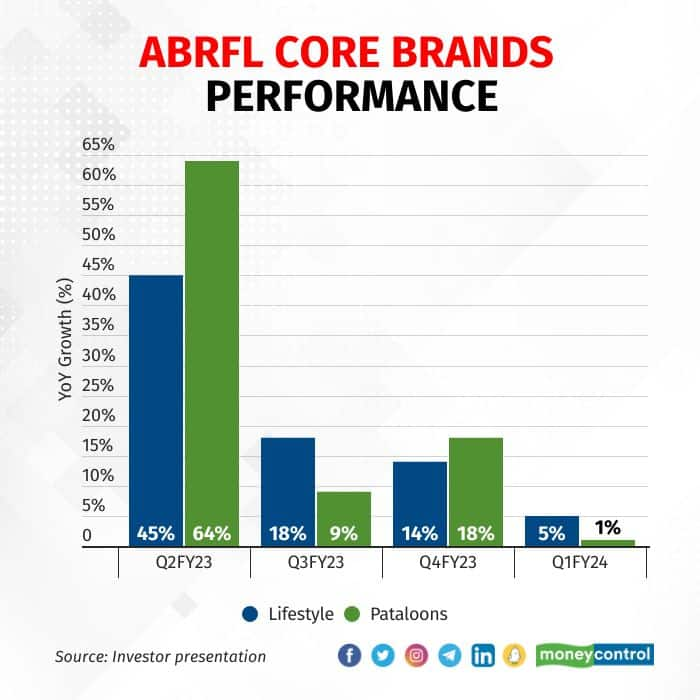

ABFRL’s underlying performance has been weak. Revenue growth in the company’s core brands — Lifestyle and Pantaloons — has been weak over the last year. Lifestyle has brands such as Allen Solly, Van Heusen, Louis Philippe, and Peter England. In the April-to-June quarter, Lifestyle’s revenue increased 5 percent and Pantaloons' revenue grew 1 percent to year-on-year.

ABFRL attributed the poor revenue growth to subdued demand because of fewer wedding dates in the quarter. However, the growth rate of its two core brands has been declining over the quarters.

According to analysts, there is rising demand for apparel in the Rs 450-600 price range, which is catered to by Trent. However, ABFRL, except for Pantaloons, is positioned on the higher side of this range, leading to disappointing sales. The company may be hoping to address this gap through the acquisition of TCNS Clothing. However, analysts are unconvinced.

The company is focusing on expensive acquisitions to bolster sales instead of focusing on developing its core brands, which could be a more rewarding strategy, said another analyst, who did to want to be named.

How much debt is too much?

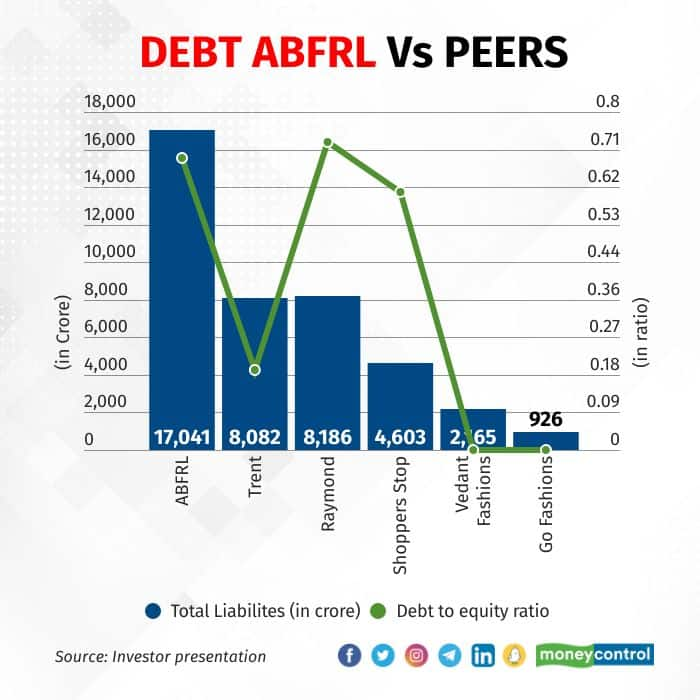

What is also making analysts sceptical is that the fashion company has the highest debt compared to its industry peers. ABFRL’s total liabilities are equivalent to the combined liabilities of Trent and Raymond. “ABFRL has a lot of debt on its books and a low cash flow, which is why investors are not positive about the stock,” said Ankit Kedia, Vice-President, Equity Research, at Phillip Capital.

So, what next?

So, what next?

Motilal Oswal has a ‘neutral’ rating on the stock with a target price of Rs 190 and sees a 10 percent downside. The brokerage firm has cut its FY24-25 EBITDA estimates for the company by 10 percent. “In the last few years ABFRL has invested in multiple new businesses, majority of which are presently loss-making or yet to stabilise and scaling up the ethnic wear and Reebok businesses and turning around the newly set-up D2C segment could be a bumpy ride,” it said in a report dated August 6. The report added that inclusion of TCNS to this portfolio may deepen ABFRL’s near-term profitability risks.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.