For months, the aviation minister has been talking of air travel reviving to pre-pandemic levels in the near future, but the government’s stringent control on airline capacity and fares is clouding the sector’s outlook.

Air travel is certainly looking up with a steady rise in numbers. On February 14, passenger numbers crossed the 3 lakh per day mark for second consecutive day, which is 73 percent of daily traffic of last February - the last full month of operations before lockdown and other measures were taken in the country to control COVID-19.

The government has gradually relaxed the limit on operating capacity of airlines from 33 percent on May 26 last year to 50 percent a month later, 60 percent from September 2 and finally 80 percent since November 11. It has now decided to continue with the current limit until the end of March, which means that there is no chance for airlines to report normal numbers for another month and a half. There is hardly any other sector where the government has intervened so intensively in the market.

What do the numbers say?

The government’s restriction on capacity does not include flights under Regional Connectivity Scheme (RCS) - UDAN (Ude Desh ka Aam Nagrik),

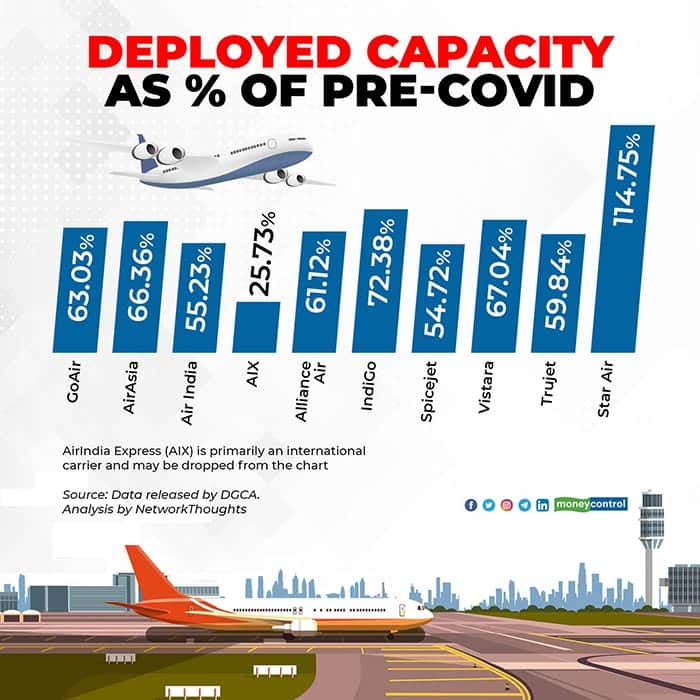

In December, when leisure travel had picked up, airlines deployed varying capacities. Among major carriers, Spicejet deployed the least with barely 54.72 percent of departures compared with pre-COVID levels, while market leader IndiGo deployed the most at 72.38 percent. These numbers include RCS as well as non-RCS flights.

Star Air, which predominantly operates RCS-UDAN flights, was the only carrier that operated more flights than it did before the pandemic. This is primarily because it inducted more aircraft and operated on more routes it was allocated under RCS-UDAN. However, there was a contraction in operations of Trujet and Alliance Air which also primarily operate RCS-UDAN routes. Compared with normal times, Trujet operated 59.84 percent of departures while Alliance Air - a subsidiary of Air India, which is not up for sale, operated 61.12 percent.

IndiGo operated 31,847 departures last December, about 10,000 less than it reported in February. However, the airline now has higher seats deployed - thanks to the additional A321s it has inducted.

Both the Tata airlines operated at barely two-thirds of pre-COVID levels with full-service carrier Vistara operating at 67.04 percent and AirAsia India at 66.36 percent.

A spoke in wheel for recovery

Before the pandemic, the lowest load factor amongst all major airlines was 81 percent but in December last year, the highest load factor recorded was 78 percent. At a lower capacity and much lower loads, reaching pre-COVID passenger numbers may be a pipe dream.

If the capacity remains capped at 80 percent, the pre-COVID numbers cannot be achieved even in the unlikely event of all flights being full. Full recovery is possible only when the capacity caps are removed and airlines are allowed market freedom.

There has been a fear of dominance by a single player, but in a fragmented market where there is no real challenger to IndiGo, on many routes, the market leader has enjoyed a monopoly or duopoly for a very long time.

In fact, if the caps are removed and IndiGo is the only player which scales up, which is unlikely, the airline will still not cross 60 percent capacity share, but will add about 350 additional flights that could translate into 38,000 additional daily passengers and speed up recovery.

While Tatas seems set to back their two ventures, the focus would now be on Spicejet and Go Air - on how they recover from here on. While Go Air is also backed by a large group, Spicejet does not have any other group business to fall back on. While its cargo business is profitable, it does not match the passenger business yet.

As the second-largest carrier in the country, operating much lesser than what is allowed puts the airline at a disadvantage, with the silver lining being that it is far ahead of the No. 3 in the market.

Capping capacity was initially seen as necessary for social distancing, but it is now being widely perceived as an instrument to control market dynamics, which is not good for the sector. India has always seen passenger numbers follow capacity. To that extent, any limit on capacity would impede recovery.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!